For the over-55’s April 2015 heralds a new dawn in the way we look at pensions. Under the new rules those over this age threshold will have total freedom to access their pensions when reaching retirement. It is now possible to take pension benefits from personal pensions without buying an annuity. This means that retirees will be able to withdraw capital from their personal pension and have greater control on how their hard-earned cash benefits them in the future.

This of course leads to a whole raft of questions and decisions to be made. Now is the time to think hard about the future and be honest about what you want your pension pot to deliver and of course consult a financial advisor. Think about short, medium and long term goals and commitments and the obvious advice would be to tailor your investment plan accordingly.

Investors are wise to diversify to minimise risk and enhance returns and a rounded portfolio will include traditional investments including equity-based products along with alternative assets and in particular tangible ones with a strong growth performance such as fine wine.

Fine wine has a track record of providing average compound returns of more than 10% per annum in the medium to long term, is tax-efficient which is particularly important for pension investors and generally resistant to the effects of inflation. Fine wine is now considered by wealth advisors as a means to diversify and strengthen investment portfolios.

The recently published Knight Frank Wealth Report 2015 canvases the opinions of 500 wealth managers and the investment practices of their Ultra High Net Worth clients, collectively worth US$1.7trillion. The report states that 6.1% of this total investment is in tangible assets including fine wine.

“In our experience UNHWIs are becoming concerned about paper assets such as bonds and equities and are increasingly looking for tangible alternatives. The scarcity of luxury assets and their historic ability to hedge against inflation makes them an appealing investment proposition – it is always possible to commission a new yacht, but nobody can paint another Monet or build a classic Ferrari.” Saeed Patel,Investment Analyst Schroders

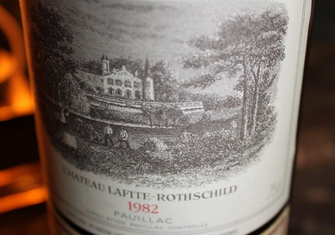

Likewise no-one can recreate a Lafite 1982 which at release was priced at 25.9 euros a bottle in 1983 en primeur, and at its peak reached £84,300 (1 x12-bottle case) at auction. There is a finite amount of investment-grade wine globally and the opportunity to acquire wines from super vintages (such as 2009 and 2010 in recent times) even rarer over time. This scarcity increases again as wines reach their drinking windows.

For the newly liberated pension investor the timing could not be better to enter the fine wine market. The current price trend in Bordeaux offers superb opportunities for long term growth. The market is perfect positioned to adopt the old adage of buy at the bottom and plan to exit at the top!

For more information on the opportunities available right now contact our team on 0203 384 2262 and catch up with news and views in our free newsletter.