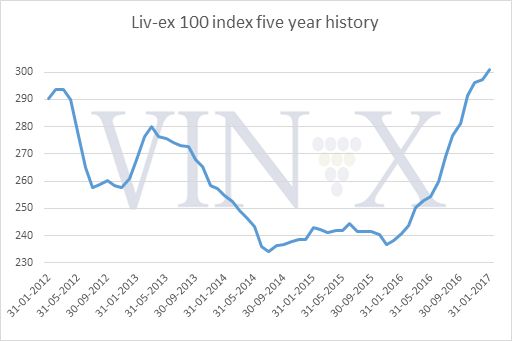

Another month, another rise for the Liv-ex Fine Wine 100 index. Up for the 14th month in succession, and by a healthy 1.26% after a somewhat modest increase in December. I wrote early this year that the trend was all that mattered, and the trend shows no sign of abating. One can easily get blasé in the face of such a bull run, but those who have already invested won’t mind getting ever hoarser after another bout of shouting from the rooftops.

When will it all end, when will the correction or profit-taking come? No one knows of course. But fine wine’s great strength is that, with no CGT applicable on it, the need for profit-taking at a particular time is not as pronounced as in the stock market.

The FW100 index, calculated at the end of every month and reflecting the hundred most traded labels on Liv-ex’s exchange, moved emphatically north in a traditionally underwhelming trading month. It now sits at 301.8, its highest level since October 2011. The LIv-ex Fine Wine 50 index, featuring the Bordeaux first growths from the vintages of this millennium only, had barely moved by the end of January, but the Liv-ex 1000 index was up half a per cent. Significantly, though, it enjoyed a rise for a sixth consecutive month.

The prime movers were led by Guigal’s La Landonne 2012, helped no doubt by the Wine Advocate’s upgrade late last year to 100-point status. Two other wines with the same Parker rating, Pavie and Smith Haut Lafitte (both from the 2009 vintage) also performed especially well, as did the Super Tuscan Ornellaia 2010, and La Tâche 2012.

Investors may be either amused, or rather disappointed, to hear that fine wine merchants were completely wrong-footed by last year’s sustained leaps in value by the FW100. As many as 98% underestimated, in some cases badly, how the index would fare. The figures came from Liv-ex who, every year, asks its members to predict where the FW100 will finish at the end of it.

Not since 2013 had the index surpassed the merchants’ predictions. What took them by the surprise, coming up on the blindside, was the Brexit vote, with the resultant falling pound leading Euro and dollar-rich investors to pile in heavily from late June. As a result, the merchants’ forecast, as an average, that the index would rise 5.4% was way short of the actual increase for 2016 of 24.8%.

One particularly pessimistic merchant predicted the index would close as low as 215, although one optimistic one went for over 300. Only one merchant forecast it would finish in the 290s, earning himself a magnum of Louis Roederer 1990 for his prescience.