Alternative assets have become increasingly attractive to investors looking at new ways to get returns in recent years. The key attraction being that they generally offer a balance to equity performance and the potential to diversify an investment portfolio against market risk. Professional investors are now taking alternative assets seriously as assets such as gold and wine tend to perform well in times of sharply rising inflation.

Fine wine’s key alternative asset attributes

- Tangible ‘real’ investment

- Stable long term growth that does not directly correlate with financial markets

- Performs well in periods of rising inflation

- Low risk

- Tax efficient – generally exempt from Capital Gains Tax (subject to personal circumstances)

- Diversification potential

In the financial advisory community, alternative assets typically considered for diversification are property, infrastructure funds and commodities such as oil and gas. These may offer income linked to the underlying asset, however they can tend to still be listed as an equity-based fund and as such still be exposed to risk and volatility in financial markets.

An investment manager quoted in a recent FTAdvisor article stated that “Real assets, and alternative assets have an increasingly important role to play in a diversified portfolio.” Diversification tools carry different characteristics in terms of risk and returns and the investor should consider the complementary elements they bring to a portfolio.”

Fine wine and other ‘real assets’ tend to deliver value over the long term, with characteristically stable growth that can hedge inflation, contrasting equities which offer a higher propensity for short term gains but experience greater volatility and market risk.

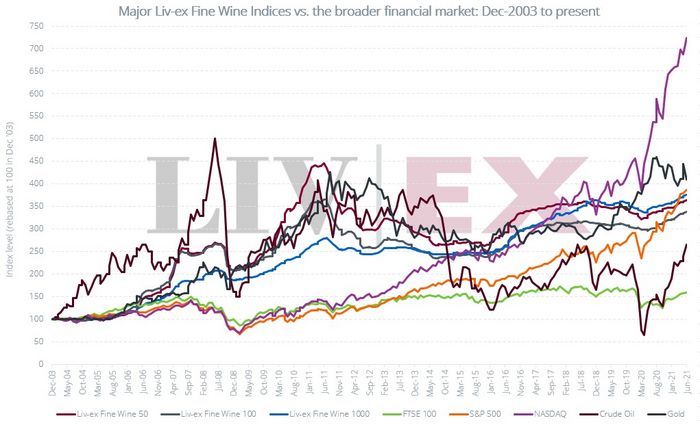

Liv-ex recently published a comparison of its key fine wine benchmarks, the Liv-ex 50 (measures the ten most recent physical vintages of the five Bordeaux First Growths), the Liv-ex 100 (the 100 most traded wines on the market) and the Liv-ex 1000 (the broadest measure of the fine wine market) the FTSE 100, S&P 500, Nasdaq and commodities oil and gold from December 2003 to June 2021 – see chart

The period under review includes the 2008 financial crisis, the fine wine market peak in 2010-2011 and subsequent fall as the Chinese buyers drove the market in top Bordeaux and then broadened focus to other regions resultling in the more diversified market we have a decade on in 2021. Later the effects of Brexit and Covid-19 can also be seen and finally the removal of the US Tariffs in Spring 2021.

Fine wine’s performance over this near 2-decade period has tracked the key financial markets and commodity benchmarks. To the end of June 2021, the Liv-ex 50 is up 263%, the Liv-ex 1000 has risen 276% and the blue-chip S&P500 recorded 286.5% growth, considerably more than the FTSE 100, but impressively, a similar performance.

As in all markets, prices will go down as well as up and ideally a diversified investment portfolio will offer balance as certain assets suffer down periods, cash may be protected in periods of higher inflation and tax benefits can be enjoyed.

Fine wine investments do not generally attract Capital Gains Tax on any profits made, subject to personal circumstances. Of course, EIS qualifying shares and other tax-efficient financial instruments offer tax advantages but there tends to be conditions attached. See our latest Tax Report for more information on the benefits of investing in fine wine.

Finally, the reality of a ‘real asset’ is the tangible value, companies fail – paper can become worthless – you will always have your wine – to sell at market value or enjoy yourself!

Contact our expert team today on 0203 384 2262 to get the current value of your fine wine and our Guide to Investing and Collecting in Fine wine for more information.