Champagne has continued to fizz during 2020, despite the global pandemic, with the region’s share of trade on Liv-ex set to be the largest on record and individual wines delivering double digit returns to investors.

Strong demand has driven growth in Champagne’s share of trade in the secondary market, which was further enhanced by exemption from Trump’s tariffs imposed last year. Alongside Italy’s top performing wines, Champagne has been a solid performer and the wines of the region accounted for 9.8% of total trade on Liv-ex in October 2020. The fine wine exchange also reported this week that three of the Top 5 most traded wines by value in 2020 year to 31stOctober are all from Champagne.

Extract: Liv-ex Ranking of Fine Wines Traded on Liv-ex by value 2020:

| RANKING: | WINE | VINTAGE | CRITIC SCORE: | YTD growth |

| 3 | Taittinger, Comtes de Champagne Blanc de Blancs | 2008 | 98+ A. Galloni | 3.6% |

| 4 | Dom Perignon | 2008 | 98 A. Galloni | 10.7% |

| 5 | Louis Roederer, Cristal | 2012 | 98 A. Galloni | 11.6% |

Source: Liv-ex.com 23.11.2020

Taittinger Comtes de Champagne Blanc de Blancs 2008 has enjoyed the third highest level of trade by value in the secondary market (Liv-ex.com) in 2020 so far, with Dom Perignon 2008 and Louis Roederer, Cristal 2012 ranked 4th and 5th. Taittinger released its Comtes de Champagne Blanc de Blancs 2008 vintage in October which also stimulated volume traded and overall value.

In terms of comparing price performance and returns to investors, Cristal 2012 has had a sparkling year to date seeing 11.6% growth, whilst the remarkable Dom Perignon 2008 also enjoyed a fizzing double-digit uplift of 10.7%. The Taittinger 2008 has delivered a more modest 3.6% return YTD and is in line with general trend, delivering stable growth in a very challenging period for world economies and financial markets.

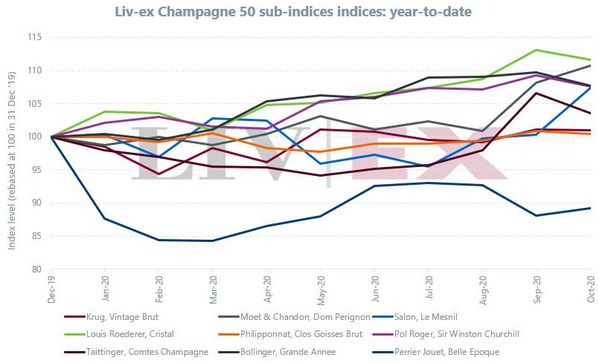

We reported recently that the key benchmark, Liv-ex 100’s YTD performance stood at 3.8% on the 31st October, this reflecting the average growth across the 100 most traded wines on the exchange, despite Covid-19. Liv-ex’s Champagne 50 index has recorded 5.91% growth during the same period with a number of individual wines exceeding this level.

Historical performance has shown that Champagne tends to be the most stable fine wine asset and seemingly even more robust to events creating volatility in other markets. This could in part be due to the larger initial levels of supply. As a consequence, it is important for fine wine investors to also hold key Champagne wines to diversify and strengthen a fine wine portfolio.