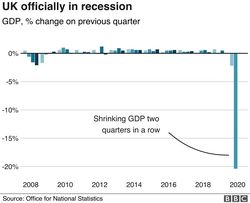

Figures released by the Office of National Statistics on the morning of the 12th August 2020 make it official – the UK is in recession for the first time in 11 years. The 20.4% contraction in the UK economy between April and June sees a second quarter of negative growth, the technical definition of a recession. Covid-19 now has its unhealthy grasp on world economies and the UK’s decline is rated as one of the largest of the leading countries, estimated twice that of Germany and the US.

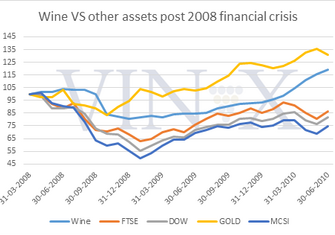

Stability is a highly prized commodity in territory like this. As an asset, one of fine wine’s defining characteristics is its performance delivering stable, long-term growth over time. This is largely influenced by its lack of correlation with financial markets. As a tangible investment, it attracts investors when ‘virtual’ assets such as company shares can lose significant value overnight. Shareholders in airline companies know this only too well at the moment.

In March and April this year we witnessed an horrific free-fall in global markets; the FTSE 100 lost over 15% of value in March and an additional 6.9% in April, in comparison the Liv-ex 100 dipped just -1.1% in the former and -0.3% in the latter.

We only have to look at some of the circumstances post the 2008 recession to learn some valuable lessons. For example, the Bordeaux Chateaux applied a similar approach in the release of their 2019 vintage in June this year to the 2009 en primeurs campaign, post the 2008 market crash. The 2008 vintage was released at significant discount in Spring 2009 – this year’s Bordeaux En Primeurs campaign was extraordinary. The top Chateaux released the high quality 2019 vintage at discounts as high as 30% on the previous 2018 vintage – no wonder that demand and trade is up 400% on last year’s campaign.

In broader terms, the post 2008 crash period, 2009 to 2010 saw the fastest growth rate in the values of top investment wines since records began. This was certainly fuelled by the entrance of new Asian buyers into the market but also growth in demand for a tangible asset at a period of extreme volatility and uncertainty in financial markets. These levels came to be unsustainable as Bordeaux prices peaked and then fell as investors sought wines of similar quality and critical ratings by key influencers, such as Robert Parker, from Burgundy and other regions. We all learnt a valuable lesson at that time and the importance of diversifying a fine wine portfolio by region and vintage to minimise risk. Since 2011, Bordeaux’s dominance over market share on Liv-ex has reduced from 95% to 50% or less as the market has grown and broadened to include new regions and more brands. Top Bordeaux continue to be core fine wine investments due to their superlative quality and the established secondary market in these blue-chip wines.

Investors are keen to identify assets that are currently ‘bucking’ the downward trend. We reported recently on fine wine’s general performance at the end of the first half of 2020 and those top fine wines that achieved a growth rate of between 12 – 15%, similar to ‘safe haven’ gold’s performance during January to June this year. This growth achieved at a time when the UK economy went into recession. See the table below as a reminder:

Liv-ex Top Performing wines 1H 2020

| Region | Wine | Vintage | Price at 01.01.20 | Price at 30.06.20 | 6-month performance |

| Burgundy | DRC, Tache | 2007 | £33,048 | £38,004 | 15% |

| Italy | Sassicaia | 2009 | £1,550 | £1,770 | 14% |

| Champagne | Pol Roger, Winston Churchill | 2002 | £1,590 | £1,796 | 13% |

| Italy | Tignanello | 2010 | £840 | £940 | 12% |

| Italy | Sassicaia | 2010 | £1,600 | £1,790 | 12% |

| Champagne | Louis Roederer, Cristal Rosé | 2009 | £3,600 | £3,950 | 10% |

| Italy | Giacomo Conterno Barolo, Riserva Montfortino | 2000 | £8,268 | £8,964 | 8% |

| Champagne | Premier Jouet, Belle Epoque | 2008 | £1,692 | £1,824 | 8% |

Source: Liv-ex.com July 2020

Champagne and Italian wines have continued to enjoy strong performances throughout 2020, building on increasing demand since the US 25% tariffs were imposed in October 2019, which they remain exempt from. Wines from these regions have been some of the top performers so far this year, seeing growth of 12 – 14%, as noted in the table above.

The latest news from Liv-ex is that fine wine is continuing its upward trend – the Liv-ex 100 grew 1.5% in the month of July 2020 to its highest level in five months. This has been largely driven by the active secondary market in Bordeaux 2019 en primeurs.

Fine wine offers an important tool for diversifying an investment portfolio, especially in periods of recession and economic uncertainty. 2020 is producing challenges on a scale previously unseen and understanding how to strengthen a portfolio with fine wine’s stable growth and diversifying to de-risk and protect capital is explained in our Guide to Fine Wine Investment. Call our experts to find out which investment-grade wines to start a collection with or to add to an existing collection on 0203 384 2262.