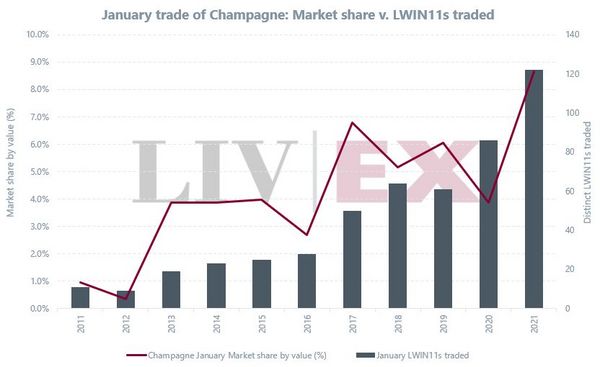

Investment Champagnes were fizzing winners in 2020 with Moet & Chandon’s Dom Perignon and Louis Roederer both ranked in the top ten most powerful fine wine brands in Liv-ex’s Power 100 2020 Report. Investors and collectors’ demand for top flight bubbles accounted for 8.9% of trade value on Liv-ex last year and the trend has continued into ‘abstemious January’ with 8.7% of market share recorded month to date on the 22nd January 2021. The chart records the growth in Champagne sold in the month of January 2011 to 2021.

The 2008 Champagne vintage was the most traded in 2020, partly due to key releases and Dom Perignon 2008 is currently the most ‘in demand’ label on Liv-ex in January 2021. This year it is one hundred years since the first Dom Perignon vintage Champagne was produced in 1921, but not made available for sale until 1936.

Dom Perignon is exclusively produced as vintage Champagne in strong years and with all of that harvest’s growth used in the wine and since the first vintage in 1921 just 43 vintages have been created. The famed Benedictine Monk’s heritage has considerable value, but owners, LVMH, are not frightened of radical brand developments in the 21st Century, with the launch of the Plenitude range and partnerships with celebrities such as Lenny Kravitz, current Creative Director.

Ranked 6th in the Liv-ex 2020 Power 100 Report, Dom Perignon has achieved its highest ever ranking and is also the highest listed Champagne in the Report. Its 2008 vintage was also the most traded Champagne by value on Liv-ex in January 2021. Louis Roederer was ranked 10th overall in the 2020 Power 100 and Taittinger 6th by volume, largely down to its Comtes de Champagne Blanc de Blancs 2008.

As a wine investment, Champagne is probably the most consistent in terms of regional performance and growth. The Liv-ex Champagne 50 index recorded 7.78% growth in 2020, and 57.19% over 5 years to 31st December 2020, second only to Burgundy’s 83%. It is a proven performer and offers one of the most accessible price points for new investors in fine wine. It is also excellent as a fine wine portfolio diversifier due to its stable growth attributes, particularly important as financial markets will continue to be highly unpredictable due to Covid-19 in the year ahead.

If you’re looking at fine wine investment for the first time in 2021, or wanting to expand your existing portfolio, Champagne is an important addition to a fine wine portfolio and is off to a flying start this January! To learn more about Champagne, contact our team today.