It’s Budget week and what a challenging time to hold the purse strings – to the nation or household! Understanding how to invest smartly from a tax perspective is valuable knowledge and wine has a part to play. Top performing investment wines are seeing value grow by thousands of pounds, exceeding property and, currently, this is tax free for most investors.

With the highest inflation levels in 30 years, interest rates and commodity prices rising and major challenges in geo-politics, capped off with Russia’s attack on Ukraine, these are not easy times for investors and the Chancellor. Delivering a financial exit plan to the pandemic had seemed the sole priority for the Budget this time last year, we now face a much more complicated scenario.

Rishi Sunak will have appraised the economic landscape looking for opportunities to be mined to, perhaps, off-set some of the tax tactics already announced in the Autumn 2021 Budget. Will he stick to his plan to raise NI, instigate an energy loan scheme and reinstate Hotel VAT levels to 20% this Spring? Or defer what is now seen as punitive action given the rise in inflation and energy prices since then and look for other options?

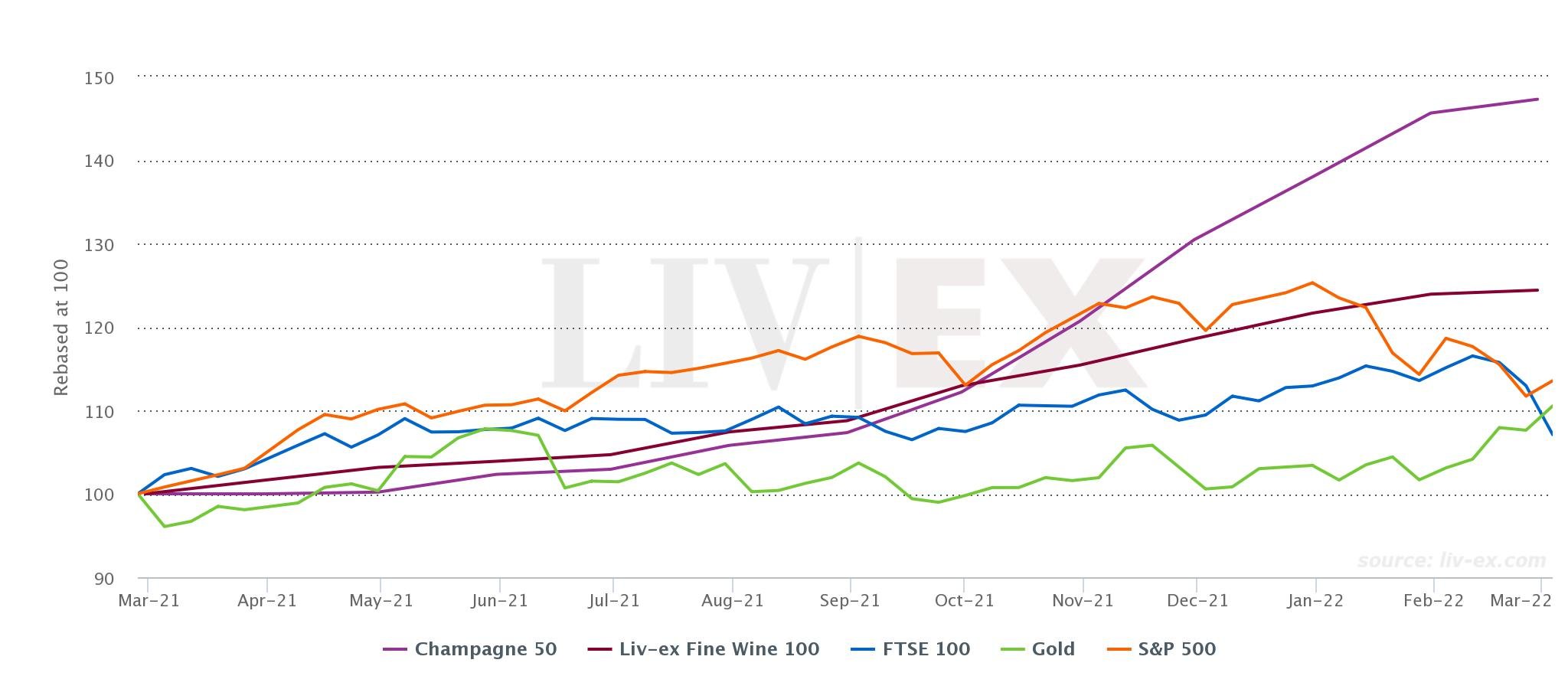

Liv-ex 100 & Champagne 50 compared to FTSE 100, S&P500 and gold

Source: www.liv-ex.com, March 2022

The money for the nation’s coffers has to come from somewhere and, again, commentators are asking if Capital Gains Tax will become a target for this Budget statement? CGT raised £10.6bn in 2021 and this tax income is currently rising due to property price and investment growth. There is speculation that a potential cut in the tax-free allowance for CGT, currently £12,300, could be a card the Chancellor may want to play. The allowance was frozen until 2026 last year but a reduction to £6,000 could generate £480million as calculated by the Office for Tax Simplification.

Tax and wine investments

Investors and property owners accept that CGT has to be factored in, but also consider those assets that may be exempt from this tax. Fine wine is classed by HMRC as a ’Wasting Asset’, i.e. it does not have a predictable life beyond 50 years. As a result, generally, gains made from wine investment do not attract CGT.

Another tax benefit includes the ‘off-shore’ treatment of wine stored in specialist bonded warehouses. Duty and VAT are not triggered on these wines until they are removed from storage and those investors who sell their wine whilst still in bond, which most do, never cause these taxes to be applied.

Given the nature of the fine wine market, it is unlikely that wine’s classification by HMRC will change and, consequently, its exemption from CGT is an important attraction for investors, especially when combined with its performance. Investors should always seek specialist tax advice as everybody’s circumstances are unique to them.

Wine investments saw record growth in 2021, with average price rises over 24%, and individual wine much more, outperforming equities and gold. Stable growth in wine assets has been maintained in 2022 as financial markets have become increasingly volatile. Top performing wines are seeing value grow by thousands of pounds and, currently, this is tax free.

For more information see our specialist Report on Tax and Fine Wine and speak to your financial advisor. Contact our expert team for information on the fine wine market and current opportunities on 0203 384 2262.