Why choose fine wine as an alternative asset?

Most of us enjoy a glass of wine but how can this be something to invest in?

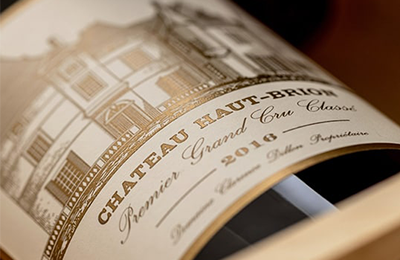

Consider that less than one per cent of the world’s wine production has the quality, critical acclaim and demand to trade on the secondary market.

Fundamentally, the limited supply and high quality of these fine wines, supports long-term value growth.