Happy New Year!

To start the new year, I thought it would be useful to offer my view on the fine wine investment market and my professional opinion on where we could head in terms of performance in 2024.

Looking back

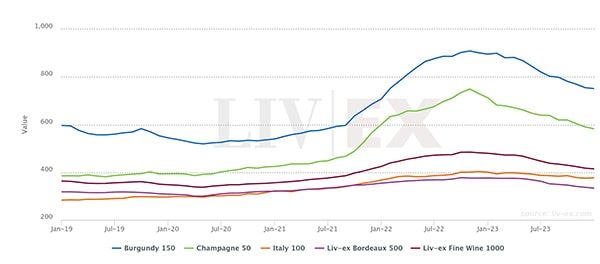

As an investment class, fine wine has experienced steady growth year after year, decade after decade. If you follow our quarterly report, you will know the fine wine market excelled during the period from mid-2020, as the fallout from COVID-19 impacted financial markets, to peak in October 2022.

If 2023 can be summed up in a word across all financial markets, currencies, and commodities, it would be 'challenging’. However, testing periods should be expected in any market, and these times also bring opportunities, which I’ll go into shortly.

The fine wine market experienced a flattening from the start of 2023, providing a back-drop to the release of the Bordeaux 2022 En-Primeurs. As the year evolved we saw prices return to levels last seen in 2021. The market contracted in the first half of the year as buyers became more cautious combined with an increased demand for liquidation.

Although short term this resulted in Liv-ex recording lowering average market prices, it went on to create a fantastic opportunity for fine wine investment in the second half of 2023. The reduction in trade prices on the exchange allows us the opportunity to procure wines from all major regions at prices that offer increasing growth potential for investors like you.

Wine Investment Fundamentals

As we all know, fine wine should not be considered as a short-term investment.

At Vin-X we will always recommend a 3–5 year hold as a minimum. If you are in the position to hold your investment longer, then that is always my advice! Give each case the chance to mature, grow, become even more desirable and valuable.

Once a new vintage is released, there will never be more bottles produced from that year. With supply diminishing year on year, the longer you hold your wine the higher demand becomes.

Although my advice is to hold for longer term, stronger returns, if you choose to release your investment, our procurement team will of course work tirelessly to ensure we achieve the best possible price for your wine.

Similar to many other passion assets, fine wine is often used to diversify an investor's overall portfolio. To optimise growth our portfolio management team are highly skilled at creating further diversification within your fine wine holdings by regional, vintage and brand strategies.

| Liv-ex Indices | 5 Yr Growth % |

|---|---|

| Fine Wine 1000 | 14.10% |

| Burgundy 150 | 25.80% |

| Champagne 50 | 51.30% |

| Italy 100 | 33.00% |

With regions such as Burgundy and Champagne, which led the price growth in 2022, and Italian wines showing their resolve in 2023, diversification has never been more important to profitable wine investment. If your goal is to see steady growth of 8%-12%+ per annum, you can increase your potential returns by spreading your investment between the major wine regions.

What's on the horizon?

In terms of what 2024 has in store for us, with global equity markets and other traditional asset classes proving to be as volatile as in recent years, alternative assets such as wine become increasingly relevant to profitable investment planning.

Liv-ex data published in our Reports in H2 2023 showed that the volume of trades in fine wine grew month-on-month as investors took advantage of the attractive prices now on offer for wine investors. For the first time in a number of years, we are entering a new year with wine values having undergone a significant correction across a protracted period.

It is however encouraging that the last few months of 2023 showed a slowdown in the softening prices. It is our view that some of the Liv-ex fine wine indices will start to show positivity in the first half of 2024.

We expect this recovery to be particularly true for some of the ‘safe havens’ within the wine market. The recent increased trading activity with top wines from iconic vineyards from across France and Italy is a key indicator. The first half of 2024 looks to be a very interesting and opportunistic period for wine investors.

If you have any questions on how to maximise your fine wine investment portfolio this year, please feel free to book a call with your portfolio manager, and follow us across Social Media for the very latest updates.

I wish you all the best for 2024!

James