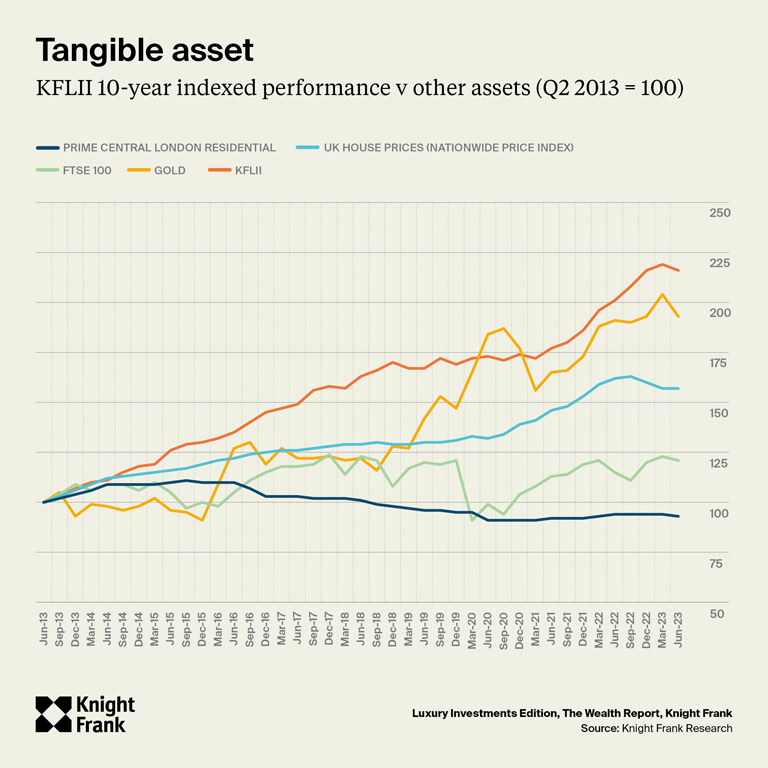

Knight Frank’s latest Wealth Report records that luxury assets delivered stronger returns than Prime Central London Property, gold and equities. Passion assets are still providing owners with some defence against inflation.

Property specialist, Knight Frank publishes Wealth Reports providing an independent view on important tangible, alternative investments that are increasingly relevant to more and more investors as they proactively manage their investment portfolios in the current economic environment. Whilst our primary focus is on fine wine, we appreciate this independent view on the ‘Passion Asset’ sector.

How are luxury investments performing in 2023?

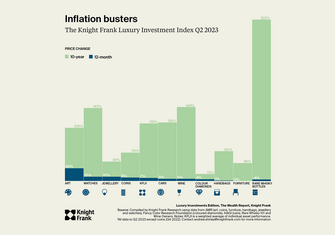

Their latest Report takes a deeper look at ‘Luxury Investments’, within which they provide performance information on a ‘basket’ of ten asset classes owned by ultra-high-net-worth investors. These include art, classic cars, coins, coloured diamonds, fine wine, furniture, jewellery, watches, and rare whisky. Collectively, the Knight Frank Luxury Investment Index (KFLII) measures the overall performance of these prized possessions.

Knight Frank’s Luxury Investments Report, published in August 2023, shows that in the 12 months to the end of Q2 2023, the KFLII recorded an average growth of 7%. In comparison Prime London Property fell -1%, gold rose 1% and the FTSE 100 recorded a 5% increase, demonstrating the value of ‘Passion Investments’.

The Report also refers to the fact that this has been the weakest performance period for the KFLII since Q2 2021, with the slowdown in classic car and fine wine markets over the 12 months measured being a key factor.

Fine wine and classic cars are key drivers of the KFLII

Consistently robust fine wine has been a key asset in the historical strong performance of the KFLII collectively. The Report observes the impact of the recent market adjustment on their collective luxury index. “A slowdown in the wine and classic car markets, where double-digit rises have often underpinned the index’s performance, helped temper growth.” The detail below summarises key points made in the Report on the leading ‘Passion assets’.

