As Daniel Craig’s James Bond sups Chateau Angelus and puts the Aston Martin through its paces in the newly launched ‘No Time to Die’, we learn that Fine Wine is the top performing ‘luxury asset’ in 2021 delivering an average 13% growth, compared to classic cars’ flat-line nil return.

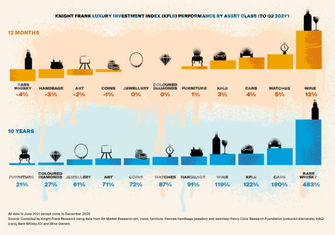

Knight Frank have updated their annual Wealth Report with luxury asset performance to the 30thJune 2021. Investment wine has been ranked first with 13% growth in the year to that date. The average performance of the luxury assets in the period under review was 3% growth, as recorded by the Knight Frank Luxury Investment Index (KFLII). Investment wine achieved nearly five times this and returned considerably more than the next best performer, rare watches where value grew by an average 5%.

Fine wine is the most ‘liquid’ luxury investment, in that it benefits from a well-established secondary market, with price transparency and efficient routes to market. Valuations can be clearly explained due to role of Liv-ex and other platforms. Fine wine investment is not wholly reliant on auctions and private sales which can lead to price inflation in the ‘heat of the moment’.

Which investment-grade wines have performed the best in August?

| Wine | Region | July 2021 | August 2021 | Change % |

| Masseto 2015 | Italy | £6,134 | £6,982 | 14.0% |

| Screaming Eagle 2008 | USA | £28,557 | £32,071 | 12.3% |

| Dominus 2009 | USA | £1,856 | £2,060 | 11.0% |

| Giacomo Conterno, Barolo Reierva Monfortino 2014 | Italy | £7,780 | £8,632 | 11.0% |

| Dominus 2017 | USA | £1,637 | £1,810 | 10.6% |

Source: Liv-ex, September 2021

How does fine wine compare to Prime London Houses and the FTSE at Q2 2021?

Knight Frank’s Annual Wealth Report consistently ranks fine wine in the top luxury investments of Ultra High Net Worth and High Net Worth investors around the world. However, it is not just an investment for the super-wealthy! Fine wine is highly accessible with an entry point less than £10,000 (as little as £1,500 for a tentative ‘toe-dip’ case of investment-grade Champagne). It is now considered as an important means to diversify and de-risk an investment portfolio.

In terms of other luxury assets, Whisky lost its 2018 first-place ranking during the pandemic to see a -4% decline in the year to the 30th June 2021. However, over the longer 10-year measure, it still recorded an impressive 483% growth.

London Property performance and the FTSE 100 were compared to luxury assets in a webinar hosted by Knight Frank in July 2021. Over the year to 30th June 2021, fine wine measured a 15% gain, where prime London houses, the FTSE 100 and luxury asset performance average saw just 1% uplift. This demonstrates fine wine’s robust performance during the pandemic compared to other assets in periods of economic uncertainty.

| Asset | 1 Year | 10 Years |

| Wine | 15% | 117% |

| Knight Frank Luxury Index | 1% | 120% |

| Prime London Houses | 1% | 9% |

| FTSE 100 | 1% | 18% |

| Cars | 0% | 181% |

| Luxury handbags | -3% | 91% |

| Art | -10% | 64% |

| Rare Whisky | -5% | 487% |

Source: Knight Frank Luxury Investment Webinar, 01.07.2021, data to 30th June 2021

Luxury handbags were the top performer recorded at the end of Q4 2020, with an average 17% growth in the 12 months to 31st December 2020. The logistics challenges posed by the pandemic may well have had an impact in H1, 2021.

Classic car lovers have seen poor short term returns over recent years, but over the longer-term, an average 181% growth in ten years still gives confidence. Passion investments are termed that for a good reason, for many it is about the joy of owning an aspirational, unique or rare collectible.

For more information on investment wines, current performance and opportunities contact the Vin-X team on 0203 384 2262 and see our latest Market Report.