On the 9th of April the Bordeaux chateaux will open their doors to the world’s wine trade for the industry’s official sampling of the 2017 vintage. This annual gathering of global merchants and critics is one of the key events in the wine calendar and the success of a vintage campaign can determine the sentiment of the Bordeaux market for the remainder of 2018.

The rationale of the en primeur process was put in to question with seemingly over-priced campaigns during 2011 – 2014, but more successful 2015 and ‘16 en primeur campaigns have helped to rebuild confidence. Even so, we will continue to approach the en primeur process with caution and select only those wines that we believe offer real opportunity for growth.

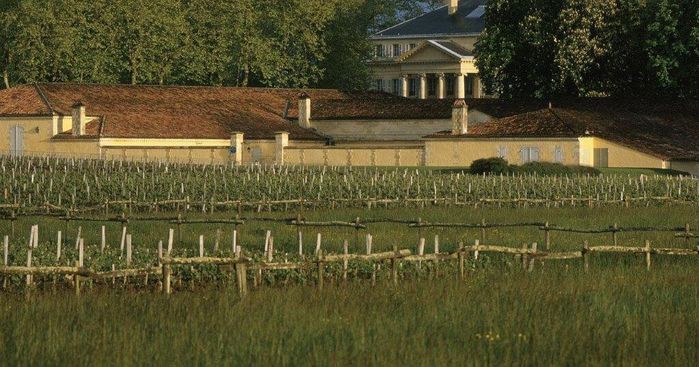

The over-riding message about 2017 since April last year has been the effect of damaging frosts. Growers published their supply data earlier in the year and despite Bordeaux’s overall supply being down on 2016 by 40 per cent, very few investment-grade wines report serious supply issues. Left Bank wines from Pauillac, St Julien and St Estephe pretty much got away without any vine-damage, the Margaux commune was harder hit. The worst affected areas were towards the south and east of the region, with the chateaux of St Emilion, Pessac-Leognan and Sauternes most affected.

So, supply may be an issue for the 2017 vintage, but later good growing conditions in the year helped quality but it won’t be uniform and buyers will have to be selective with price adding a further key factor.

Supply will also be affected by how much wine the Chateaux will release en primeur. Another trend developing over recent vintages is the increasing amount being held back in cellar, with vineyard owners and managers looking to boost margin by drip feeding stocks into the market at later stages. So, for the best wines, the challenge will be getting hold of these wines at a strategically sensible price.

Bordeaux’s flagship First Growths saw an uplift in demand post the Brexit referendum when Sterling weakness presented a great buying opportunity for overseas collectors, but their market share has lost its previous dominance with the estates’ second wines being some of the highest traded wines on Liv-ex and enjoying excellent price growth performance. It will be interesting to see their quality scores for 2017 in the next few weeks.

Latour’s exit from the en primeur process following 2012 certainly impacted on the Chateau’s trading levels, but they took the hit for a long term supply strategy to hold vintages back until they are ready to drink, supporting higher prices and better margins. Latour has only recently started feeding wine into the market and we will watch the future price performance with interest.

The 2015 and 2016 en priimeur campaigns saw Liv-ex UK member sales grow to £58.6million and £82million respectively, but even these stronger figures are nothing like the £225million generated by the 2010 vintage campaign. That said, it was the previous peak of the market and values were eye-watering at the time.

When looking at the rationale of buying en primeur, you cannot take the broad-brush, ‘average discount to future values’ approach any more – you have to be selective and make your choices carefully, balancing quality score from key critics, price and overall vintage quality as your markers. Average return can mask individual wine performance. For example, Liv-ex reports that the 2015 vintage has delivered an average return in euros of 11 per cent, however the returns of individual wines included in the Bordeaux 500 index have a range of returns spanning from -17 per cent to +162 per cent growth performance. The vintage top performer, Margaux, has delivered 160% growth so far as a result of its superb quality with the added bonus of a commemorative bottle adding extra collector appeal.

Key to the up and coming 2017 tastings are the views of a few top critics. The days of the world waiting for Robert Parker Jnr’s view on a Bordeaux vintage are well and truly over and there appears to be a broader critical view, and influence on the market. Suckling and Martin are probably the two the growers and merchants will take most notice of but there possibly isn’t the same push on price dynamics, rather the affirmation of a broader view.

Our Bordeaux-based Director, Renaud Ruer will be at the tastings and we look forward to updating you through the campaign and we shall cover it in detail in our April Market Report.