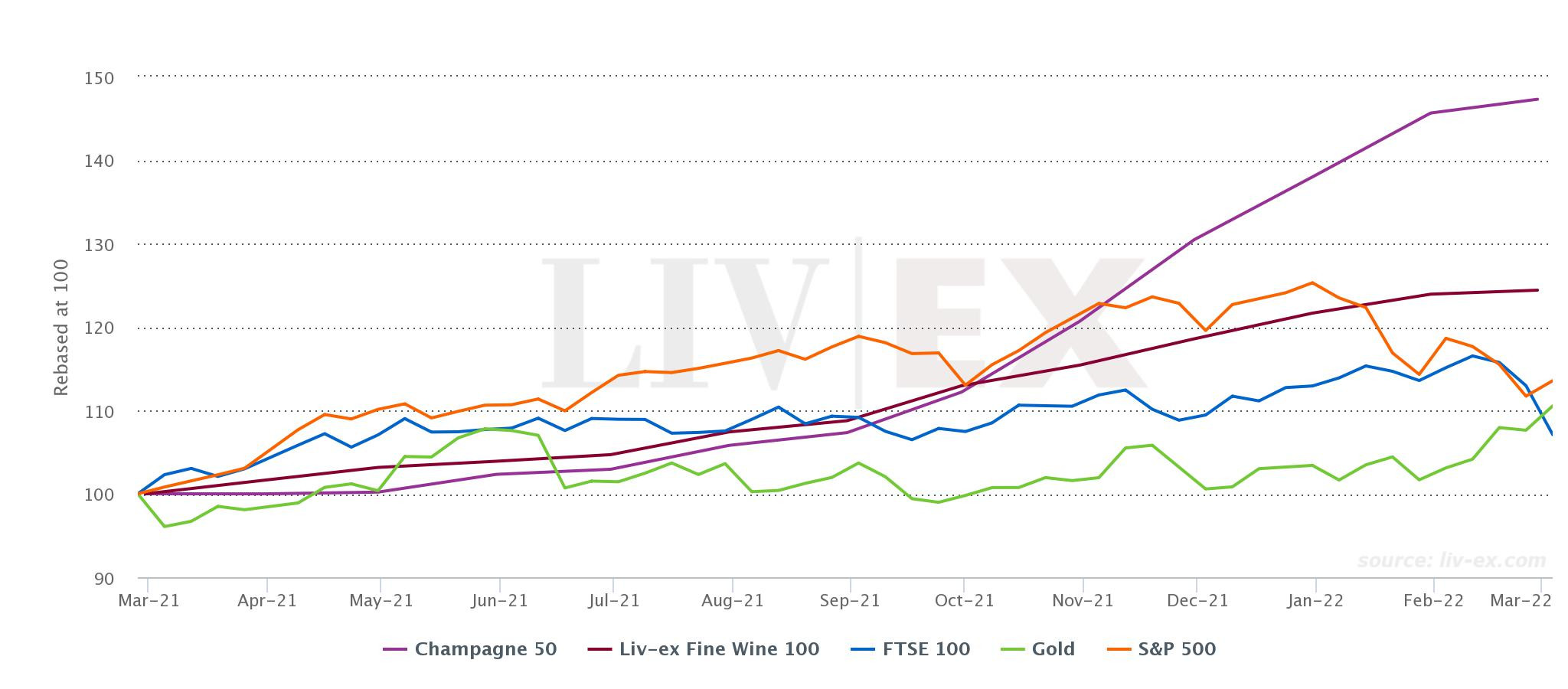

Knight Frank has published its 2022 Wealth Report and predicts increasing demand for investment wines this year. If anything can be forecast for the next 12-months it is the need for safe haven investments as the world reacts to the Ukraine crisis. Gold has risen to its highest level since May 2021 in the last week and fine wine continues to deliver stable growth. Investors are now seeing both assets as key to protecting capital.

Fine wine performance compared to gold and equities – 1 year

Source: Liv-ex.com, 04.03.2022, data at 28.02.2022

The Wealth Manager’s view

Knight Frank’s Annual Wealth Report observes that “There has been a new wave of investment money coming into the wine market, some of it led by macro factors, such as inflation worries – with wine being seen as a hedge – but also more localised factors such as supply shortages due to weather conditions, particularly frost, and supply chain issues.” Knight Frank Wealth Report, 2022.

The report recognises that all sorts of new records for wine investment returns were set in 2021 and, in particular, auction sales for rare Burgundies, for which Asia is a key market. Champagne is also noted as a key driver for the market and the stellar 2008 vintage has enjoyed “huge consumer and investor demand”.

Ukraine crisis: effect on assets

The Ukraine crisis is now dominating global markets amplifying the pandemic’s impact on inflation, supply chains and energy. Oil prices surged to $120 per barrel in response to Russia’s attack on the Zaporizhzhia nucleur power plant and are now up 44% YTD. Gold has been rising solidly and over the last week, gained 3.09% to £1,467.35 per ounce (nearly US$2000) as investors seek security.

Wine is holding value securely with Champagne still the leading regional producer in February 2022. Liv-ex reports that price rises have softened on January’s record level, but top performers are still seeing nearly 10% growth in the month.

Top performing wines in February 2022:

| Wine | Region | % growth 1 month |

| Louis Roederer, Cristal 2013 | Champagne | 9.7% |

| Bollinger La Grande Annee 2012 | Champagne | 9.0% |

| E. Guigal Cote Rotie, La Turque 2017 | Rhone | 8.6% |

| Petrus 2010 | Bordeaux | 7.9% |

| Poggio di Sotto, Brunello di Montalcino 2016 | Piedmont | 6.2% |

Source: Liv-ex.com, 04.03.2022, data at 28.02.2022

What about Cypto-currency?

Questions are being asked about Crypto-currency investments in the current environment and whether they could be targeted. There has been a reported recent spike in Ruble-based transactions as Russian investors seek to protect themselves from their diving currency and possible sanctions.

Find out more

Investors have benefited from wine’s strong growth, resistance to the effects of recession and inflation over the last year and stability as financial markets have suffered volatility. This seems even more valuable at the start of March 2022. For more information see our Guide to Investing in Fine Wine, our latest Market Report and speak to a member of our expert team on 0203 384 2262.