Fine wine’s classic appeal

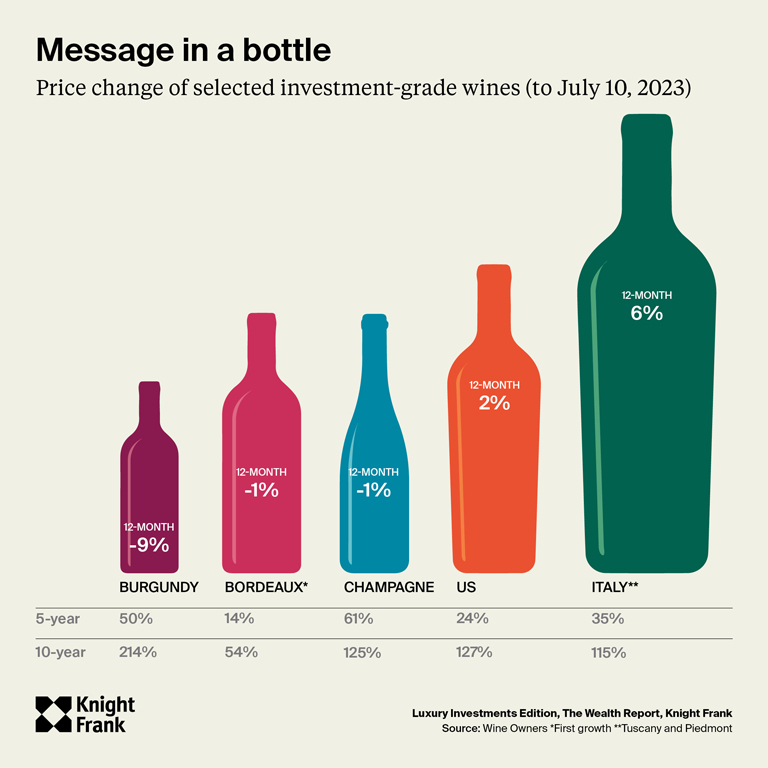

The Knight Frank Report records an annual average 12-month growth of 5% and a ten-year rise of 149%, second only to Whisky. The data is provided by Wine Owners and they refer to recent performance being largely driven by Burgundy. Fine wine is relatively consistent and is normally ranked in the top three performing assets of the KFLII.

“Burgundy has been the big success story of the past decade, with prices having escalated 367% by the early autumn of 2022. However, the top of the Burgundy market peaked about that time and has fallen by -9%.” Nick Owen, Wine Owners.

The Report considers the regional performance of fine wine and records Italy as the top performer in the year to 30th June 2023, with an average growth of 6% and US investment wines are up 2%. Wine Owner data records an average -1% fall in prices of Bordeaux and Champagne investment wines in the same period.

They report that rising interest rates and the cost of capital has affected the market in the last 12 months and trade buyers are looking to producers and their agents to price wines at first release to provide growth potential for new owners in the secondary market. This will influence the level of energy in the market and price performance over the coming months.

OUR VIEW: The correction in the market this year has seen fine wine’s average 12-month price performance slip, and this is reflected in the Report’s findings. The regions, brands and vintages are all performing differently and as with the other assets some have held their value better than others. Italy and Bordeaux did not see the extreme price growth, in excess of 50% in the bull run of 2020 to 2022 that Champagne and Burgundy enjoyed, and as a result are relatively buffered from the current head winds.

In the second half of the year we are now seeing the trajectory of the decline flattening out, particularly in Champagne, as lower prices brings buyers back into the market. The secondary market in fine wine is well established with over 600 global merchants transacting through Liv-ex, its stock-exchange equivalent. This provides investors with greater liquidity, transparency and trading efficiency which ensures a more robust pricing environment investors can trust.

Inflation appears to be heading in the right direction but still has a long way to go. Investors should note that fine wine held its value as inflation rose to its peak in October 2022 and we have seen an adjustment in fine wine prices as central banks around the world tackled inflation with multiple rate rises over the 12 months to 30 June 2023. It could be that the fine wine market is now settling into its ‘corrected space’ – we will see in the coming months.

