Are you looking for a stable, tax-efficient asset that can hedge inflation and is giving returns triple that of the current average FTSE stock? Burgundy’s robust growth and market diversification means that you don’t have to pay 6-figures to enjoy the benefits of owning one of the top performing luxury assets.

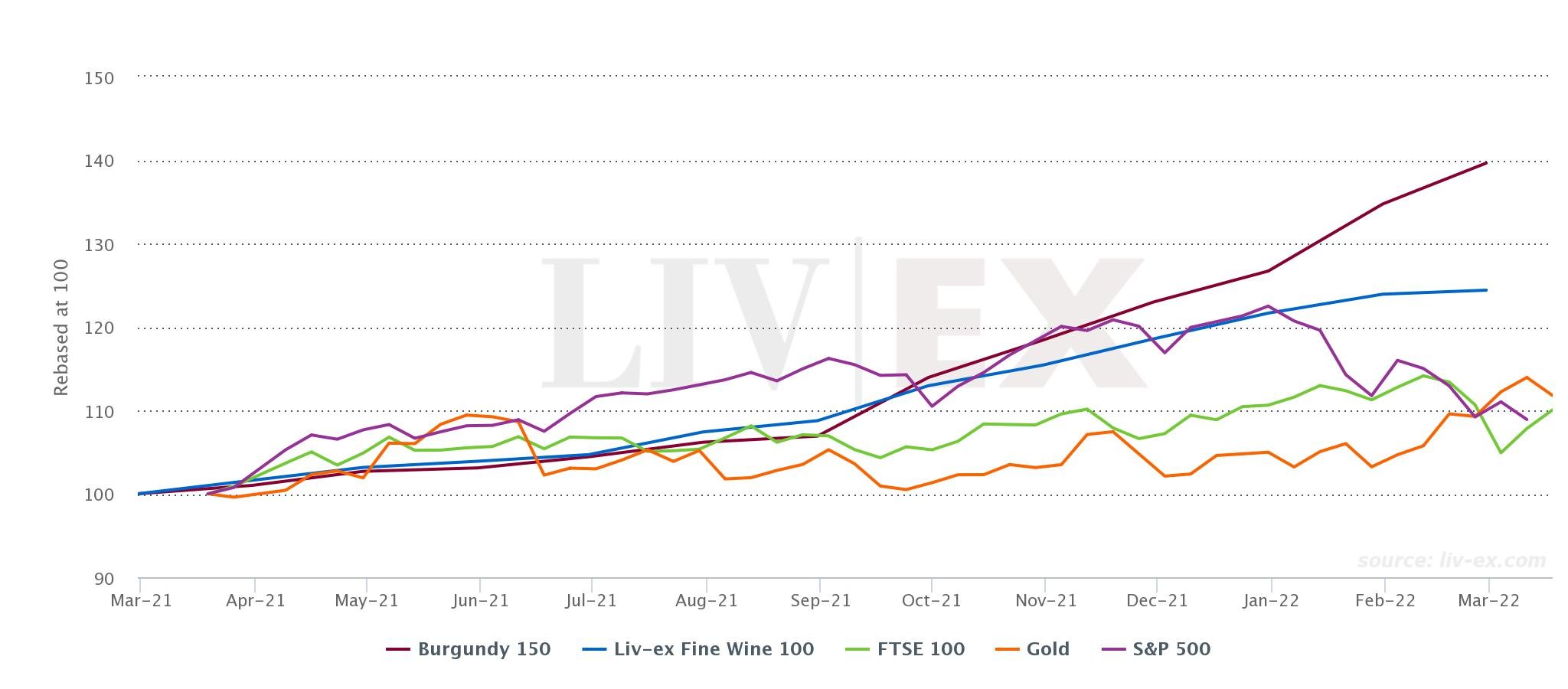

- Liv-ex Burgundy 150 index grew 39.6% in 12 months to 28th February 2022 compared to gold 7.6% and FTSE 100 13.6%

- Average Burgundy trade price on the secondary market is £5,720 (12 x 75cl)

- DRC, Romanee-Conti 2018 traded at £303,000 (12 x 75cl) w/c 11th March 2022

- Increasingly scarce supply and growing global demand continues to drive growth

- The 2021 Burgundy vintage is 37% smaller than 10-year average for release in 2023

- Burgundy paradox – the scarcer the wines, the higher the prices, the more desired

Liv-ex Burgundy 150 compared to gold and equities – 1 year:

Source: Liv-ex.com, 24th March 2022

The insatiable, growing appetite for Burgundy Grand Crus has driven a bull run for the region’s wines since 2015. To be fair, this was disrupted for 12 months by Trump’s US tariffs which saw prices drift in 2020, however since their removal in March last year prices have rebounded and some.

Scarcity is a driver of Burgundy prices, but this would be nothing alone without the exceptional quality of the region’s Grand Crus. The secondary market trade in Burgundy ballooned in 2021 as buyers sought value outside of the high-profile brands bringing diversity and robustness as more labels became regularly traded and invested in. The average trade price for Burgundy on Liv-ex currently is £5,720, however the DRC’s of this world command a premium of 4,000% on this level with an average trade price tag of £243,841 (12 x 75cl).

Low production levels hit by climate events have compounded low supply levels in the market. Devastating frosts have become regular features of Spring in the region. The 2020 vintage (released in Q1 this year) had relatively average productivity, however 2019 was 14.6% lower than the ten-year average and 2021 is 37.5% lower. This has impacted prices and similar supply issues are expected for the future.

Top 10 Burgundy growers by value in 2021

| Grower | Burgundy Market share by value 2021 |

| Domaine de la Romanee Conti | 23.9% |

| Domaine Leroy | 9.6% |

| Domaine Armand Rousseau | 8% |

| Domaine Ponsot | 6.3% |

| Maison Leroy | 5.1% |

| Domaine Faiveley | 4% |

| Domaine Georges Roumier | 3.5% |

| Domaine Leflaive | 2.9% |

| Domaine d’Auvenay | 2.1% |

| Domaine Comte Georges de Vogue | 1.9% |

Source: Liv-ex Burgundy Report Spring 2022

Growing choice for wine investors

Burgundy’s share of trade on Liv-ex, by value, grew significantly in 2021 to nearly match that of Bordeaux by the end of the year. The number of unique wines from the region in the secondary market rose by 36.8% year on year in 2021, as the wine investment focus shifted from a tunnel vision approach to DRC wines to embrace a collection of wines to suit a wider choice of budgets. As many as 166 domaines traded on the market last year.

Burgundy wine investments have maintained strong growth throughout the challenges of the pandemic and rising inflation in the last twelve months, offering a safe haven for capital that has so far out-performed gold significantly. Furthermore, subject to personal circumstances, this gain in value is likely to be tax free to UK investors.

For more information see our March Market Update Report and speak to a member of our expert team on 0203 384 2262.