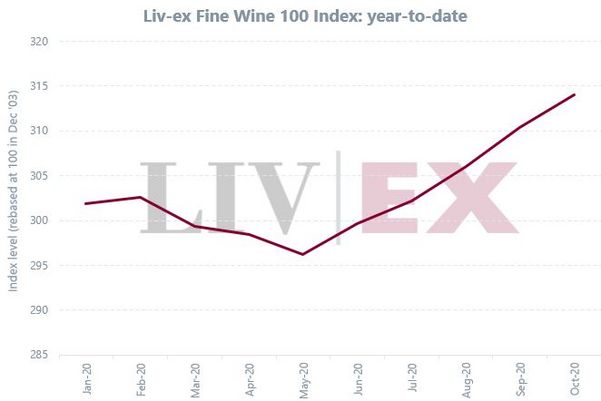

Fine wine is withstanding unparalleled challenges in 2020 and despite this market confidence has grown as trade maintains robust growth whilst global economies have shrunk and financial markets become increasingly volatile.

Liv-ex: Growing fine wine market confidence

Despite Brexit, US Tariffs and Covid-19 the key benchmark Liv-ex fine wine indices record performance trends that are all positive YTD and some of the key drivers of this are increasing liquidity, growth in products and participants and technological advances in the fine wine secondary market.

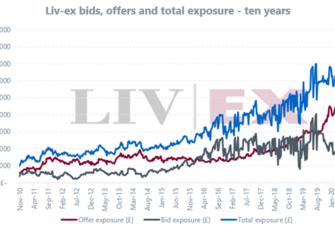

Liquidity

The secondary market in fine wine has enjoyed sustained growth throughout 2020. Month-on-month Liv-ex has reported increasingly higher levels of trade by volume and value. The total exposure (combined value of bids and offers on the exchange) reached a new record high early November 2020 (following a previous in September) where total exposure stood at £81M. In the midst of a global pandemic this figure was up £30M on the same point in November 2019 – a remarkable 37% increase.

Broadening Market

We comment regularly on the effects of the broadening fine wine market and its impact on investor demand and prices. We have watched regional market share shift dramatically over the last ten years when in 2010 Bordeaux accounted for over 95% of the value of trade on Liv-ex. In 2020, secondary market trade in the great Bordeaux wines now represents 40% of overall share. This reflects the broadening interest of buyers, initially seeking better value as Bordeaux prices hit an astronomical peak in 2010 to become sustained as the quality of wines from Burgundy, Italy and Champagne become better understood and access grew.

As the number of labels from these regions became available on the secondary market, we saw collectors and investors respond and further market growth. Burgundy was the first beneficiary of this broadening but as this region also saw a significant uplift in prices (to the benefit of many owners) buyers looked at wines from Italy and Champagne. Italy’s 2019 average 8.8% share of trade on Liv-ex has nearly doubled to 15.3% at the end of October 2020.

Screaming Eagle: Growing wine market confidence

USA wines have enjoyed the latest growth in demand and its share of trade on Liv-ex now stands at 7% of value – a far cry from 0.1% in 2010. All investors want to understand where the next opportunities are coming from and the wine growing regions currently seeing uplift in volume are the best of what Liv-ex categorise as the RoW (Rest of the World). This captures wines of Australia, Spain, Germany, Chile and Portugal. For investors the most notable wines of the RoW are Australia’s Penfold Grange and Spain’s Pingus and Vega Sicilia estates. But other brands are now starting to become noticed and not just in the territories alongside these great brands but also wines from Germany, Austria, Argentina and Chile – perhaps James Suckling’s Top 100 Wines of 2020 published recently provides insight to this.

Technology advances

Liv-ex apportions some market confidence to technology initiatives that are improving efficiency in the secondary market. They have developed their systems this year to provide merchant members with 24/7 trading facilitating growth and efficiency around the world in the trade in fine wine. This provides further access for buyers and more exit routes for sellers as even more players enter the market. Liv-ex reports that the number of trade merchants on Liv-ex has grown by 15% in 2020 alone.

Tangible asset performance in volatile markets

From a solely investment point of view growth in demand and values this year will in some part be influenced by investors seeking protection for their capital in a period of extreme economic distress. Fine wine as a tangible asset with a track record of stable long term growth provides the means to diversify and de-risk portfolios. This has influenced growth this year but demand is only achieved if an investor has confidence in the asset. Fine wine is delivering that confidence.

Conclusion

Growth in liquidity, market participants and investment wines trading, along with developments in functionality and efficiency all support a market that is delivering value during a global pandemic. If ever there was a case study to illustrate the value of including fine wine in portfolio planning, 2020 is it and it is easy to understand the growing market confidence.

For more information contact us now on 0203 384 2262 or download our Guide to Fine Wine Investment.