Are you looking at wine investment performance, liking what you see but still not sure? We look at some of the frequently asked questions of people just like you.

1.Why do people invest in wine?

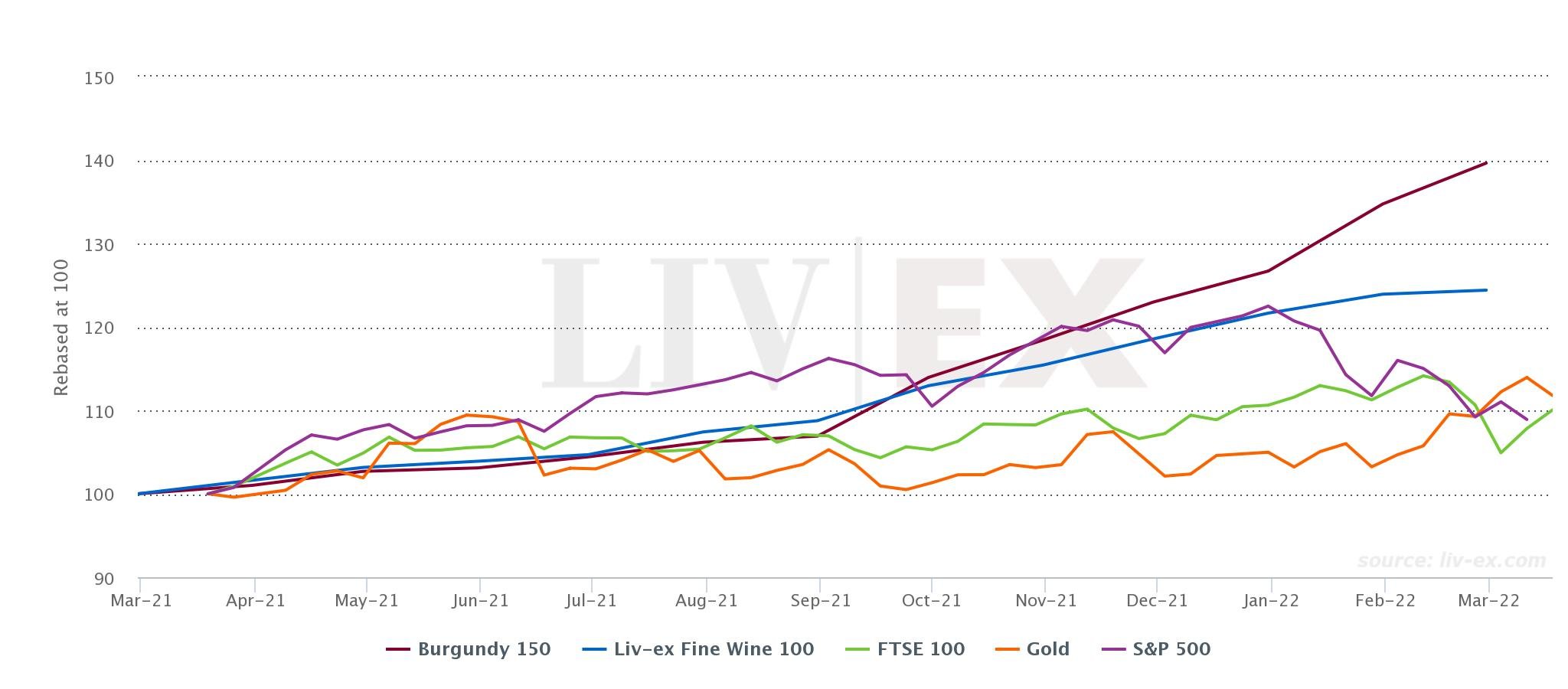

- Value growth: wine has delivered stronger growth and higher returns to investors than equities, gold and other alternative assets over certain periods.

- Performance: the finite supply of investment wine must satisfy growing global demand, causing prices to rise as wine becomes rarer. Price performance is not directly correlated to financial markets and values are generally boosted by inflation. As such wine can be seen as a ‘safe-haven’ asset

- Diversification: fine wine can be used to vary the returns profile of an investment portfolio, and can be used to hedge inflation and volatility in financial markets

- Stability: fine wine offers stability, with slow changes to market dynamics, in contrast to more volatile financial markets and assets like cryptocurrency

- Hedge inflation: fine wine prices tend to rise with inflation in contrast to cash savings which are eroded

- Tax efficient: subject to personal circumstances, profits from fine wine do not generally attract CGT, see our Special Report on Tax and Wine

- Passion: many collect wine simply because they are passionate about it, building collections around certain wine-makers, regions or vintages.

