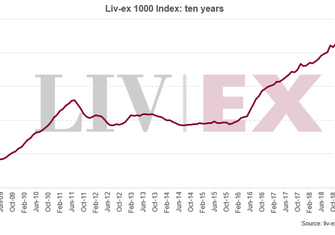

Liv-ex has reported that its major benchmarks rose in June 2019, rallying against the drift in performance in recent months. The Liv-ex 1000, which provides the broadest measure of the fine wine market, was up 0.69% on the previous month and the Liv-ex 100 recorded a 0.39% growth during June 2019.

The table below sets out the performance for the key sector and regional benchmarks:

Key Liv-ex Benchmarks – June 2019:

| Liv-ex benchmark | MoM % | 1 year | 5 years |

| Liv-ex Fine Wine 1000 | 0.69 | 2.98 | 46.15 |

| Liv-ex Bordeaux 500 | 0.74 | -1.61 | 34.84 |

| Bordeaux Legends 50 | 0.82 | -2.73 | 37.43 |

| Burgundy 150 | 0.46 | 14.19 | 94.9 |

| Champagne 50 | 1.4 | 3.72 | 43.08 |

| Rhone 100 | 1.62 | 3.81 | 19.50 |

| Italy 100 | 0.72 | 7.07 | 33.75 |

| Rest of the World 50 | -0.58 | -0.99 | 37.83 |

Source: Liv-ex.com 30th June, 2019

The fine wine market has been static during 2019 year to date and the focus on the Bordeaux en primeurs in Q2 can affect momentum generally. Burgundy has seen a slow-down of the meteoric price performance of its top wines throughout 2019. In June, however, the Burgundy 150 benchmark posted an average 0.46% growth and its one year 14.19% average growth has it tracking as the top performing sub-index of the Liv-ex 1000.

Investment wines from the Rhone are also recording good growth, the Rhone 100 grew 1.62% in June and is tracking ahead of the Bordeaux indices over the last 12 months. Diversifying into both Rhone and Champagne could strengthen overall portfolio values.

Sterling is an important factor, both against the Euro and the US Dollar, with concerns over the US – China trade relationship hardening and a highly unpredictable UK political scene. As a truly global tangible asset, fine wine offers the opportunity to hedge currency positions and protect capital in these uncertain times. With the market potentially showing early signs of strengthening this could be an important moment to add fine wine to your portfolio.

For more information call us now on 0203 384 2262.