Art - leading by design, but how clear is the market?

Art has been the top performing collectable in the 12 months to the end of June 2023 according to AMR data which recorded an average 30% growth in art valuations. Over the longer-term, 10-year period, this increased to 109%, ranking art 4th behind whisky (1), fine wine (2) and watches (3).

Art is a more subjective and certainly more opaque market than fine wine. Valuations are driven by either auctions or private sales and data can be skewed by individual landmark sales. For example, the most valuable artwork sold in 2023 to date was Gustav Klimt’s painting, ‘Lady with a Fan’ which sold for €86M (£74M) in June. The current most valuable painting ever sold ‘Salvator Mundi’, is attributed to Leonardo Da Vinci and was sold at auction for an incredible US$450.3M in November 2017.

The Report explores the gender agenda in art and the growing popularity of female artists and corresponding growth in the value of their works. This is thought to be influenced by significant global social change with the #MeToo and #MLM movements key drivers. Art also enjoyed a boost in popularity with the end of Covid Lockdowns seeing the auction and exhibition worlds resume business as usual.

OUR VIEW: Art is not totally immune to the current market conditions. The top three auction houses reported that their total art sales figure had slipped from US$2.5bn in the month of May 2022 to US$2bn in May 2023. Lower pre-sale estimates, more expensive capital due to rising interest rates, and concerns over the global economy has seen a growing cautiousness in the market. Art is also extremely illiquid, it does not benefit from an efficient, transparent secondary market and the potential for future sale should be borne in mind.

Art has been a primary focus of the NFT movement and digital art investment is a market attracting a lot of interest with a surge in demand during the pandemic. No surprise as lockdown drove investors to look online. Extreme volatility in the cryptocurrency sector in 2021 knocked confidence and transaction volumes and values have since slumped. That said, there has been a pick-up in 2023, with the current revival in cryptocurrency, perhaps in part due to the arrival of early-stage regulation.

Watches keeping time but are they holding value?

Knight Frank’s report and data from ARM suggested that collectable watches and jewellery both achieved average growth of 10% in the 12 months to 30th June 2023. Over the longer 10-year period watches have returned an average 147%, just a stroke behind fine wine’s 149%. Individual land-mark sales for extremely rare watches, often associated with a celebrity, can achieve significant sums at auction. A record watch sale was a stainless-steel Paul Newman Daytona Rolex, which sold for US$17.8M in October 2017.

OUR VIEW: Price points can be similar to fine wine in collectable watches generally, but a few rare models can command significant valuations. The market is becoming more ordered as additional agents and platforms enter the market. A notable development is Rolex introducing its Certified Pre-owned Programme in January 2023.

Rolex is the mega-brand, representing 28.8% of market share for collectable watches, as much as the total of the next five brands collectively. It can be likened to Chateau Lafite Rothschild in terms of quality, supply and liquidity, where Patek-Philippe maybe thought to be more akin to Burgundy’s Domaine de la Romanee Conti, with smaller supply driving extraordinary prices.

Other trade commentary reveals that watch prices have fallen 15% in 2023 as supply of pre-owned watches has increased in the secondary market in response to slowing global economic growth, higher interest rates and trauma in the cryptocurrency sector. The top end watch brands are making more expensive watches, but less of them, this may shape the market in years to come.

Are Classic Cars driving growth?

Knight Frank and HAGI report an average 5% growth in the values of classic cars in the 12 months to 30th June 2023, on a par with fine wine in the period under review. Over 10 years cars have delivered an average 118% return on investment.

The Report states that in 2022, the most investable classic cars increased in value by 25%, however over the last year the brakes went on climbing values as inflation and interest rates rose. HAGI recorded a drop of almost 7% in average prices in H1 2023.

The Report states that in 2022, the most investable classic cars increased in value by 25%, however over the last year the brakes went on climbing values as inflation and interest rates rose. HAGI recorded a drop of almost 7% in average prices in H1 2023.

