We review the fine wine market at the end of the year with the backdrop that 2020 will go down in history as the year Covid-19 shaped all of our lives, where the terrible cost of a pandemic in the 21st Century became apparent. The European Centre for Disease Prevention and Control reported on the 30th December that global Covid-19 cases stood at 80,316,555 and that 1,770,695 people have sadly lost their lives since 31st December 2019 – and the numbers continue to rise!

We have commented regularly on Covid-19’s impact on financial markets which experienced record-breaking losses in Q1 and then significant ongoing volatility throughout 2020. Added to Coronavirus, this year has also produced extraordinary geo-political conditions. The US Presidential election and Brexit have been major influences with developments playing right through to the close of 2020 with the UK and EU approving the Brexit deal on the 30th December. Financial markets, equity investments and currencies have been paying the price all year.

What has been the impact on the wine market in 2020?

The wine industry globally has had its challenges, like many other sectors major trade events were cancelled, hospitality decimated and changes in consumer habits as more acquired wine online for home deliveries and at higher prices with money saved from not dining out.

Merchants with a good online presence have done well and many have invested further in technology and logistics to capitalise on new areas of demand and some to simply survive, having lost valuable licensed customers as hotels, restaurants and event venues closed. In the face of these challenges the industry has been driven to innovate with technological improvements and Liv-ex reported that automated trades accounted for 40% of their secondary market transactions in 2020.

Fine wine market growth bucks the trend

Fine wine has stood out as one of the very few markets that has maintained strong growth during 2020. Liv-ex, the foremost global fine wine exchange, grew significantly during the year recording a broadening and deepening market.

Unlike financial exchanges the Liv-ex indices all maintained stable growth and individual top performing investment wines saw price increases exceeding 20% and some considerably more. This strong performance was influenced by increasing liquidity as more merchants around the world chose to trade on Liv-ex this year, improving transaction efficiency; and driving higher values in bids and offers. The total exposure on Liv-ex has grown by 44% in 2020, up £33million year on year to £83million, despite Covid-19.

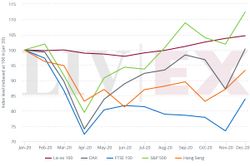

Liv-ex indices v Financial Markets in 2020

| Indices | At 30.11.2020 | 1 Year | 5 Years |

| Liv-ex Fine Wine 50 | 3.26% | 2.47% | 32.24% |

| Liv-ex Fine Wine 100 | 4.65% | 4.01% | 33.76% |

| Liv-ex Bordeaux 500 | 2.96% | 2.44% | 34.38% |

| Liv-ex Fine Wine 1000 | 1.31% | 0.65% | 44.22% |

| Liv-ex Investables | 4.64% | 3.85% | 34.58% |

| FTSE 100 | -15.6% | -13.4% | 0.1% |

| S&P 500 | 12.1% | 15.3% | 74.1% |

| Gold | 16.3% | 21.1% | 66.5% |

Source: Liv-ex Report The Fine Wine Market in 2020 and Liv-ex Market Report December 2020

All of the Liv-ex indices have maintained growth since the pandemic struck markets in March 2020. The key Liv-ex 100 index grew 4.65% in the year to 30th November (December data will be available in early January 2021) and reached its highest level In two years that month, attaining a ten-year high on trade by value. This in stark contrast to the FTSE 100’s -15.6% decline over the same period.

Fine wine values in the secondary market have remained robust in the face of 2020’s challenges with top performing wines seeing growth of up to 37% this year, more than double that of gold’s 16% increase.

Top ten price performers in Liv-ex 1000 in 2020:

| Region | Wine | Vintage | Dec. 2019 £ | Nov. 2020 £ | Growth |

| Bordeaux | Chateau L’Eglise Clinet | 2010 | 2,300 | 3,150 | 37% |

| Italy | Sassicaia | 2013 | 1,500 | 1,960 | 30.7% |

| Champagne | Bollinger, La Grande Annee | 2008 | 860 | 1,096 | 27.4% |

| Bordeaux | Chateau La Conseillante | 2009 | 1,360 | 1,692 | 24.4% |

| Italy | Solaia | 2013 | 1,610 | 1,998 | 24.1% |

| Spain | Vega Sicilia, Ribeuro del Duero Unico | 2008 | 2,280 | 2,800 | 22.8% |

| Italy | Tignanello | 2013 | 780 | 950 | 21.8% |

| Rhone | Vieux Telegraphe, CNDP La Crau Red | 2016 | 450 | 544 | 20.9% |

| Champagne | Dom Perignon | 2006 | 1,160 | 1,392 | 20% |

| Italy | Tignanello | 2016 | 814 | 970 | 19.2% |

Source: Liv-ex Annual Market Review 2020 (Liv-ex Market Prices at 30.11.20)

Sterling, the key denomination for the fine wine market, weakened by geo-political forces, added appeal for international buyers and collectors. Deloitte Director Adriano Picinati commented: “From all the surveys we conducted for our Deloitte Art & Finance Report over the last ten years we find that collectibles indeed represent a sizeable growing portion of the worth of wealthy individuals.”

