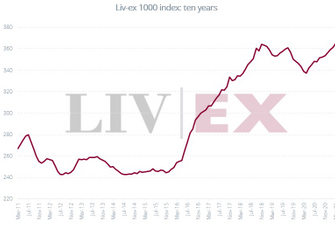

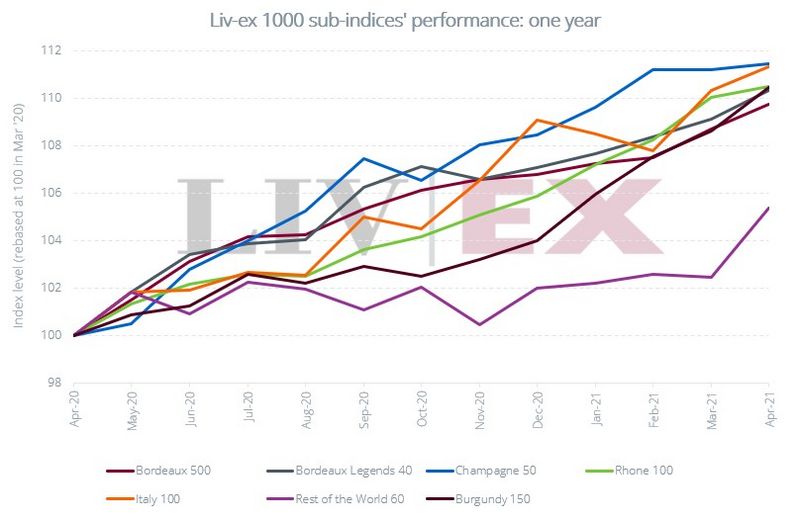

Performance data at the end of April 2021 shows further increases on the record levels the Liv-ex 1000 reached in March 2021. The exchange’s broadest measure is up a further 1.34% in the fourth month of 2021, taking it to nearly 10% growth over the last year. But which are the strongest performing regions for investment wines?

The Liv-ex 1000 comprises the regional benchmarks set out in the table, all of which have recorded positive growth over the last 12 months and YTD.

Fine Wine Regional Performance to 30th April 2021

| LIV-EX INDEX @ 30.04.2021 | M.o.M | YTD | 1 Year | 5 Years |

| Liv-ex Fine Wine 1000 | 1.34% | 3.79% | 9.65% | 45.21% |

| Liv-ex Bordeaux 500 | 0.98% | 2.78% | 9.74% | 30.93% |

| Bordeaux Legends 40 | 1.12% | 3.03% | 10.33% | 37.06% |

| Burgundy 150 | 1.67% | 6.2% | 10.43% | 89.68% |

| Champagne 50 | 0.21% | 2.76% | 11.43% | 58.62% |

| Rhone 100 | 0.42% | 4.36% | 10.47% | 29.73% |

| Italy 100 | 0.9% | 2.06% | 11.31% | 50.36% |

| Rest of the World 60 | 2.87% | 3.31% | 5.38% | 32.51% |

Source: Liv-ex.com 06.05.2021

April 2021’s top performing regional measure in the month was the Liv-ex RoW 60 index, which measures the most recent physical vintages of 6 wines from Spain, Portugal, USA and Australia. These are currently vintages of California’s Opus One and Screaming Eagle, Australia’s Penfolds Grange and Spain’s Vega Sicilia Unico. April’s performance was strongly influenced by a flurry of activity focused on Napa icon, Screaming Eagle.

Burgundy, however, has had a significant first few months of 2021 with a rally turbo – boosted by the suspension of the US tariffs and a perceived window of opportunity right now for US buyers. There is still no certainty that the 25% levy won’t be reimposed at the end of the current 4-month suspension period. The Liv-ex Burgundy 150 index rose 1.67% in the month and stood at a healthy 6.2% YTD at 30th April 2021.

Bordeaux investment wines have also benefited from Biden’s efforts to improve international relations, enjoying a surge in demand from US buyers following the announcement on the 5th March. The region’s key measures include the Liv-ex 50 standing at 1.29% growth for April and 10.81% YTD along with the Liv-ex Bordeaux 500 and Bordeaux Legends 40 indices reporting 2.78% and 3.03% growth respectively YTD.

The fine wine trade has its focus firmly on Bordeaux as usual at this time of the year. The 2020 vintage en primeur tastings by key critics and global merchants took place last week with the first of the critics’ ratings now revealed. James Suckling and Jancis Robinson MW have published their scores and tasting notes for the majority of the key investment wines. For further information on Bordeaux 2020 en primeurs and to see critics scores as they are released register here and keep an eye on our blog.

Italy is building its trade momentum in the secondary market after a relatively muted start to 2021 with 2.06% growth YTD and 11.31% over the last year.

Champagne has also delivered returns for fine wine investors in the first four months of 2021 with strong individual performances and the regional trend, recorded by Liv-ex’s Champagne 50 index, has risen by 2.71% YTD and 11.43% one year, making it the top performing region since 30 April 2020.

Fine wine is maintaining steady growth throughout the pandemic and delivering stability and solid returns to investors. For more information about adding investment wines to your portfolio contact our expert team on 0203 384 2262 and download our Guide to Investing in Fine Wine.