This morning the FTSE fell over 8% in the first 11 minutes of trading, oil prices dropped 30% and are now at their lowest level for 30 years, with financial market commentators worldwide drawing parallels to the 2008 banking crisis.

The impact of COVID-19 is being felt across the world, we are watching with increasing concern the case numbers escalating, the lockdown of some of the most advanced cities in the world, and panic buying of masks, antiseptic wipes, soap, medicines and food. Of course the human cost is the most dreadful; from the loss of loved ones through to financial hardship.

Comparisons to earlier financial crashes such as 2008 are being expounded but this is a different ‘ballgame’ – the fall out and aftershocks from the Sub-Prime disaster were managed by authorities through fiscal strategies, lowering interest rates over the long term and injecting more capital into the system at unprecedented levels – helping to keep consumers buying and businesses afloat.

Coronavirus is a natural disaster which is currently unpredictable; shockingly people are dying, borders are closing and supply chains are being disrupted. Governments and authorities are restricting travel, consumers are cancelling holidays, reducing spend and collectively this is all delivering a sharp shock to the system. Coronavirus demands a different response from Governments and China and now Italy offer examples for other countries to model and make plans.

Former Conservative Chancellor, George Osbourne commented on BBC R4 this morning that Rishi Sunak’s first Budget tomorrow would have to be focused on tackling Coronavirus in his view, and the Chancellor will need to do his best to ‘vaccinate the economy’. This Budget should attempt to ensure that the NHS has the cash it needs to cope, individuals should have some form of financial protection to stay at home if they are unwell. Help should be given to companies, especially SMEs, to cope with business impact, perhaps a break on NI and other tax payments, and banks should be encouraged and supported to restart lending to help companies deal with lost business.

How is fine wine responding to the current conditions?

Liv-ex has just published the February 2020 performance data comparing its fine wine indices with FTSE100, S&P500 and Gold.

| Index | MoM | YTD | 1 Year | 5 Years |

| Liv-ex 100 | 0.2% | 0% | -2.3% | 25.0% |

| Liv-ex 500 | -0.5% | -1.0% | -3.6% | 28.8% |

| Liv-ex 1000 | -0.8% | -1.4% | -4.2% | 40.2% |

| FTSE 100 | -9.7% | -12.7% | -7.0% | -5.6% |

| S&P 500 | -8.4% | -8.6% | 6.1% | 40.4% |

| Gold | 4.5% | 7.6% | 24.4% | 35.4% |

Source: Liv-ex March 2020 Report – data at 29.02.2020

The data in the report sets out performance to the end of February 2020, the markets have continued to fall since then, fine wine is staying stable and in fact is now, like gold, demonstrating its value as a safe haven in times of great uncertainty. We are in the early stages of experiencing the global damage COVID-19 has the potential to cause. This could change working patterns, world-wide supply chains and Government policy over the coming months with possible long term ramifications.

Fine wine does not have to move to deliver its value to investors. It can be held in bonded storage at source or at qualifying facilities elsewhere and be owned by individuals all over the world without involving ‘at risk’ supply chains. It offers a rare safe haven for capital in a period of extreme global uncertainty.

That said, there is some concern as key markets such as China and Asia stall as a result of their ‘no travel’ policy. Asian buyers will not be attending the Bordeaux 2019 en primeur tastings this Spring and there is talk of these being deferred to the Autumn. Major wine trade events are being cancelled around the world but these are generally focused on retail wines to be sold in supermarkets, wine merchants and the hospitality industry. The demand for wines at the retail level will fall where they are event and travel dependent, as we have already seen major sporting and music events cancelled and the likelihood of anyone planning a cruise in the short term is not going to be high!

Fine wines acquired for investment purposes resist these pressures; they are much rarer, made to age and therefore there is no time pressure on their sale, they enjoy more stable demand from ‘high net worth’ customers and generally are recession proof. Buyers will be able to take advantage of any softening in price due to the disabled Asian market but there has been evidence of an upturn in demand from the Far East so it could be a closing window, especially with continued losses in financial markets. Notably, Easyjet reported a 7% fall in its share price at 8.45am this morning.

No doubt the current environment highlights the need to diversify and reduce risk in portfolio planning and to include more stable assets like fine wine whose performance is not directly linked to movements in financial markets. Fine wine offers the compelling combination of strong long term growth potential and wealth preservation capability.

Obviously, we are not experts in regards to Coronavirus or its impact, nobody appears to know how long we can expect the current challenges to prevail for nor the overall outcome. We can only try and take sensible precautions with our health and security, an element of which is obviously financial and, wherever possible, takes steps to mitigate risk.

How can we expect fine wine to perform during a financial crisis?

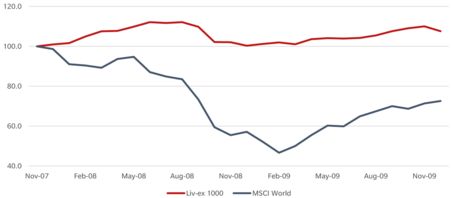

- Historically fine wine performance is less correlated to financial markets and the Liv-ex 1000 outperformed the MSCI World index during the 2008 financial crisis period as shown in the chart.

Fine Wine Vs. Equity During 2008 Financial Crisis:

Source: Liv-ex.com

- Equities were most effected during the 2008 financial crisis, compared to other assets. In comparison Gold, the traditional safe haven asset in times of uncertainty, delivered a positive gain of 1.6% during the same period.

- The inclusion of fine wine over a long term investment strategy can reduce risk and provide diversification benefits to a portfolio, delivering stability, and resistance to the effects of recession.

- Fine Wine has the potential to provide investors with both shelter from extreme short-term volatility and long-term capital appreciation.

For more information on investing in fine wine and the current opportunities contact the Vin-X team on 0203 384 2262.