Property investment specialist, Knight Frank published its 2018 Wealth Report this month providing an update on the performance of global property markets and an insight into the current investment trends of the world’s ‘Super Wealthy’.

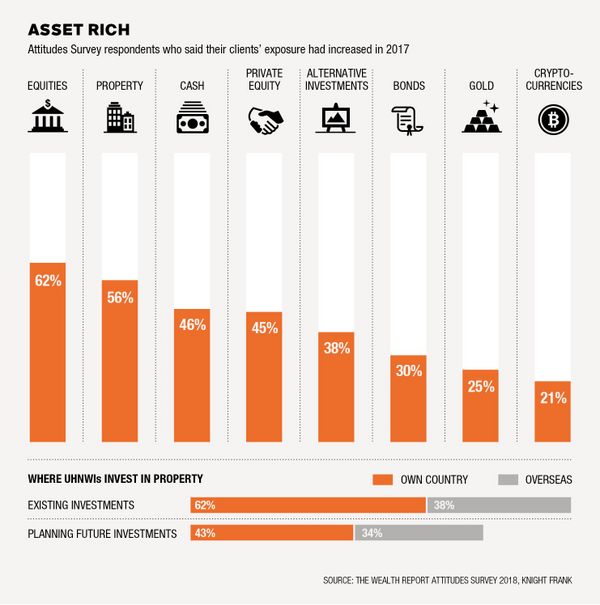

The report includes the findings of the Knight Frank’s Attitudes Survey 2018 is based on the responses of over 500 of the world’s leading private bankers and wealth advisers who between them represent about 50,000 wealthy individuals with a combined wealth of over US$3trillion. We look at the findings in more detail in our March report but note here that, globally, the survey reports a 29% growth in exposure to alternative assets, including fine wine, by UHNWIs (ultra-high net worth investors). When broken down the most significant territories are Australasia with 53% growth, North America 46%, Europe 38%, Russia 27% and Asia 22% during 2017. This may be in part due to an increased appetite to extend the risk profile on investments with a global average of 38% of these investors being classed as happy to take more risk.

Property continued to be an important sector for UHNWIs in the continued global low yield, low return environment. The year saw a notable move away from hedge funds, and in early 2018 there are ongoing concerns around perceived stretched valuations in bond markets and how much longer will the record-breaking equities rally run for? 2017 saw stock markets enjoy significant highs with US tax reforms a key influencing factor, not unsurprising then that 62% of the Wealth Manager respondents confirm that their UHNW clients had increased their exposure to equities in the year.

Private wealth, especially that represented by Family Offices, is becoming increasingly sophisticated in their investment approach. Andrew Duggan, Head of Capital Markets Research at Knight Frank states that “The 1990s were all about the wave of institutional capital hitting real estate markets. That was followed by waves of private equity and sovereign wealth capital. The next ten years will be about the impact of private wealth.”

Our observations would concur that investors are seeking greater control over their investments and see diversification into alternative assets as an important strategy.

Looking forward Knight Frank research points to further strengthening of global economic growth in 2018. The International Monetary Fund is predicting 3.7% expansion, which would be the highest level of growth since 2011, if it transpires. Knight Frank Chief Economist, James Roberts, states that “In this context UHNWIs need to think of moving away from safe haven investments and towards risk-facing assets, which typically perform strongly in cyclical upswings.”

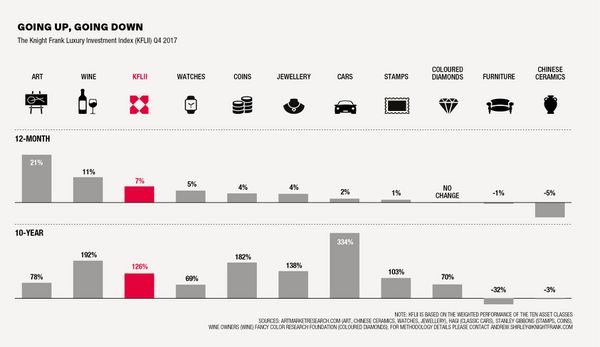

This annual report also looks at investment in ‘Passion Assets’ such as classic cars, fine art, jewellery, coins and fine wine. Last year’s 2017 Wealth Report showed that fine wine was the top performing Passion Asset in 2016 with growth of 24%. In 2017 fine wine is pushed to second place by fine art, with the Knight Frank Fine Wine Icons Index recording 11% growth.

2017 was an extraordinary year for fine art, with the sale of Leonardo da Vinci’s Salvator Mundi blowing all previous records raising US$450million (including the auction house’s $50million commission). A second significant art transaction in the year of Jean-Michel Basquiat’s ‘Untitled’, for US$110.5million, secured another landmark sale and the ripple effect raised fine art to the top of the Passion Assets ranking last year.

Sterling dynamics in 2016 had a positive impact on the price performance of fine wine and Brexit was a significant trigger. Since summer 2017 the currency effect caused by Sterling’s devaluation dropped away and this may well account for the more moderate growth in the Knight Frank Fine Wine Icons Index in the latter half of the year, compiled by Wine Owners.

The report did point to the stronger performing Burgundy market which saw a rise of 16.5% in 2017, off the back of ‘insatiable demand for the top wines and a series of short harvests.’ “…buyers in the Far East have extremely sophisticated tastes and an ever-increasing depth of knowledge, which makes it an exciting time for buyers and sellers alike.”

Over longer-term periods of 2, 5 and 10 years, fine art does not have the sustained performance of the normal class leaders, classic cars and fine wine, which are ranked first over ten years at 334% growth and second, at 192% respectively.

Highlight Passion Asset sales in 2017 included the following:

| Class | Item | Value achieved in 2017 |

|---|---|---|

| Fine art | Salvator Mundi, Leonard da Vinci | Sotheby’s US$450M |

| Classic cars | 1995 McLaren F1 | Bonhams US$15.6M |

| 1959 Ferrari 250GT California Spider LWB | Sotheby’s US$18M | |

| 1956 Aston Martin DBR (raced by Stirling Moss) | Sotheby’s US$22.5M | |

| Vintage watch | Paul Newman’s Rolex Daytona | Philips US$17.8M |

| Jewellery | Pink Star (59.6 carat pink diamond) | US$71M |

| Chinese ceramics | 1,000-year old Ru guanyo ceramic bowl | US$40M |

| Furniture | Four rare Chinese Huanghuali folding chairs | £5.3M |

| Fine wine | Domaine de la Romanee Conti, Romanee Conti 1988 (12 x 75cl) | £198,000 |

| Chateau Cheval Blanc 1947 (1 x 6 litre bottle) | £192,000 |

Fine wine is certainly a more accessible investment, and the active secondary market with established exchanges such as Liv-ex.com provides clear provenance, price transparency and investment liquidity. The other Passion Assets do not enjoy similar levels of these benefits, in part because of the singular nature of many of these assets and the challenge then to value them.

The Passion Asset review concludes that collections are “an extension of their owners… An expression of who they are and what they enjoy.” Certainly, property investors are using fine art and spacious wine cellars to secure improved sales for their assets.

For more information see the Vin-X March report due out soon and download the Knight Frank Wealth Report 2017 http://www.knightfrank.com/resources/wealthreport2018/the-wealth-report-2018.pdf