Effervescent, bubbling, sparkling, frothy Champagne overtook ‘serious’ blue-chip Burgundy in October 2021 as the top performing region for investment wines. In a record year for the wine investment market, Champagne is leading the way and investors have a lot to celebrate.

Investment Champagne Headlines:

- Champagne prices have risen 30% in the last year

- Liv-ex Champagne 50 index has risen 23.8% in 2021

- Dom Perignon 2008 – top performer seeing a 52.5% price rise YTD

- Investment wines from the region have produced the highest average growth

- Louis Roederer Cristal Rosé, 2012 is the most traded Champagne on Liv-ex by value

- Rosé Champagne market continues to expand

Champagne Investments – Performance

Reliable, consistent growth; Champagne wine investments deliver a ‘steady-Eddie’ investment performance, in stark contrast to their exciting, exuberant drinking characteristics. But that is to be celebrated and a key reason for wine investors to include Champagne in their portfolio planning.

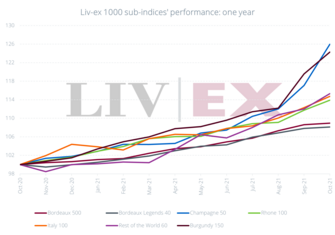

The Liv-ex Champagne 50 index tracks the recent vintage prices of twelve investment Champagne labels and has grown 23.8% through to the end of October 2021 and 30% over 12 months, surpassing the Burgundy 150, Italy 100 and Bordeaux 500 regional benchmarks during the same period.

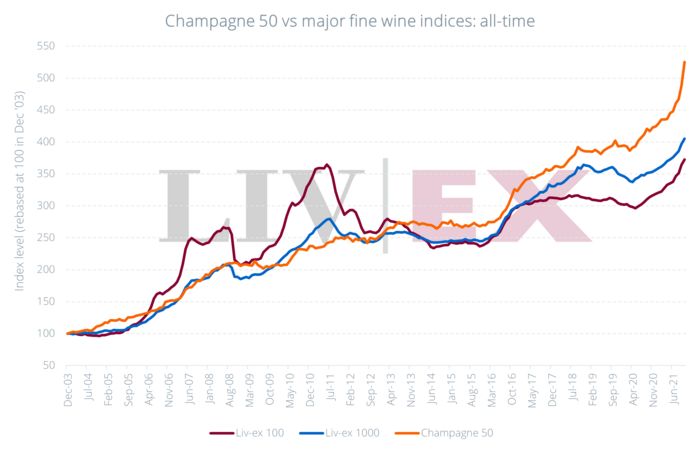

This isn’t a blip. Over the long term, Champagne has maintained stable, solid growth. The chart below shows Champagne’s long term performance trend since price data started being compared by Liv-ex, the fine wine market ‘stock exchange’. Investment Champagnes have remained resilient to economic and fine wine market drivers which have triggered more extreme price movements in Bordeaux and Burgundy.

Champagne Market Drivers

Champagne’s stable growth performance can be largely attributed to:

- significantly large volumes of supply in the market,

- the broader consumer platform than that for much higher value investment wines from Burgundy, Bordeaux and Napa particularly, with products in restaurants, hotels, at major events and in private cellars

- a much more extensive distribution network with highly efficient routes to market.

In terms of the secondary market, Champagne accounts for just 8% of the total value investment wines traded on Liv-ex, which was led by Bordeaux (39.5%), Burgundy (20.8%) and Tuscany (8.5%) this year, to 31st October.

Most Traded Champagnes by Value in 2021

| Champagne | Vintage |

| Louis Roederer, Cristal Rose | 2012 |

| Dom Perignon | 2008 |

| Bollinger, La Grande Annee | 2012 |

| Dom Perignon | 2010 |

| Taittinger, Comtes de Champagne Blanc de Blancs | 2008 |

| Louis Roederer, Cristal | 2013 |

| Dom Perignon Luminous | 2010 |

| Taittinger, Comtes de Champagne Rose | 2007 |

| Louis Roederer, Cristal | 2008 |

| Rol Roger, Sir Winston Churchill | 2012 |

Source Liv-ex, November 2021

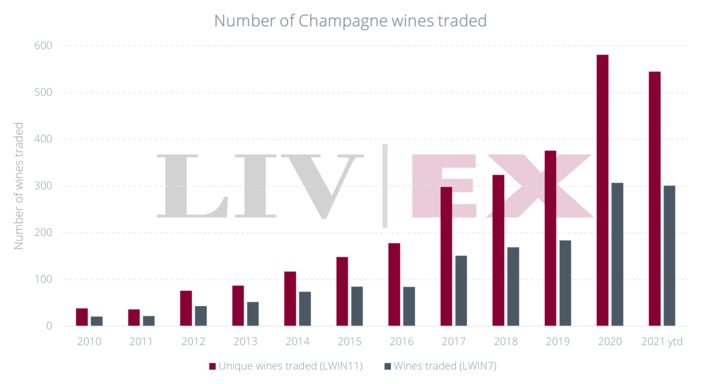

The number of Champagne investment wines traded on Liv-ex has increased significantly in the last decade with Rosés seeing strong growth in demand in 2021. Louis Roederer Cristal Rosé 2012 has been the most traded Champagne by value on the exchange in 2021 YTD.

Dom Perigon has been the most traded Champagne investment brand in 2021 and the 2008 vintage has been the epynomous Monk’s top performer this year, rising 52.5% to 31st October.

US buyers have led demand for Champagne, at 39.1% of market share surpassing the UK’s normal top spot to a second place 37.4%. Europe accounts for just 13.7% of Champagne trade on the secondary market.

Conclusion

2021 has been a climatically very challenging year for the region, and this will be measured by vintage supply in years to come, when released. But in terms of the market and values for Champagne investments, this has been a record year and one for producers and investors to celebrate.

For more information on investing in Champagne and our latest recommendations, contact the Vin-X team now on 0203 384 2262. See our November Market Update for a summary of the latest wine investment performance information.