Super-brand Ferrari saw the sharpest fall of the most popular marques, down 15% on average. Newer and lower priced cars are holding value better, Lamborghini for example has seen an average 9% price growth, where Mercedez and Porsche are down -10% and -5% respectively.

OUR VIEW: The classic car market is not an easy ride and owners have to buy ‘for the love of it’. There’s a lot less predictability in the economics of owning a classic car. The 2008 financial crisis shunted cars with a 16% fall in values over the year to August 2009. The market slowly clawed value back to a market peak in 2015 to then see the sector hit a 2-year downhill plunge losing 17% and a bearish market prevailed. The pandemic pushed many investors to tangibles and cars saw a rise in trade and value in 2021.

Higher interest rates, energy costs and economic uncertainty has slowed the market this year. Longer term, will the green agenda mean the great classics simply become museum pieces? They are going to become even rarer. Will we even see them driven? Knight Frank points to owners who shape their house purchase and refurbishments around their passion. Some UHNWIs choose to live near a race circuit or build their own along with state-of-the-art-garaging to house their auto-investments.

Classic cars, like art, tend to be less accessible. The price tag can be in the millions and the cost of maintaining the investment over time is not insignificant. The secondary market is also driven by private sales and auctions where prices may not be as robustly tested as they are in the fine wine market for example. Ultimately an investment in one car could be applied across a more affordable, diversified wine portfolio.

Is it truly ‘Whisky galore’?

Knight Frank’s whisky data is provided by Rare Whisky 101. It is the only luxury asset in the KFLII to have recorded a decline in the 12-month period under review, falling -4%. However, it’s also the highest 10-year performer with growth of 322%. Whisky first featured in the KFLII in 2019 when it really hit the investment radar.

Iconic brand Macallan has seen individual commemorative bottles sold for more than £1M, but has been one of the hardest hit brands in the current price adjustment the sector is experiencing. Its average value is down 11.7% in the year to 30th June 2023. Other brands have done well and Balvenie is pointed to as a top performer, up 22% in 12 months.

The Report endorses the sales pitch of the ‘amber nectar’ asset being held for the long term and ideally 5 to 20 years should be planned for. Recent issues with increased fraud in the sector is also pointed to and investors should be robust in their due-diligence.

OUR VIEW: Whisky is an ancient brew, but a relatively new investment. Individual bottles are generally the most attractive way to invest in whisky. The tax treatment of investing in bottles or collectively in cask is different and investors should seek advice from their financial advisor. Liquidity is still very tight, hence the whopping whisky valuations for the most iconic, rare Scottish single malts. This also explains the record 10-year data featured by Knight Frank which is massively impacted by the price growth of a relatively small number of new investors entering the global market in 2018 to 2019.

Whisky is certainly an interesting space, but it is embryonic with a long way to go before investors can enjoy the transparency, liquidity, stability and performance enjoyed by fine wine.

Our Conclusion

Luxury assets have all experienced a similar trend of ‘correction’ in the 12 months to 30th June 2023. This covers the period post the surge for tangible, inflation-resistant investments during the pandemic and start of the Ukraine War. Additional factors have influenced those assets that are more advanced in digital commoditisation but ultimately passion assets have gone through a recent ‘cooling period’. Nobody has fallen out of love with them, but for some there was highly attractive profit to be made during the rising bull-run, and for others, prices became unsustainable.

All ten asset classes, apart from whisky, demonstrated their ability to hold value during a period of significant rising inflation. As the air is being forced out of that balloon by central bank action, prices are coming down, and this is having some effect in those markets.

For more information – you can read the full Knight Frank Luxury Investments Report. For more information about the benefits of wine investment, please speak to a member of our expert team at 0203 384 2262.

Explanatory note: Knight Frank luxury investment data is sourced from independent third-party specialists; ARM monitors art, coins, handbags, jewellery and watches; Fancy Colour Research Foundation – coloured diamonds; HAGI – cars; Wine Owners – fine wine and Rare Whisky 101 – Whisky. The KFLII is a weighted average of individual asset performance. For more information please refer to the Knight Frank Luxury Investments Report, August 2023.