We talk a lot about diversification when portfolio planning, whether that’s including alternative assets such as fine wine in an overall investment strategy or – when the focus is narrowed down to a fine wine portfolio – how we enhance performance and spread risk by diversifying by region and vintage.

In a recent Vin-X blog, we touched on vintage selection, looking at Mid and Off vintage performance with some wines from Bordeaux Off vintages having seen triple digit growth demonstrating the significant benefits to investors by including the best wines of vintages with an overall average lower score than Prime vintages such as 2009 and 2010.

We extend that view to regional diversification as the latest performance figures are published. Liv-ex’s market data provides a steer on the market movers and indicators of evolving trends. The broadening of the fine wine market and increasing trade share being focused on regions outside of Bordeaux is not a new phenomenon. Burgundy has reigned supreme for some time in terms of landmark sales attracting media attention and growth in prices. However, the growing levels of take-up of the wines of Italy, for example, is proving to be sustainable and the returns for investors will continue to attract new buyers.

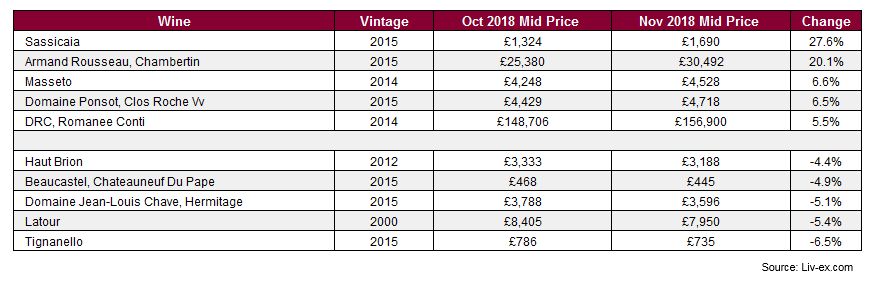

Liv-ex Market Movers November 2018:

Super Tuscan, Sassicaia 2015, was Liv-ex’s top market mover in November 2018, seeing a 26.7% leap in value over the month. Fellow Italian, Masseto 2104 was also in demand, rising 6.6%. Saying that you need to look carefully at the fundamentals and pick your winners as Tignanello 2015 declined 6.5% since the start of the month, as too did Bordeaux’s Latour 2000 which saw a 5.4% dip.

So, given the potential performance benefit of extending your portfolio into a new region – how do you make the right choice?

- Brand: Ensure that you choose wines from the key producers of the region, renowned for their quality and with a strong secondary market. Ultimately, that is why including the five Bordeaux First Growths and Prime vintage wines are key strategies when starting to build a fine wine portfolio. But in a new territory, this is a fundamental requirement.

- Quality: Look for wines scored very highly by key international critics.

- Rarity: Acquiring older, rarer wines at the ‘right price’ should also put you in a stronger position to make good gains.

- Vintage: Bear in mind the opportunity to add value through vintage diversification and building a vertical collection

Working with an expert to help you select and source the wines you wish to build into your portfolio should help to create a rewarding collection of wines. Always remember, like all investments, the value of wines can go down as well as up, but wine tends to be considerably less volatile than stocks and shares, especially in the current environment, and can be Capital Gains Tax free

For more information call us now on 0203 384 2262.