Scarcity is the key driver of Burgundy investment wines and avid global demand is driving prices which saw average growth of 31% in 2021 and is dominating the market in January 2022. The supply and demand economics are simple added to which inflation is boosting values. Are you ready to invest in Burgundy in 2022?

Burgundy wine investment key facts:

- Average growth trend of 31% in 2021 (Liv-ex Burgundy150)

- 2021 performance exceeded the general wine trend of 23% (Liv-ex 100)

- Prices are rising faster than ever

- Highest regional trade share on Liv-ex at 28.8% in January 2022

- The secondary market in Burgundy is more diversified, robust and liquid than ever

- Climate conditions in 2019 and 2021 means supply is reducing

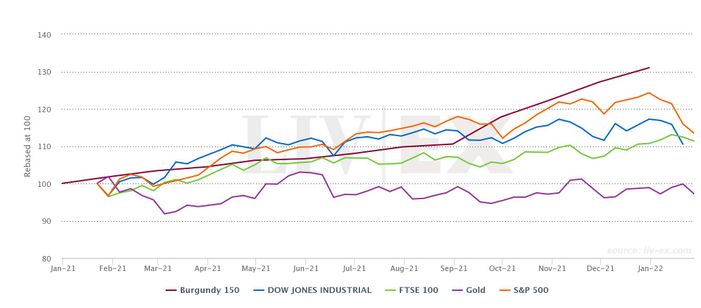

Burgundy wine investments compared to equities and gold:

Burgundy’s 31% growth trend exceeded the S&P500 (23%), Dow Jones (16.5%) and the FTSE100 (8.8%), last year with individual wines seeing much higher price performance. Second only to Champagne’s 41% average price increase in 2021, the foremost home of Pinot Noir has been leading trade on Liv-ex in the first weeks of 2022. The release of the 2020 Burgundy vintage has driven further interest in older wines and the region’s trade share on Liv-ex rose to 29% in January 2022, ahead of Bordeaux’s 25.7%.

The Burgundy investment market view for 2022:

“The secondary market for Burgundy thrived in 2021, recording new levels of trade and its highest ever share of the overall market. Blue-chip labels continued to command significant attention even as the category broadened to encompass new growers and appellations, a trend likely to continue in 2022.” Anthony Maxwell, Sales Director, Liv-ex.

Traditionally, Burgundy wine investment was centred on the world-famous brands, such as Domaine de la Romanée-Conti and Leflaive, and mainly by wine investors and collectors with very deep pockets, due to the five and six-figure sums involved. Demand for value in Burgundy in recent years has seen new labels traded on the secondary market and last year 166 producers saw action on Liv-ex compared to 78 in 2015. The region had the highest number of different wines traded on the wine exchange in 2021, rising 36.8%. Burgundy has become more diverse and robust and the region now offers greater accessibility to investors.

Top 10 Burgundy Growers’ Trade Share by Value on Liv-ex in 2021

| Rank | Burgundy Producer | Trade share |

| 1 | Domaine de la Romanée-Conti | 23.9% |

| 2 | Domaine Leroy | 9.6% |

| 3 | Domaine Armand Rousseau | 8% |

| 4 | Domaine Ponsot | 6.3% |

| 5 | Maison Leroy | 5.1% |

| 6 | Domaine Faiveley | 4% |

| 7 | Domaine Georges Roumier | 3.5% |

| 8 | Domaine Leflaive | 2.9% |

| 9 | Domaine d’Auvenay | 2.1% |

| 10 | Domaine Comtes Georges de Vogue | 1.9% |

Source: Liv-ex Report Burgundy 2020 – Stocks & Sweet Spots, January 2022

Investors are increasingly curious about the less famous Burgundy wines and the excellent quality scores they are achieving from the key wine critics. Demand is increasing and as they become more valuable, price growth is securing confidence in their asset value and growing liquidity, supporting an increasingly diverse and robust market.

Wine investment market share and supply

In late January 2022, Burgundy’s share of trade on Liv-ex was 28.8%, higher than the region’s 2021 average of 22% and Bordeaux’s January share at that point of 25.7%. This was in part down to the release of the 2020 vintage which, overall, is a more plentiful vintage than 2019 which was 14.6% lower than the Burgundy average production. But when you focus in on the red investment wines, 2020 supply is on a par with the earlier year. 2021 supply is even more worrying, climate challenges last year had a catastrophic effect, with production reduced by 37%.

Tight supply for the foreseeable future means price performance is likely to remain strong. Find out more about top performing wines regions and for more information on Burgundy investment wines offering scope for growth, contact our team on 0203 384 226.