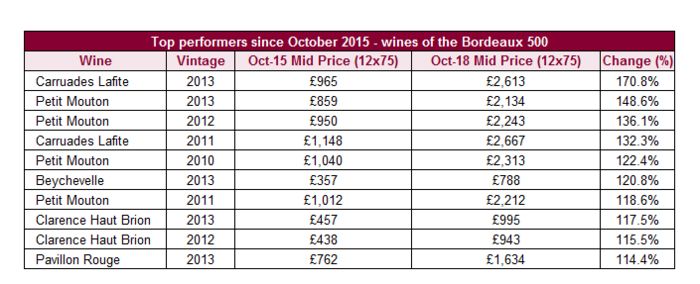

We have previously reported on the benefits of including ‘Off-Vintage’ wines in fine wine investment portfolios as they offer value and strong returns. Information just published by Liv-ex analysts endorses this view with top performing wines that have been acquired for modest sums seeing growth up to 170%.

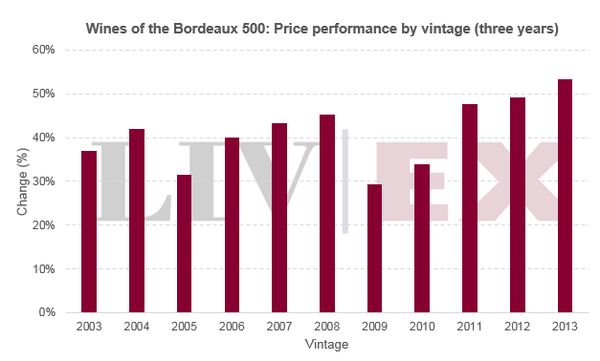

Liv-ex has looked at the Bordeaux wines categorised in the Liv-ex 500 index with a focus on the vintages 2003 to 2013 and performance over the last three years. Over this period the average prices for these Bordeaux vintages have risen strongly with the mean increase at 41%. Interestingly, Off-Vintage Bordeaux wines have enjoyed the highest level of growth with the top performers actually being the best value wines on purchase.

As can be seen from the Liv-ex table, the 2013 vintage has experienced an overall average growth of +53% during the period despite the lowest average Bordeaux vintage score (Parker 83.3). These wines will have been acquired at the lowest entry prices and provided significant value to their owners. Wines of the 2012 (average Parker score 91.1) and 2011 (88.2) vintages offered the next highest levels of average growth at 49% and 48% respectively in the last three years.

The important thing to remember is that the overall average vintage quality score will not be indicative of individual wine quality scores. In every vintage there will still be outstanding wines which will achieve very high scores. The overall average higher score of Prime vintages such as 2005 (96.5), 2009 (97) and 2010 (95.2) generally adds a premium to individual wine prices. Similarly scored wines of Off vintages can be acquired at lower prices and provide real value and growth potential to a portfolio smartly diversified by vintage.

Not unsurprisingly, the wines of the top Prime vintages of 2009, 2010 and 2005 were generally priced higher on release and, whilst still seeing positive growth (2009 achieved an average 29%), overall they have seen the lowest average levels per vintage.

On this basis we strongly support the strategy of including well scored Mid and Off vintage wines in your fine wine portfolio planning. You can combine this diversification with a regional influence, for example if you are currently long on Left Bank First Growths adding a well-scored Right Bank Cheval Blanc, Angelus or Pavie from a Mid or Off vintage could provide balance and growth potential. First Growth Second wines can also influence overall growth performance, for example Carruades Lafite 2013 saw 170.7% and Petit Mouton 2013 148.6% growth in the period under review and were the individual top performers.

For more information on how to diversify your portfolio by vintage and the superb wines we currently have available contact us now on 0203 384 2262.