As rising inflation and interest rates put the squeeze on investors, is it ‘worth’ looking at wine investments to boost your returns this year?

Wine investment indicators for 2022

- Fine wine market saw average 23% growth in 2021

- Champagne top performing region with average 41% rise in prices

- The key fine wine market Liv-ex 100 index rose 1.9% in January 2022

- Top performing Burgundy investment wine rose 45% in January 2022

- Champagne is still fizzing with Cristal seeing the most trade by value in January 2022

- Robust trading activity on the secondary market in the first weeks of 2022

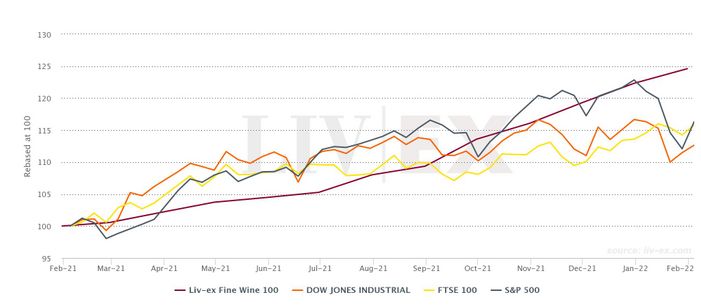

Wine investments v. financial markets – 1 year to 31st January 2022:

Source: Liv-ex.com 31st January, 2022

What are the challenges for investors?

Global economies are responding to high levels of inflation and UK interest rates are forecast to double again to hit 1% in May and 1.5% by November 2022.

The Bank of England has declared these ‘tough love’ measures necessary to rein in inflation

Sterling rose in response to the rate rise announcement at the beginning of February 2022 and it’s evident that the economic conditions are likely to create more volatility in financial and commodities markets this year.

Investors are feeling the pinch with savings value contracting as household costs soar, causing the largest reduction in spending power since 1990. Bricks and mortar investments are likely to be less accessible this year as rising rates deter buyers and some mortgage providers are withdrawing certain products, adding further drag to a slowing property market.

There is real unpredictability on where to find growth and protection for cash in traditional investments in 2022.

In contrast, wine investments are offering stability and growth during these uncertain times and, far from losing value to inflation, fine wine prices are on the rise.

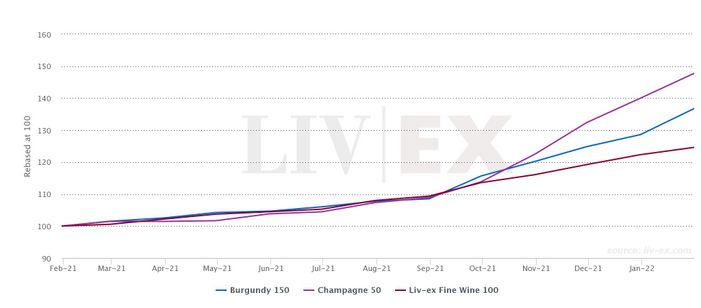

Growth driven by Champagne and Burgundy wine investments – 1 year

Source: Liv-ex.com 31st January, 2022

How do we measure wine investment worth?

Simply look at the numbers – the fine wine exchange, Liv-ex.com reports on the trading information of over 560 of the most prestigious fine wine merchants and wine investment specialists around the world. We can compare this data with the key financial indices and commodities such as gold and oil and get a true understanding of the performance of investment wines compared to equities and other assets.

Top performing wine investments in January 2022

| Wine | Region | Dec. ’21 £ | Jan ’22 £ | Change |

| Leflaive Bienvenue Batard-Montrachet 2018 | Burgundy | £5,799 | £8446 | 45.7% |

| Armand Rousseaux Chambertin-Clos de Beze 2018 | Burgundy | £20,404 | £27,940 | 36.9% |

| Taittinger Comtes de Champagne Bl. De bl. 2008 | Champagne | £1,930 | £2,300 | 19.2% |

| Bartolo Mascerello, Barolo 2016 | Piedmont | £4,456 | £5,168 | 16% |

| Dom Perignon 2008 | Champagne | £1,900 | £2,137 | 12.5% |

Source: Liv-ex.com 31st January 2022. Prices quoted – Liv-ex Mid Price (12 x 75cl)

Considerations for wine investors in 2022

The wine investment market is enjoying record levels of growth. It is broader, deeper and more diversified than ever. Tighter spreads between ‘bids’ and ‘offers’ on investment wines are an indication of the increasing liquidity and efficiency of the fine wine market.

Perhaps the most significant reason to invest in wine in 2022 is fine wine’s ability to be resistant to the negative impact of inflation. The impressive growth throughout the Covid-19 pandemic to date has been boosted by inflation. Fine wine’s ability to hold its value during recession, makes it a valuable means of strengthening an investment portfolio in the current environment.

So, is investing in fine wine worth the money? Without doubt and an important risk management strategy in portfolio planning. To find out more contact our expert team on 0203 384 2262 and download our Guide to Investing in and Collecting Fine Wine.