Add some ‘stars and spangle’ to your wine investments. Investors are using fine wine to diversify and strengthen their portfolios as we experience uncertainty in financial markets and rising inflation. We look at the building blocks of a diversified wine portfolio and the opportunity US wines currently have to offer.

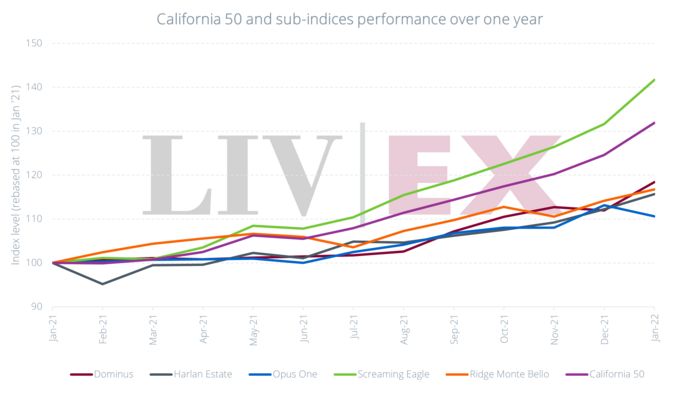

Source: Liv-ex.com 21st February 2022, data at 31.01.2022

‘Blue-chip’ Bordeaux has been the traditional cornerstone wine investment providing unparalleled liquidity in wine assets. In the last few years Burgundy and Champagne have emerged as key drivers for growth, with average increases of 36.6% and 47.7% respectively in the year to 31st January 2022. Investment wines from these regions are essential components of a rounded wine investment portfolio. In terms of regional diversification there are more steps you can take.

Perhaps the next region to grab investor attention this year is the US, and in particular the flagship wines of Napa. Like Burgundy, supply is tight with Californian investment wines generally made in very small quantities, but the quality is unquestionable. The region was awarded the highest number of perfect 100-point wines by the world’s most influential wine critics in 2021.

Which US wines should you look at for investment?

Liv-ex’s California 50 index measures the last ten physical vintages of the most traded US investment wines, Screaming Eagle, Opus One, Dominus, Harlan Estate and Ridge Monte Bello. The index rose 31.9% last year with Screaming Eagle the top performing estate, seeing an average 41.7% growth in its wines.

The key wines have largely been influenced by some of the most iconic Bordeaux estates and wine makers. Opus One is the result of a partnership formed between Baron Philippe de Rothschild (owner of First Growth Chateau Mouton Rothschild) and Robert Mondavi. Mondavi was also involved with Screaming Eagle which was strongly supported by Robert Parker, probably the most influential wine critic ever. Dominus is aligned with the Mouiex family, owners of the iconic Petrus, and Harlan Estate engaged the great Bordeaux oenologist, Michel Rolland as a consultant.

Other brands of note include the charismatic Scarecrow, formerly owned by Joseph J Cohn, most famed as the producer of The Wizard of Oz, the estate has retained its Hollywood glitter, now co-owned by his grandson Bret Lopez and Francis Ford Coppola.

The number of Californian wines traded on Liv-ex has grown by 480% in the last five years with share of trade on the secondary market (by value) rising, and in January 2022 recorded 10.4%, a similar level to Champagne’s 10.9%. In summer 2021, we witnessed a rush on Californian wines and looked at ten key facts investors should know about US investment wines.

The quality and market interest in California’s cult wines mark this as a key area of focus for wine investors and an important source of diversification potential in 2022. For more information on US wines currently grabbing attention on the secondary market speak to our team on 0203 384 2262.