What are some of the challenges when it comes to investing in wine?

- You need to work with a reputable wine investment specialist to advise you on the market and the most suitable wines for your budget and personal goals

- Acquire wines with excellent provenance, from a well-respected source that can demonstrate the wine has been correctly stored in the optimum conditions.

- Investment wine should ideally be stored in its original wooden case in a specialist bonded storage facility to protect the quality and value of your wine and enjoy prices net of VAT and Duty.

- Stay informed about the market, to understand the current trends, opportunities for growth and the best time to sell your wine for optimum gains. You should be guided by a wine investment specialist who can advise you on the asset performance of your wine.

- As a collector looking for value growth you should also look at diversifying your wine portfolio with wines from different regions, producers and vintages, and make sure you are informed about which offer the best opportunities for growth.

How do you even invest in wine? Do you just buy the bottles and store them?

- Firstly, work with a specialist who can help you understand the market and guide you to build a collection of fine wine suitable for your budget and the time frame you would like to hold your fine wine for.

- You should be guided to select wines that offer future growth potential. These will be in their original wooden case as packaged by the chateau or wine estate

- Wine should be stored in a specialist bonded storage facility to protect future quality and value, and also beneficial tax treatment

- Stay up to date with performance and market information with your specialist wine investment expert

- Continue to add value to your collection, diversify it with wines from different regions and vintages to optimise performance.

How liquid are wine investments? How easy is it to sell?

- The wine investment market has become increasingly transparent and efficient since the advent of Liv-ex.com in 2000. This has improved investor confidence and engagement in the market. A key consideration for investors is the ability to exit and fine wine is the most liquid passion asset.

- Bordeaux blue-chip wines are still the most ‘liquid’ wines due as the volume produced (supply) supports a high level of trade in the secondary market. Lafite Rothschild wines were the most traded by value and second by volume on Liv-ex in 2021.

- The most active wine investments also include key Champagne wines. Cristal was the most actively traded brand in January and Salon Le Mesnil sur Oger Oenotheque led trade by value on Liv-ex in February 2022.

- Burgundies are generally low supply investment wines and do not enjoy the levels of liquidity of Bordeaux. However, returns can be outstanding with single bottle rare DRC 1945 vintage selling for nearly US$500,000 in 2018. The Burgundy region is broadening and becoming increasingly liquid as investors seeking value have driven demand for other wines outside of the superstar brands of DRC, Armand Rousseau and Leflaive.

- Italian investment wines are enjoying increasing liquidity. The Super Tuscan Sassicaia was the most traded wine brand by volume on Liv-ex in 2021.

- A good wine investment specialist will be a Liv-ex trading member and have access to established routes to market enabling owners to value and sell investment wines readily

What is the current state of the wine market?

- The fine wine market had its most buoyant year on record in 2021 and trading levels and demand is predicted to grow in 2022.

Fine wine compared with equities and gold – 1 year:

Source: Liv-ex.com, data at 28th February 2022

For current performance data, see our latest Market Report

How has the Covid pandemic impacted the wine trade?

- The wine trade has seen robust growth throughout the pandemic to date.

- Demand for fine wine has increased as investors look for stability and growth as financial markets experience volatility

- The market had continued to broaden with more labels and wines traded in the secondary market than ever before

- Increased diversification in regions such as Burgundy and Italy are providing greater choice, access to the market and price resilience

- The market has become increasingly efficient over the last decade and more liquid. The spreads between bids and offers has narrowed and there is more trading activity in a broader spread of investment wines. Covid hasn’t affected this ongoing evolution.

- Supply chain hasn’t been an issue for wine investors who are acquiring wine already stored in bonded storage in the UK.

Is global warming a threat or an opportunity for wine investment?

- The fundamentals driving the market are supply and demand, climate change is already affecting supply and Burgundy is a classic example. Smaller harvests due to frost and drought have resulted in lower supply in recent years in a world where demand is growing. Reduced supply supports strong price growth.

- Wine producers are already introducing new viticultural techniques and technology to protect production and quality over time. These include biodynamic growing, which many of the top estates lead on. Champagne is investing millions into research on the effect of climate change and how to manage in the changing environment.

For more information see our Guide to Collecting and Investing in Fine Wine and speak to a member of our expert team on 0203 284 2262.