“Never put all your eggs in one basket” should be the canny mantra of any investor and the same is true of the fine wine market. Traditionally Bordeaux has always dominated any fine wine portfolio but in the 21st century there are now a handful of other wine-producing regions which may also claim to be producing some of the greatest wines in the world and which should be part of the mix.

Don’t get me wrong, Bordeaux should still be considered the back-bone to a wine portfolio with its well-established and active secondary market. Some of the very best Bordeaux wines are very well-priced for buyers at the moment and there has probably never been a better time to strengthen a Bordeaux position and average down the cost-base of a wine portfolio.

We believe that diversification is essential and some of the most consistent performers and attractive opportunities are the best wines of Champagne.

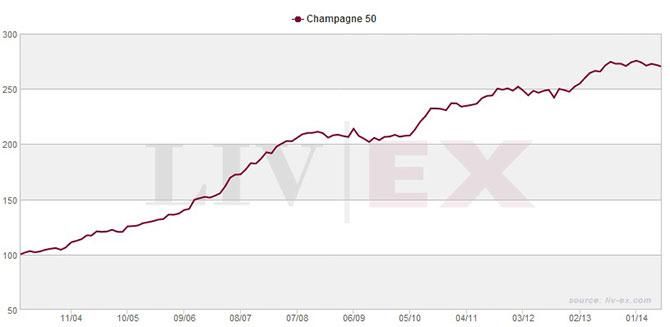

Champagne as a wine producing region is perhaps the most recognized wine brand globally, it has been super consistent in performance terms in recent years (see chart) and consumption worldwide is growing, in part due to improving global economic conditions.

The largest European markets for Champagne outside France remain the UK (51% of exports) and Germany (21%), and the USA (27%) has the largest market outside Europe with imports of sparkling wine increasing by 49% since 2009. The ‘sleeping giant’, however is undoubtedly China whose export share is only 3% currently. Contrast this with their taste for Bordeaux where they account for 23% of the export total. The market for Champagne in China has doubled since 2008 and we will continue to monitor this demand going forward. Certainly the appetite for premium Bordeaux and the flagship brands would suggest that future growth from the Far East will probably be focused on the investment-grade champagnes.

In the past year we have recommended selected top cuvees (Dom Perignon, Cristal and Krug) from the Grande Marque houses and their performance to date has all been positive, in some cases up to 20% growth. This simply proves not only our rigorous stock selection but also that Champagne always provides consistent, regular growth and should form part of diversified wine investment portfolio.