Trump’s US Tariff Truce

The fine wine trade breathed a collective sigh of relief with the news this week that Presidents Macron and Trump have agreed to defer any decision about further tariffs on the import of European wines into the US. France’s Macron has announced that the two countries would “work together on a good agreement to avoid tariff escalation” which Trump has tweeted a positive response to.

The threatened action could have had a very significant impact on the market with a proposed imposition of a 100% levy on all EU wines being imported into the US. There has been lobbying from global trade against this punitive measure which could have affected Italian and sparkling wines, which are currently exempt from the 25% tariffs introduced in Autumn 2019. The Autumn tariff was imposed in response to EU subsidies provided to Airbus and subsequently the 3% Digital Tax on US companies such as Google, Apple and Facebook, providing services to French consumers.

The Presidents have agreed to defer any further action to beyond 2020 which is very good news for the year ahead, especially for Italian and Champagne wines, seen as targets for growth in the next 12 months.

Read more: https://www.thedrinksbusiness.com/2020/01/us-and-france-agree-tariff-truce-for-a-year/

Liv-ex trade results mid-January shows continued demand for top Italian Piedmonts

Regional share of trade on Liv-ex 10 – 16th January 2020 reported an uptick in demand for Burgundy as the 2018 vintage trade tastings got underway. However, the most traded wines by value on the exchange were led by Piedmont’s Giacomo Conterno, Barolo, Reserva Monfortino 2013. Very much a brand of the moment, this wine is only made in the very best vintages and aged in bottle for seven years.

| Liv-ex most traded wines 10 – 16 January, 2020 | Vintage | Price |

| Giacomo Conterno, Barolo Reserva Monfortino | 2013 | £8,200 (12 x 75cl) |

| Chateau Angelus | 2012 | £3,244 (12 x 75cl) |

| DRC, Romanée Conti | 2010 | £45,000 (3 x 75cl) |

| Caymus, Special selection Cabernet Sauvignon | 2014 | £1,020 (12 x 75cl) |

| Georges Roumier, Banners Mores | 2005 | £26,000 (12 x 75cl) |

Source: Liv-ex.com, January 2020

St Emilion’s Angelus 2012 also enjoyed good levels of trade mid-month, in particular its commemorative label of achieving Grand Cru Class A status makes it, and Chateau Pavie, collectors’ items for this vintage. Bordeaux 2012 generally was a reasonably priced vintage compared to the previous few and now many of the wines are entering drinking windows; increased demand can be expected.

Chinese New Year of the Rat – which previous Rat vintages demand interest?

The Chinese New Year is the Year of the Rat in 2020 and we note that the most recent Rat vintages are 2008 and 1996. 2008 was a pivotal year in fine wine when the industry started to feel the real influence of the Chinese and Far East consumers on the market. Lucky number 8 drove demand for the vintage and in particular in the top Bordeaux brands which enjoyed the most recognition with these new buyers.

This awakening market then went on to buy heavily into the stellar 2009 and 2010 vintages, which still have the most prolific number of highly scored (Parker 100) wines. The combination of these factors drove the values of the Bordeaux First Growths, and by association the region’s other top wines, to unsustainable levels as the trade and international buyers subsequently sought value in similarly quality wines from Burgundy and elsewhere.

Despite all this 2008 will continue to have appeal to Chinese consumers and Bordeaux prices may well now look very attractive for the top wines of the vintage. Furthermore, 2008 was a very good vintage for Champagne and the obvious choice of cork to be popped at the New Year celebrations. As Champagne is a key source of growth for fine wine investors in 2020, Champagne 2008 has to be on our watch list.

Alain Ducasse tempts diners with discounted top Bordeaux and Burgundies

Distinctly dis-engaged and unimpressed with the ‘Anglosaxon’ attempt at abstinence post the festive season, world renowned chef, Alain Ducasse is offering top French wines at special prices to keep his guests drinking this January – with this kind of temptation the gastronomic lovers amongst us may be being sorely tested – how strong are you?

Read more: https://www.thedrinksbusiness.com/2020/01/the-week-in-pictures-354/8/

Champagne Bollinger and England Rugby continue Anglo-French alliance

Not all cross-channel relationships are uncomfortable. Champagne house Bollinger has confirmed their continued partnership with England Rugby for another five years meaning a bottle of Bollie will be the ‘Absolutely Fabulous’ toast of the Quilter England Men’s and Women’s Red Roses International fixtures.

Read more: https://www.thedrinksbusiness.com/2020/01/the-week-in-pictures-354/7/

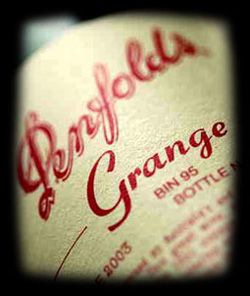

Black Rock increases its interest in Penfolds Grange

Black Rock investment firm has announced its increased stake in Treasure Wine Estates (TWE), owners of Australia’s most famous investment wine, to 8.32%. Black Rock’s investment strategy is now to divest its interests in coal based acquisitions to increase its holdings in sustainability focused companies. The investment firm also owns 5.79% of Kent wine producer Chapel Down, which is listed on the NEX Exchange for young, entrepreneurial companies.

For more information on the latest news to influence the fine wine market and the latest opportunities contact us now on 0203 384 2262.