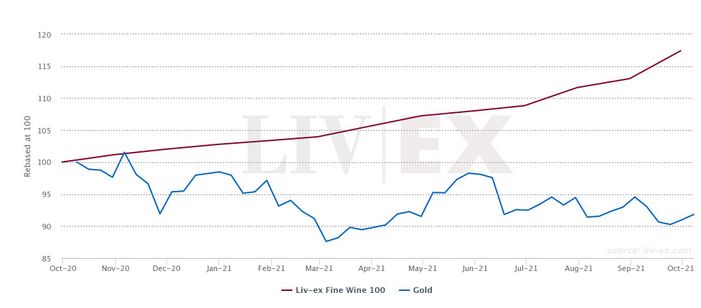

How is wine investment comparing with gold’s performance in 2021? The traditional ‘safe haven’ asset, the yellow metal is looking a little tarnished at the end of Q3 with a negative performance YTD compared to fine wine’s best year on record.

KEY PERFORMANCE HEADLINES – Gold v Fine wine investments 2021:

| PERIOD | GOLD | FINE WINE |

| September 2021 | – 4% | +3.9% |

| Q3 2021 | -2.3% | +5% |

| YTD 2021 (30.09.21) | -8.4% | +14.3% |

| 1 Year | -7.8 | +17.4% |

Data source: Liv-ex.com, 30 September 2021

Historically, September is a good month for gold – not so this year. In a month where equities were destabilised with global supply chain issues and rising inflation, gold declined 4% and has not been the ‘go-to’ point of capital shelter. This performance topped off a Q3 deterioration of 2.3% continuing gold’s downward trajectory throughout 2021 to a YTD of -8.4% at the 30th September.

Normally, gold is seen to be deployed as a hedge to rising inflation. With global forecasts on the rise and UK experts predicting a potential uplift to nearly 5% by the end of the year, we’re not seeing the expected rally in gold prices. Gold’s poor performance in September may be partly explained by a strengthening dollar, certainly the golden gleam has been dampened in 2021.

In comparison, investment-grade wine is enjoying the best performing year on record. The key benchmark, Liv-ex 100 is up 17.4% in 1 year and has risen 5% in Q3, compared to gold’s 2.3% loss.

September 2021 was another strong month for the fine wine market, the leading regional performance for investment wines came from Burgundy, with Liv-ex’s Burgundy 150 index reporting a YTD growth of 18.08%.

Sparkling wine investments saw some of the top individual market movers and include Taittinger Comtes de Champagne 2006, up 18.7%, and Dom Perignon 2008 rise 11.7% in September.

Investment wines have demonstrated their value as a ‘safe haven asset’ in the last year, maintaining stable growth, outperforming equities and gold in periods and also being ranked as the top performing luxury collectable, or passion asset.

For more information on investing in fine wine see our Guide to Collecting and Investing in Fine Wine and our latest Market Reports. Find out which wines are currently offering opportunity for growth by speaking to a member of our expert team on 0203 384 2262.