The top wines of Burgundy are produced in low volumes, are of a superlative quality and command some of the highest values in the world and the market just can’t get enough of them!

The growing global demand for Burgundy’s wines has driven growth in the region’s market share by value traded on Liv-ex from 1% in 2010 to 12.3% in 2017. The Burgundy150 index, which measures the most traded Burgundy wines in the secondary market, has grown an impressive 108% over the same period.

SUPPLY

The double-edged sword of extremely low supply, means top Burgundies achieve extraordinary values but at the same time do not enjoy the same levels of liquidity and ‘speed of price discovery’ as Bordeaux. Extremely rare bottles can quickly become price setters in a way that may create unsustainable spikes in the market, but buoyant conditions for the region’s best has held that particular challenge at bay over the last few years.

Burgundy production examples:

| Producer | Wine | Maximum bottles | Av. Price per bottle |

|---|---|---|---|

| Leflaive | Le Montrachet | 400 | £6,000 |

| DRC | Romanee Conti | 5,000 | £10,500 |

| Rousseau | Chambertin | 8,800 | £900 |

| Clos Tart | Clos Tart | 29,000 | £250 |

| Lambrays | Lambrays | 30,000 | £150 |

Source: Liv-ex Report: Burgundy – The Market’s Favourite Tipple, February 2018

The market has matured since 2010, it is broader and deeper than ever before. 1,572 unique Burgundy wines traded on Liv-ex in 2017, a 539% increase on the number in 2010. Liv-ex report that the total value of bids and offers in Burgundy wines has increased from £3million to £9million in the last three years with particularly strong growth in 2017.

Increased demand from Asia has driven price growth, Liv-ex reports that the value of Burgundy wine acquired by their Asia-based trade members has increased by 140% since 2009 (in absolute terms), in comparison to a growth in Bordeaux trade of 77%, which includes the decrease in demand since 2013.

PRICING DYNAMICS

Critics’ influence:

Burgundy wines are not as susceptible to price movements due to critic’s ratings of a vintage and as such they are not as important for the price setting process in Burgundy. Scores are often published after the growers and merchants have agreed allocations and prices. Once the wines are in bottle, they are generally not tasted as regularly by the critics as the Bordeaux wines and as such there are fewer opportunities for prices to be influenced by critics.

Global demand:

As in Bordeaux, strict AOC rules in Burgundy limit production levels, and this relatively fixed, small supply has to satisfy a growing global demand, in essence more money is chasing fewer bottles. It’s simple supply v demand economics, the prices now being reached for top Burgundies, particularly older and rarer vintages, can be extraordinary. For example, a 12-bottle case of Domaine de la Romanée Conti 1988 sold for £198,000 in 2017.

DOMAINE DE LA ROMANEE CONTI

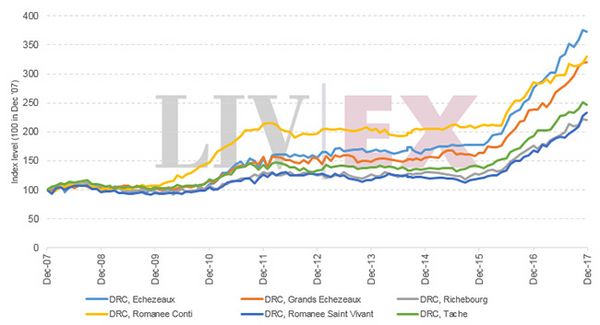

DRC is one of the most important brands in the fine wine world and encompasses the wines of DRC Romanée Conti, Echezeaux, Grands Echezeaux, Romanée St Vivant, Richebourg and La Tache.

Figure 10: DRC sub-indices ten year performance

Source: Liv-ex Report: Burgundy – The Market’s Favourite Tipple, February 2018

Liv-ex estimate that the total annual production across the DRC vineyards is between 7,000 – 8,000 cases per annum. This compares to average annual production across the Grand Vins of the Bordeaux five First Growths (Haut Brion, Lafite, Latour, Margaux and Mouton Rothschild) of 70,000 cases.

As demand continues to significantly outstrip supply, relative prices are pushed increasingly higher and DRC values have looked overstretched for some time now. Bordeaux’s market heights of 2011 saw unsustainable price levels, is Burgundy, and in particular DRC, reaching a similar level? We will continue to monitor closely and keep you informed.

We look at Burgundy in more detail in our February Market report. For more information contact us now on 0203 384 2262, enquiries@vin-x.com or visit our website www.vin-x.com