Property investors may want to consider diversifying their portfolios with fine wine as they buckle up for a bumpy ride in 2023.

Property investors face a challenging period

We all feel safe with bricks and mortar, for most of us our homes are the largest and most important investment we will ever make. The advent of ‘buy-to-let’ mortgages created such demand for second homes and property investments that it has become a well-established investment strategy.

Investing in property is not for the short term, usually requires a large capital outlay and, for most, a commitment to debt. Tax payments in the form of Stamp Duty, Income Tax and Capital Gains Tax are all considerations for second homes. The returns, of course, can be significant and income generated from buy-to-let a key reason.

But these are very complicated times for mortgage holders and landlords. Interest rates are on the rise with no sign of abatement. The CPI hit 10.1% in September, back up into double figures and at the highest level for forty years. The Bank of England has forecast it could hit 13% this year and has seemingly no other choice than to amplify its policy to increase interest rates to put the brakes on inflation. These will have to translate into the mortgage market.

Many property investors will struggle to increase rents to match mortgage rate rises as tenants are struggling with the spiralling cost of living. Food and drink inflation was at 14.5% in September and ,even though there is a cap on energy costs, the price increases still represent an unbearable rise for many.

Buy-to-let investments at risk

Property news sources have reported in October 2022 that more than 22 per cent of buy-to-let properties are at risk of becoming loss-making in the southeast of England. Landlords here may need to lift their rents by 28 per cent to make their properties mortgageable and profitable. Across the UK this figure stands at 24 per cent.

Landlords are under pressure due to the soaring cost of borrowing. It is expected that two-thirds of landlords on fixed-rate mortgages will see these deals end before December 2024. It is also reported that if mortgage rates increase by 4 per cent on their current arrangements, 38 per cent of these properties will not be mortgageable and will be loss-making.

How are property assets performing compared to fine wine in 2022?

At the end of Q2 Halifax recorded the average UK property price as having risen by 13% in the preceding 12 months. This measure has fallen to 9.9% at the end of Q3. June’s average growth of 1.8%, was the highest monthly uptick in fifteen years, September recorded just 0.1% average growth.

A lack of supply supported property price growth in the first half of 2022 but with the Bank of England likely to instigate larger rate rises into 2023 we can expect to see more significant contraction in house price growth in the next 12 months.

The property market has become significantly more complicated at the start of Q4 2022 with extraordinary political and economic headwinds fuelling conditions that will further challenge property investors in the coming months.

Meanwhile, fine wine assets are continuing to see steady growth and strong trade in the secondary market.

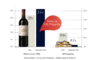

Fine Wine compared with UK residential property:

Asset | 1 Year average |

Burgundy investments | 41.9% |

Fine Wine - Liv-ex 1000 | 22% |

UK residential property | 9.9% |

Equities - FTSE 100 | -2% |

Source: Property - Halifax, Wine – Liv-ex.com, data at 30.09.2022

How does fine wine differ from property?

Accessibility

For investors, key points of difference when investing in fine wine are a much lower entry point into the market. For example, a case of Louis Roederer Cristal 2008, has a trade price of around £1,850 (6 x 75cl) in October 2022 and has enjoyed 49 per cent growth in the last year. Salon Le Mesnil sur Oger 2004 is the top performing Champagne returning 137.2 per cent to owners in 12 months to 30 September 2022.

Tax

In terms of the tax treatment of fine wine, there is no Income Tax liability and profits are Capital Gains Tax exempt, subject to personal circumstances.

Wine like property has ongoing costs for storage and insurance, where property has maintenance and insurance costs. Both are tangible assets that are generally stable, however property is more response to economic pressures.

Conclusion

Nobody is suggesting fine wine investments should replace property, however there is a very compelling argument for investors to diversify their portfolios with fine wine to manage risk, protect capital and enjoy tax free growth.

For more information on the tax treatment of fine wine see our special Report and speak to a member of our expert team on 0203 384 2262 about investing in this rewarding market.