I have already written about a potential Brexit on one or two occasions, specifically from our point of view as a wine company. With just over 100 days until we all (hopefully) go out and vote, I thought it appropriate to express an opinion more generally on the matter. Ultimately we are all currently devoid of facts on the real impact of Brexit, we have therefore considered the case-studies presented by other nations’ relationships with Europe.

At Vin-X we are happy to add our voice to those in our industry who have already expressed their views through the WSTA and present our opinion to our clients.

Vin-X are firmly in favour of remaining within the EU. In keeping with a personal philosophy of your author “in God we trust, all others bring data” this decision has been data led; while we understand the philosophical concerns with the EU, and in no way see it as a perfect organisation, we believe the likely and viable alternatives to be worse.

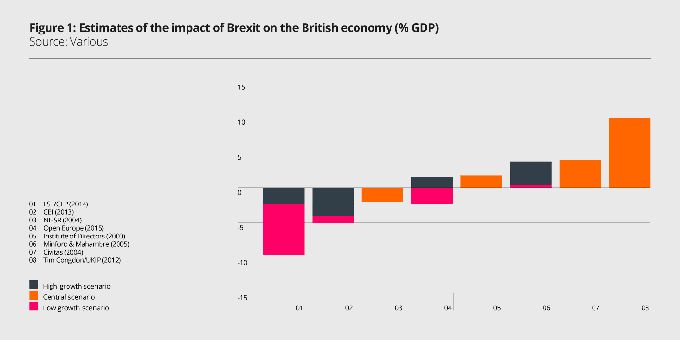

There are two aspects to the current debate; an economic one, and a philosophical one. The economic case is certainly easier to debate and arguably less contentious. Simply put there is no clear and viable economic case for Brexit; there are too many unknowns to make any definitive statement. The range of predictions for the impact on GDP is at least 20% (the poorer figures being generally more recent and from less partisan organisations) a huge number.

Financially we can be certain of a few things in the event of a Brexit.

- Prolonged negotiations with the EU

- Continuing uncertainty as to the UK’s future status

- Considerable debate in the UK as to our future relationship with the EU

Depending on the outcome of those negotiations (which EU legislation allows up to two years to be completed) there are a range of viable outcomes, some of which have problems all of their own. Blackrock the investment managers have summed up the options in their report published recently as:

- Norwegian deal: full access to the European Economic Area (EEA) as enjoyed by Norway and others under the European Free Trade Association (EFTA). In return, EFTA members contribute to the EU budget and are bound by its ‘Four Freedoms,’ including free movement of people and regulations on working hours, banking and climate change.

- Swiss style: Switzerland has bilateral accords that grant it access to parts of the single market but exclude financial services and includes contributions to the EU budget.

- urkish trade: this would be a customs union, where access to the EU internal market is allowed for goods on a tariff-free basis, but services and agriculture are excluded.

- UK-tailored deal: this would involve free trade agreements negotiated individually with the EU and others.

Norwegian and Swiss deals would seem on the face of it unacceptable to those in favour of Brexit because they entail continuing contributions to the EU budget with no say on EU legislation, and the necessity to continue observing EU regulations.

The Turkish deal seems unattractive given the exemptions for services, where the UK has a significant trade surplus with the EU.

A tailored deal seems to be the only solution that fits in with the philosophy of the leave campaigns but it could take DECADES to conclude the necessary trade deals. The EU’s trade deal with Canada has taken 7 years to complete. The total value of Canada’s trade with Europe is around €59bn [2]. The total value of the UK’s trade with the EU is around €660bn [3], so it would make sense for negotiations to be significantly longer and more complicated. Furthermore part of the apparent problem is that the UK already has trouble extracting concessions from the EU. Out campaigners have yet to demonstrate why Europe would make further concessions to the UK if it were no longer contributing to the EU budget.

To us the economic argument in favour of Brexit seems at best uncertain. As an import business we are already dealing with the problems this uncertainty is bringing to the currency markets, let alone extra layers of red tape that would come our way should we have to deal with importing wine and tariffs on a country by country basis.

For this reason alone Vin-X are firmly for remaining, although with brevity in mind, we will come back to the philosophical arguments in the coming days.

[1] https://woodfordfunds.com/economic-impact-brexit-report/

[2] http://www.parliament.uk/briefing-papers/SN06091.pdf