Fine Wine Investors – Take Note:

- Financial market experts observe increasing acquisition of tangible assets by High Net Worth investors to protect capital

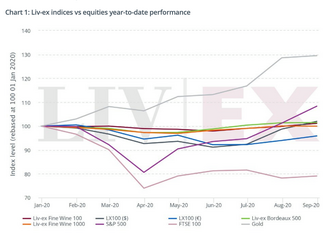

- Investment wines have delivered stable growth since Covid-19 impact, March 2020

- Liv-ex 100 up 2.6% year to 30th September 2020

- FTSE 100 down -21.6% at 30th September 2020

- Financial markets continue to be extremely volatile

- UK in the worst and most unpredictable economic recession on record

- Dividend income suspended by many companies

- Economic and financial outlook extremely uncertain – Covid and Brexit

- Fine wine’s solid growth is generally CGT exempt

Fine wine v FTSE and Gold comparison:

| Index | MoM % | YTD % | 1 year % | 5 years % |

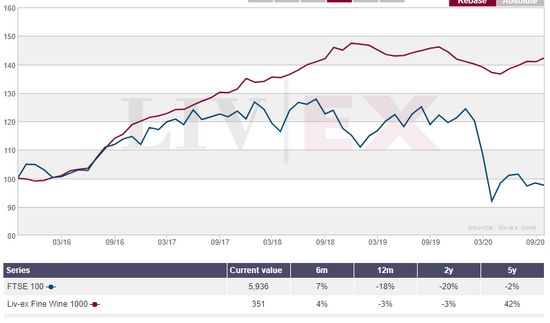

| Liv-ex fine wine 100 | 1.4% | 2.6% | -0.3 | 28.5 |

| Liv-ex fine wine 500 | 1.0% | 2.5% | 0.3 | 31.6 |

| Liv-ex fine wine 1000 | 1.0% | 1.0 | -2.6 | 42.3 |

| FTSE 100 | -0.9% | -21.6 | -20.2 | -2.5 |

| Gold | -3.9% | 23.9 | 26.1 | 69.4 |

Source: Liv-ex.com 30th September 2020

Expert publications confirm our own observation that investors are seeking the solidity of fine wines’ steadfast returns and low risk in the current environment of unprecedented economic uncertainty, extreme volatility in financial markets and the UK’s worst recession on record.

2020 has illustrated perfectly fine wine’s fundamental asset performance as uncorrelated to volatile financial markets, delivering stable growth during global economic distress as the world learns to deal with a pandemic.

Headline performance during Covid:

At 31st March 2020:

- The FTSE100 dived 15.2% in the month and a Q1 fall of 26%

- The Liv-ex100 held steady at -1.1% for the month and Q1 total of the same, i.e. Covid resistant

At 30th September 2020:

- FTSE100 down -21.6% YTD

- Liv-ex 100 up 2.6% YTD

Liv-ex has reported this week that September 2020 continued the growth curve started in Q1 for fine wine with the Liv-ex 100 index up 1.4% in the month, following August’s 1.3% and July’s 1.5% rises and YTD stands at 2.6%. Despite the global recession the fine wine market has seen burgeoning growth across a period that has wiped significant values from share portfolios, pensions and saving vehicles such as ISAs.

Fine wine trade performance driving rising trends:

- Positive month on month growth on Liv-ex since March 2020

- Liv-ex September 2020 trade up 22% by value and 9% by volume on a record August

- Buoyant market – Liv-ex number of transactions increased 7% month on month

- Individual investment wines delivering double digit growth

- Weak Sterling attracting international buyers in Autumn 2020

Investors are weighing up:

- Equities have had a rollercoaster year and will continue to be vulnerable to market volatility

- Saving vehicles could deliver negative returns as the low interest rates environment combined with a likely increasing inflation eats away at value.

- Commencement of more stringent lockdown measures apparent – uncertain economic impact and for how long?

- August economic data (2% growth) was less than predicted – continued recession

Vin-X Opinion: Diversify to de-risk, protect capital and achieve growth

- Fine wine delivers stable growth during unprecedented economic distress and financial market volatility

- Tangible asset with inherent value

- Historic long-term growth consistently outperforms FTSE and other assets

Investors should take advice from their financial advisors and look at the value of diversifying funds across assets such as fine wine that can strengthen and de-risk a portfolio in the current environment.

To understand more about investing in fine wine contact us now on +44 (0) 203 384 2262 and download our Guide to Investing in Fine Wine.