The latest House Price data from the ONS shows that the Chancellor’s Stamp Duty exemption stimulated over 10% growth in average house prices for the year to 31st September 2021, but the wind is out of the ‘bricks and mortar sails’ now with transactions falling away in October. Meanwhile, investment wine returns to investors are approaching 20% and the market continues to grow.

- Stamp Duty exemption boosted property growth of 11.8% in the year to 31st September 2021

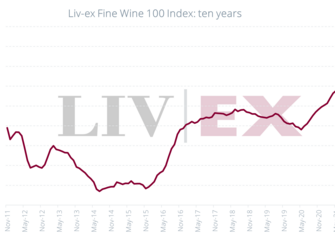

- Liv-ex 100 rose 17.4% in the same period and stood at 19% at the end of October

- Property market transactions fell 30% YoY in October 2021 – Nationwide BS

- Fine wine sees record levels of volume and value of trade on Liv-ex maintained

- November 2021 Liv-ex 100 grew 2.7% in 18th consecutive month of growth

- Average property increase was 0.9% in November – Nationwide

Wine investment performance compared to Property

Wine investors are having a great year in 2021. The Liv-ex 100 recorded 19% growth for the 12-months to the end of October and in November grew 2.7% in its eighteenth month of consecutive growth. All regions are enjoying strong demand but Burgundy and Champagne in particular are driving double-digit growth.

The property market was energised in the year to 30th September 2021 by the Chancellor’s Stamp Duty ‘holiday’ but, at the end of the scheme, the number of housing transactions fell 30% year on year in October.

Commentators in the mortgage sector have observed that consumer confidence stabilised in early November, but sentiment was below levels seen during summer 2021, as a result of the increasing cost of living. Rising inflation, with 5% levels likely in the coming quarters, will slow the housing market further as interest rate rises are being planned to curtail inflation. Current uncertainty due to the emergence of the Omicron Covid variant has led to speculation that initial rate rises will be deferred to the New Year. As a result, property forecasts for 2022 suggest a significant slowdown in growth, to be in the region of 2% by the end of next year.

Which was the Top Wine Investment in November 2021?

Meanwhile, Burgundy’s Domaine Armand Rousseau, Chambertin-Clos de Beze Grand Cru 2016 rose 43% in November 2021, making it the top price performer on Liv-ex. Other key brands also saw double digit growth including DRC La Tache. Leading Champagne investments in the same period include Krug 2004, up 11%, and Pol Roger Sir Winston Churchill 2008 grew 10% in one month with the Festive season purchases fuelling Champagne acquisitions.

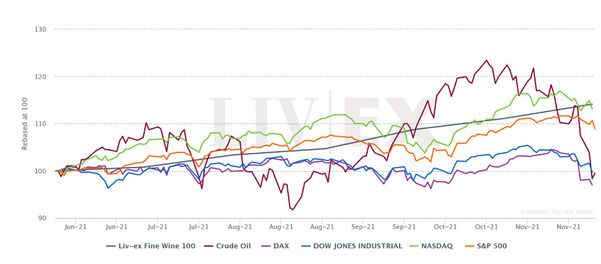

Liv-ex published the 2021 edition of the Power 100 Ranking of the most powerful investment wine brands last week showing the average trend growth for the top wine investment brands. Burgundy’s Leroy was ranked first for the third consecutive year and its average price growth for all of its wines traded on the secondary market was 39% for the 12 months to 30th September 2021. This performance exceeded property (11%) and the S&P500’s 30.1% growth over the same period.

Fine wine investments are delivering value to investors throughout the Covid era and demonstrating their ability to de-risk and add stable growth to an investment portfolio. And, unlike property, Capital Gains Tax does not generally apply to wine investments, subject to personal circumstances.

For more information, see our latest Market Update and speak to a member of our team on 0203 384 2262.