Trade magazine, Harpers, interviewed Liv-ex director, Justin Gibbs, this month wherein he acknowledged the fact that the en primeur system has priced out average collectors and investors over the past few years. The original rationale of en primeur pricing by the chateaux was to reward the payment for wine two years in advance of receipt of goods and provide ‘discount’ prices to the en primeur buyers. The pricing strategy adopted in recent years has failed to deliver this value

Gibbs points out that until the Bordelaise recognize this, buying en primeur will have increasingly less market appeal. The pain of the last three years is in part due to the time it has taken to correct en primeur prices since the high of the 2010 vintage. He likened the staggered approach to price cuts over the last three years to “death by a thousand cuts”, albeit the total price cuts achieved are 50-60% over that time. In his view a “deep critical price cut for the 2011 vintage” after the peak 2010 would have appeased the market and, we could interpret, kept it more engaged – but hindsight is a wonderful thing.

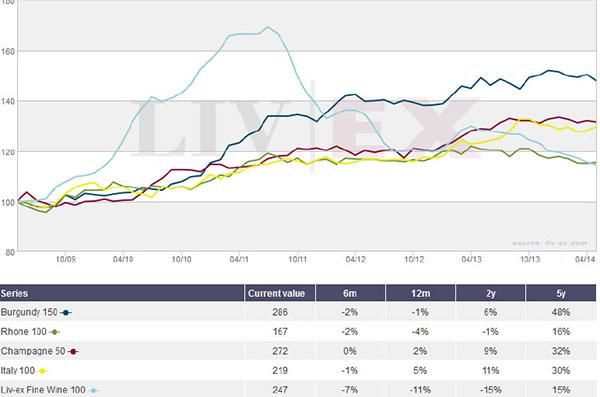

Interestingly, he comments on the entry into the market of the new Chinese wealth who continued to buy at the Bordeaux market peak, wherein at that point the traditional US and European buyers were seeking out new opportunities elsewhere. Gibbs acknowledges that investors are active in regions such as Burgundy, Rhone, Champagne and Italy, although the Liv-ex Fine Wine 100 continues to be dominated by Bordeaux. “In June 2011 Bordeaux made up 95% of all value traded on Liv-ex, now it is 78%.”

He concludes that fine wine investors do appear to be diversifying their investments and thereby stabilizing their portfolios and that the market is probably now in a better state having had some of the extreme values removed.

This supports our view in terms of timing to enter the market – we believe there are currently excellent opportunities for investors in fine wine to enhance their wine portfolios through acquisition of wines from regions that now enjoy a more active secondary market and that many of the staple blue-chip Bordeaux investments are currently available at prices which offer significant opportunity for growth.

It is important to take note of what is happening in the alternative regions as Burgundy’s finest wines, such as Domaine Romanee Conti, have seen extraordinary price growth in the last 18 months and we question the sustainability of such values. April saw the Liv-ex Burgundy 150 close down 1.8% and we will continue to monitor performance. On a positive front both the Rhone 100 and Italy 100 saw increases, the latter by 1.3% in the month.