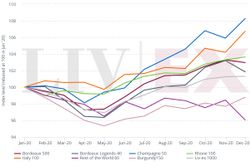

Regional Performance

Significant influencing factors such as the US 25% tariffs imposed by Trump in Autumn 2019 drove strong demand for the top wines of Italy and Champagne which were exempt. This demand was energised further as investors sought out alternative assets offering value and safety to diversify and strengthen their portfolios as financial markets plunged and stayed unpredictable through 2020 . The Liv-ex Champagne 50 index has been the top performing regional measure seeing an average growth of 8.27% followed by the Liv-ex Italy 100 at 6.72%.

Critics played an important role in the broadening market pointing investors to new labels from key regions, notably the USA which saw its share of trade on the market grow significantly in 2020 and top German wines now indicate a possible emerging market.

Prices for physical Bordeaux performed well across the year and the leading wine in terms of price performance on the exchange was Chateau L’Eglise Clinet 2010 seeing a 37% growth in price from December 2019 to 30th November 2020. The stellar 2010 vintage enjoyed investor focus as it reached a 10-year anniversary and rescores triggered interest.

Other ‘in demand’ Bordeaux wines included Chateau Lafite Rothschild 2016 which was ranked second of the most traded wines on the exchange with its 2010 vintage seventh and Right Bank Chateau Petrus 2016 ninth in the top ten most traded wines by value on Liv-ex.

Top ten most traded wines on Liv-ex in 2020:

| Rank | Region | Wine | Vintage | Market

price |

| 1 | Italy | Giacomo Conterno, Barolo Monfortino Riserva | 2013 | £8,196 |

| 2 | Bordeaux | Chateau Lafite Rothschild | 2016 | £6,600 |

| 3 | Champagne | Taittinger, Comtes de Champagne Blanc de Blancs | 2008 | £1,070 |

| 4 | Champagne | Dom Perignon | 2008 | £1,332 |

| 5 | Champagne | Louis Roederer, Cristal | 2012 | £1,516 |

| 6 | Italy | Sassicaia | 2017 | £1,556 |

| 7 | Bordeaux | Chateau Lafite Rothschild | 2010 | £7,300 |

| 8 | Italy | Tignanello | 2016 | £974 |

| 9 | Bordeaux | Chateau Petrus | 2016 | £34,000 |

| 10 | USA | Harlan Estate, Napa Valley | 2016 | £11,250 |

Source: Liv-ex Annual Market Review 2020 (Liv-ex Market Prices at 30.11.20)

The 2019 vintage en primeur campaign launch was delayed this Spring due to Covid-19 and took place in June without the annual trade pilgrimage to Bordeaux. The chateaux released their 2019 wines at a significant discount to 2018 – some as low as 30%, recognising the magnitude of the challenges facing the market. Following a similar approach to the 2008 vintage launch in Spring 2009, most of the great houses adopted a lower release price strategy. The result was an outstanding campaign and a shot in the arm for the region and its wine futures process, which many had come to question the value of with overpriced campaigns in the last decade.

Conclusion

In summary, the fine wine market showed remarkable resilience in 2020 and demonstrated its ability to protect capital and deliver stable growth whilst financial markets and economies continue to suffer a severe, prolonged shock. As 2020 draws to a close we can reflect on a very positive year for fine wine investors and this provides an important insight for portfolio planning for the year ahead.

We will commence 2021 in the intense grip of the second Covid-19 wave and, in the UK, with a new Brexit regime we are yet to fully understand. Of course, the light in the tunnel was amplified on the 30th December with the approval of the Oxford University /Astra Zeneca vaccine, but there is still much uncertainty and investors looking to protect their cash and diversify portfolios with an alternative asset that has delivered stable growth throughout 2020 should certainly be considering fine wine now.

For more information on which wines to invest in in 2021 contact the Vin-X team on 0203 384 2262.