Spring 2021 has seen the fine wine market enjoy record levels of trade with strong sector growth and individual price performances. Liv-ex has published its March data to trade members, with all of its indices recording rising trend and a significant leap in levels up from February. Commenting on fine wine’s investor appeal, Liv-ex co-founder Justin Gibbs stated that “The combination of low interest rates and massive fiscal spending suggests that asset inflation will not be confined to equity, commodity and property markets. … The fundamentals of fine wine will also be an attractive option to those with cash to spare.”

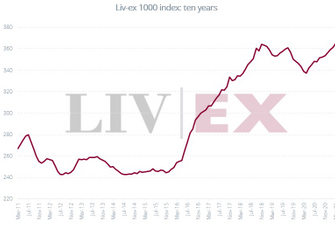

The key Liv-ex 100 benchmark for fine wine investors nearly tripled its month-on-month level in March at 1.6% growth compared to February’s 0.6%, and a cumulative 2.8% uplift across Q1. Similar multiples of growth are seen across all of the Liv-ex fine wine indices, with the Liv-ex 1000 recording its highest ever level, up 2.8% in March. The longer-term performance of five years sees fine wine outperform FTSE 100 significantly and is now exceeding gold, which swung negative in January and has remained so, standing at a -10.8% decline at the end of March 2021.

Fine wine market trends compared to equities and gold in Q1 2021

| Index | March 2021 | Feb. 2021* | YTD | 1 Year | 5 Years |

| Liv-ex 50 | 1.7% | 0.4% | 2.1% | 10.3% | 26.4% |

| Liv-ex 100 | 1.6% | 0.6% | 2.8% | 9.5% | 31.1% |

| Bordeaux 500 | 1.1% | 0.2% | 1.6% | 8.8% | 31.1% |

| Liv-ex 1000 | 1.0% | 0.6% | 2.4% | 7.8% | 44.0% |

| Liv-ex Investables | 1.5% | 0.2% | 2.3% | 10.7% | 31.5% |

| FTSE 100 | 3.1% | 1.7% | 4.3% | 20.8% | 9.1% |

| S&P500 | 4.3% | 2.6% | 5.9% | 52.7% | 93.0% |

| Gold | -3.6% | -6.1% | -10.8% | 4.6% | 37.6% |

Source: Liv-ex Market Report April 2021, *February data – Liv-ex Report March 2021

Fine wine’s energetic March 2021 was largely influenced by the announcement of the suspension of the US Tariffs on EU wines, which we have commented on in our recent blogs. The week following the EU and USA announcement of the suspension saw trade on Liv-ex surge with a 65% increase in volume and 50% value traded with US buyers heading the action.

US trade by value increased 105.5% on the prior 2-month average on Liv-ex in March, and there were increased trading levels witnessed in other regions. European trade rose 32.7%, Asia 26.5% and UK transactions grew 15.8%, also by value.

Fine Wine Market Growth Indicators

- Trading volumes on Liv-ex were up by 70% in March 2021 compared to 2019

- The total number of wines (including vintages) transacted in at 8,735, up 72% on the 6,367 last year.

- This has been the largest month of trade in Liv-ex’s 21-year history with 130 new entrants to the secondary market.

In terms of regional performance Burgundy and Bordeaux have enjoyed a resurgence in Q1 2021, with demand and trade accelerated further with the tariff suspension in early March. Burgundy trade share on Liv-ex in March stood at 23.6% as the momentum for the region picked up further. The Rhone also enjoyed a strong month at 5.1%, taking its cumulative 12 month performance to 9.94% growth. The USA wines maintain demand and Liv-ex recorded an 8.1% share of trade attributable to the region. Champagne had a quieter March (7%), whilst Italy remained constant at 15.5% and the Liv-ex Italy 100 was the top performing regional index in terms of growth in values at 2.4% increase in the month, largely led by gains made by Super Tuscans Tignanello and Solaia.

Regional trend performance over 5 years

| Liv-ex Regional Benchmark | Performance over 5 years |

| Burgundy 150 | 87% |

| Champagne 50 | 58% |

| Italy 100 | 45% |

| Bordeaux 500 | 31.1% |

| RoW 60 | 31.0% |

Source: Liv-ex.com, 31st March, 2021

We expect the fine wine market to maintain its ‘Spring growth’ and ever-growing appeal for wine investors with the pending Bordeaux 2020 vintage en primeur tastings late April and the campaign set to run through to June adding extra impetus in Q2.

For more information on the fine wine market see our Q1 2021 Market Report, download our Guide to Collecting and Investing in Fine Wine or speak to a member of our expert team on 0203 384 2262.