Fine Wine Growth in 2021 headlines:

- Liv-ex 100 at 6.7% growth in 1 Year

- Leading regional index one year – Liv-ex Champagne 50 at 10.77% growth

- Burgundy rising: Liv-ex Burgundy 150 regional index rose 1.5% in February

- January Top Market Mover: DRC Echezaux 2009 up 14.7% in the month

- February Top Market Mover: Louis Roederer, Cristal Rosé rises 12.2% in month

- US wines trade share on Liv-ex grows from 5.4% in 2020 to 8.8% in early 2021

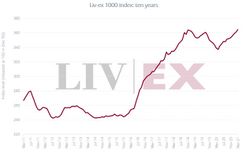

The fine wine market has had a robust start to 2021 with all of the Liv-ex Fine Wine indices in positive territory and the growth trends established in 2020 sustained in Q1 to date. The key Liv-ex 100 benchmark stood at 6.7% growth over one year at the end of February compared to the FTSE 100’s -0.6% loss over the same period.

Market breadth in terms of the distinct wines traded on the exchange is 50% higher than that in February 2020. The volume of individual wines traded is also substantially higher year on year.

Liv-ex’s Burgundy 150 index has been the top performing regional measure in 2021 so far with a monthly gain of 1.5% in February following January’s 1.9% increase. January is traditionally a ‘Burgundy month’ in the fine wine market and this year the region’s 2019 vintage releases commanded significant trade focus. Renewed interest in back vintages also lifted the region’s market share to 23.3%. Top market movers on Liv-ex in January were led by Burgundy with DRC Echezaux 2009 seeing a 14.7% price growth in the month.

Bordeaux’s market share may have slipped slightly due to key releases from Burgundy, Tuscany and Napa early in 2021, but demand for the 2009 vintage in particular spiked in February. This was, in part, driven by the Chinese New Year celebrations and demand for wines from the 2009 vintage, which is the most recent ‘Ox year’ in the Chinese horoscope and one of the highest ever average scored Bordeaux vintages.

Demand for fine wine from Champagne, Italy, Napa and other regions in 2021 is already double that of the same period last year. Italy’s share of trade (by value) on Liv-ex has risen from an 11.8% average in 2020 to 17.7% in 2021. The 2018 Tuscan and Piedmont releases have shifted market focus from the back vintages temporarily in Q1 but demand for these wines remains strong.

Liv-ex’s Champagne 50 grew 1.47% in February, its fourth consecutive record-breaking month of trade on the exchange and the best performing sub-index of the Liv-ex 1000 over one year at 10.77%.

Major Market Movers February 2021:

| Wine | Vintage | January ‘21 | February ‘21 | Change |

| Louis Roederer, Cristal Rosé | 2012 | £2,890 | £3,244 | 12.2% |

| Moet & Chandon Dom Perignon, Rosé | 2004 | £2,325 | £2,592 | 11.5% |

| Bollinger, Grande Année | 2005 | £708 | £774 | 9.3% |

| Moet & Chandon Dom Perignon, Rosé | 2003 | £2,000 | £2,150 | 7.5% |

| Moet & Chandon Dom Perignon, Rosé | 2005 | £2,214 | £2,380 | 7.5% |

Source: Liv-ex.com (Mid price:12 x 75), 28th February 2021

US wines saw their share of trade on Liv-ex grow from an average 5.4% in 2020 to 8.8% in early 2021. The highly regarded 2018 Napa vintage is seeing the top critics’ scores now being published and is another driver for current market activity.

In terms of emerging markets the Rhone is looking interesting, its share of trade on the exchange has grown from 2.1% average in 2020 to 3.3% in the first two months of 2021 with a key focus for investors on wines from the north of the region.

US Tariffs Suspended in March 2021

Liv-ex reported a surge in US member activity immediately following the announcement of the mutual suspension of the EU & US Large Civil Aircraft WTO Dispute on the 5th March 2021. Both parties have agreed to a four-month period to work to resolve the long running dispute and “embark on a fresh start in the relationship”. Bordeaux saw the largest uplift in live bids and focus on Lafite, Pontet-Canet, Figeac and the second wines of Mouton Rothschild and Lafite in the earliest trading.

For more information on investing in fine wine speak to a member of our expert team on 0203 384 2262.