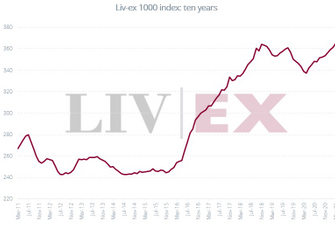

Fine wine investments have continued growing at a pace in the first quarter of 2021. Liv-ex reports increasing volume and value traded on the exchange with March recording the broadest month of trade with transactions in 1,250 distinct wines. Of these 130 are newcomers to the secondary market and we look at the top performers in the last year.

Looking at regional trend we can see where performance of fine wine portfolios maybe optimised through diversification, adding regional strength to benefit from strong demand and returns. Liv-ex has updated its regional indices performance comparison providing insight to average returns for wines comprising the key benchmarks for Bordeaux, Burgundy, Champagne, Italy, Rhone and the catch-all RoW covering Napa, Spain, Australia and a few others over differing periods of time.

Liv-ex key & regional indices performance:

| Liv-ex index | 6 months | 12 months | 2 years | 5 years |

| Liv-ex 100 | 5% | 7% | 4% | 32% |

| Liv-ex 1000 | 4% | 5% | 1% | 45% |

| Bordeaux 500 | 3% | 6% | 2% | 33% |

| Bordeaux Legends 40 | 4% | 6% | -1% | 37% |

| Burgundy 150 | 5% | 5% | -3% | 87% |

| Champagne 50 | 6% | 11% | 13% | 58% |

| Italy 100 | 5% | 7% | 12% | 45% |

| Rhone 100 | 6% | 8% | 6% | 30% |

| Rest of the World 60 | 1% | 1% | -2% | 31% |

Source: Liv-ex.com 30th March 2021

Bordeaux still remains the engine room of the secondary market in terms of the volume and value of wines traded. The correlation between the Liv-ex 100 (the 100 most active wines on the exchange) performance and the Bordeaux 500 and Bordeaux Legends illustrates this across all periods. The data also shows the strong regional performance of Champagne and Italy during 2019 and 2020 and the strength in Burgundy over the longer term.

The two-year measure takes into account the impact of the US Tariffs and particularly the negative impact on Burgundy and Bordeaux specifically. The shorter-term view reflects the robustness of the market during the pandemic and we are now seeing extra impetus with the suspension of the US tariffs at the start of March 2021. The most traded labels on Liv-ex in the last year are recorded below.

Top ten most traded fine wine brands on Liv-ex in 12 months:

| Rank | Wine | Region |

| 1 | Lafite Rothschild | Bordeaux – Pauillac |

| 2 | Petrus | Bordeaux – Pomerol |

| 3 | Mouton Rothschild | Bordeaux – Pauillac |

| 4 | Screaming Eagle | USA – Napa |

| 5 | Latour | Bordeaux – Pauillac |

| 6 | Pontet-Canet | Bordeaux – Pauillac |

| 7 | Haut Brion | Bordeaux – Pessac-Leognan |

| 8 | Sassicaia | Italy – Super Tuscan |

| 9 | Giacomo Conterno Barolo Monfortino Riserva | Italy – Piedmont |

| 10 | Taittinger, Comtes de Champagne, Blanc de Blancs | Champagne |

Source: Liv-ex.com 30 March 2021

In terms of the specific top performing wines by price growth in the 12 months to the end of February 2021, Liv-ex data records Burgundy’s Domaine Georges Roumier, Bonnes Mares Grand Cru 2012 as the top performer seeing a growth of 74.5% in price in the year – obviously not in line with the much more modest Burgundy regional trend indicator of 5% growth in the year to March 2021.

Liv-ex 1000 Top Performing Investment Wines in 12 months:

| Wine | Vintage | Region | £ Feb. 2020 | £ Feb 2021 | Growth |

| Domaine Georges Roumier, Bonnes Mares Grand Cru | 2012 | Burgundy | 10,200 | 17,800 | 74.5% |

| Domaine Jean Louis Chave Hermitage Rouge | 2011 | Rhone | 1,488 | 2,452 | 64.8% |

| DRC Richebourg Grand Cru | 2009 | Burgundy | 23,808 | 37,000 | 55.4% |

| Gaja, Sperss | 2006 | Italy | 1,780 | 2,590 | 45.5% |

| Taittinger, Comtes de Champagne, Blanc de Blancs | 2004 | Champagne | 880 | 1,250 | 42% |

| Clos Fourtet, St Emilion Grand Cru | 2011 | Bordeaux | 755 | 1,070 | 41.7% |

| Tignanello | 2008 | Italy | 936 | 1,299 | 38.8% |

| Domaine Jean Louis Chave Hermitage Rouge | 2010 | Rhone | 3,684 | 5,100 | 38.4% |

| Tignanello | 2015 | Italy | 856 | 1,150 | 34.3% |

| La Mission Haut Brion | 1990 | Bordeaux | 5,978 | 7,900 | 32.2% |

Source: Liv-ex March 2021

For more information and fine wine market news in Q1 2021 – download our MONTHLY MARKET REPORT and speak to a member of our team on 0203 384 2262.