How do you value wine?

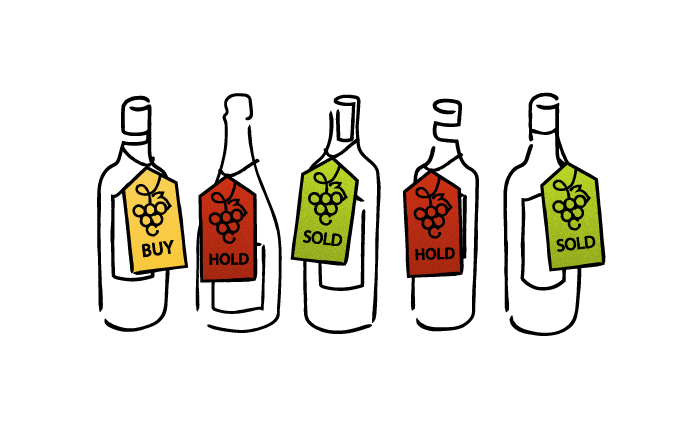

As an investor you want to understand what a wine is worth, whether you are paying a fair price with the potential for growth, and the price performance of your investment wines over time. So how is wine valued and what influences price?