CUMULATIVELY FINE WINE IS THE TOP PERFORMING ASSET OVER FIVE YEARS.

March has been the real critical impact month outside of Asia in the current pandemic and the first period where we can start to analyse fine wine data and the impact of Covid-19 at this still relatively early stage.

PERFORMANCE

Liv-ex’s April 2020 Market Report for its members shows that the leading fine wine exchange saw an increase in trade of 26% by value in March 2020 and the number of transactions and individual cases traded at a record high. We look at performance data extracted from the report and how fine wine’s performance is comparing to key financial benchmarks and gold during the Covid-19 pandemic.

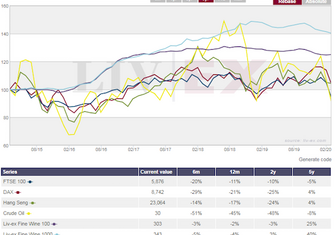

At the end of Q1 2020 the FTSE had fallen -26%, the S&P 500 was down -19.4% whilst the key Liv-ex 100 tracked a negative -3.1%, however there is a rising trend and the fine wine index matched gold’s performance in March. Cumulative measures now record FINE WINE AS THE TOP PERFORMING ASSET OVER FIVE YEARS and only exceeded by gold measured over 1 year.

Fine wine v Financial Indices and Gold:

| Index | MoM | YTD | 1 Year | 5 Years |

| Liv-ex Fine Wine 100 | -1.1 % | -1.1% | -3.1% | 24.2% |

| Liv-ex Fine Wine 1000 | -1.4% | -2.7% | -4.4% | 38.3% |

| FTSE 100 | -15.2% | -26.0% | -23.4% | -17.6 |

| S&P 500 | -11.8% | -19.4% | -8.1% | 25.9% |

| Gold | -1.1% | 6.4% | 25.5% | 37.3% |

Source: Liv-ex April 2020 Market Report, Data at 31.03.20

With the backdrop of extremely volatile financial markets, fine wine values in Sterling are remaining relatively stable. March saw marginal falls just over 1% for both the Liv-ex 100 and Liv-ex 1000 benchmarks in the month, whilst the FTSE 100 fell -15.2% and the S&P 500 a staggering -11.8%. Safe haven Gold mirrored the Liv-ex 100 performance in the month at minus 1.1%, however its cumulative performance has held up based on a strong preceding 12 months, the period within which fine wine was challenged by US Tariffs and Brexit.

Again, we remind investors that fine wine’s comparative performance as a tangible, stable asset sits it alongside Gold in its ability to hedge volatility in financial markets and generally its longer term performance often outstrips equities and gold. As we can see over the 5 year period measured fine wine is currently the top performer.

REGIONAL DEMAND

In terms of regional performance Italy continues to build on a stellar performance over the last six months accounting for 15.4% of trade on Liv-ex in March 2020 and 24.7% in the first week of April. The Liv-ex Italy 100 index has seen a one-year return of 3.9% to the end of March 2020 and in the first quarter of 2020 this performance has been influenced by releases of Barolo 2016 and Brunello 2015.

Liv-ex: Regional Market Share March – April 2020:

| REGION | Share of Total Trade 3 – 8 April 2020 | March 2020 Trade Share |

| Bordeaux | 36.1% | 50.3% |

| Italy | 24.7% | 15.4% |

| Burgundy | 11.2% | 12.3% |

| Champagne | 10.0% | 10.1% |

| USA | 7.7% | 5.2% |

| Others | 7.5% | 4.2% |

| Rhone | 2.8% | 2.5% |

Source: Liv-ex.com 14.04.20

Italy’s Piedmont region is now producing some of the most active wines on the exchange. Giacomo Conterno, Barolo Reserva Monfortino 2013, the most recent release from this top Piedmont estate, saw the highest level of trade in March, partly due to Antonio Galloni attributing it with a near perfect 99 points score and likening it to the super classic vintages, 1996 and 1999. When you compare current trade values for the 1996 vintage, selling at £12,108 (12 x 75cl) which is 35% up on the 2013 vintage and 1999 at £10,800, 28% more expensive than 2013, you get an indication of potential future growth. The 2010 vintage was awarded 100 points by Galloni and last traded at a 78% premium to its release price and the 2016 vintage was responsible for over a quarter of the trade in Italian wines on Liv-ex in the run up to the Easter weekend.

Top 5 Share of Trade by Value ( 3 – 8 April, 2020):

| WINE | VINTAGE | REGION | LAST TRADED PRICE |

| Giacomo Conterno, Barolo Reserva Monfortino | 2013 | Piedmont, Italy | £7,400 |

| Mouton Rothschild | 2003 | Bordeaux | £4,450 |

| Caymus, Cabernet Sauvignon | 2017 | £600 | |

| Taittinger, Comtes Champagne | 2008 | Champagne | £1,464 |

| GD Varja, Barolo Bricco Viole | 2016 | Piedmont, Italy | £622 |

Source: Liv-ex.com 14.04.20

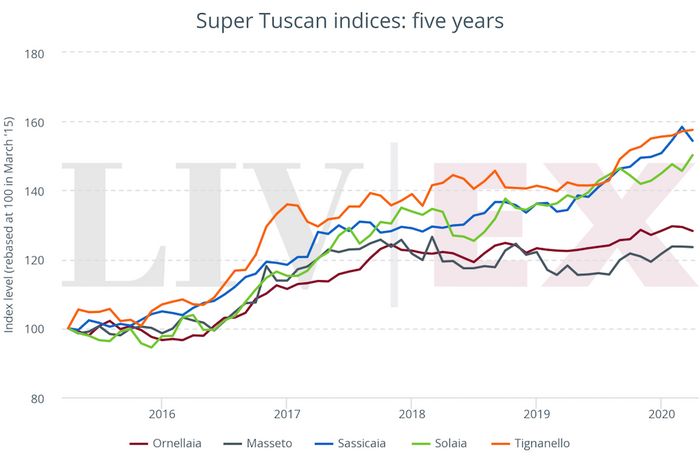

Tignanello is now the top performing Super Tuscan and the 2016 vintage, released in January 2019, is now trading at a 13% premium. A favourite of Megan Sussex and Boris Johnson, Tignanello is currently recording the highest growth of the Top Tuscan investment wines over the last five years.

Champagne is maintaining a steady 10% of market share YTD and the two most in demand wines from the region in Q 1 2020 have been Moet & Chandon, Dom Perignon 2008 (awarded 98+ points, A. Galloni) and Louis Roederer Cristal 2012. The 2008 and 2012 Champagne vintages have seen the highest levels of trade in the first quarter of the year.

Bordeaux and Burgundy, both still impacted by US Tariffs, lost ground to Italy in March in terms of market share but Bordeaux maintained its monthly average YTD at 50.3% of fine wine traded on Liv-ex. The 2010 vintage, re-tasted by the key critics in February, accounted for nearly a quarter of all trade in Bordeaux and Mouton Rothschild 2003 has been the region’s wine in most demand on Liv-ex at the start of April.

Many large scale Bordeaux releases planned for March have been deferred to later in the year including the highly anticipated Latour first release since the 2011 vintage. The market also had confirmation about the deferral of the Bordeaux 2019 en primeur campaign, now expected to take place this Autumn but this will be totally reliant on the progress made against Covid-19 over the coming months.

The next few weeks will be critical in determining timescales for any form of release on lock-downs across Europe and the US. China has commenced and Italy and Spain have published first extremely careful moves but the British Government, whilst stating there will be no immediate changes, it is expected that an extension to the current lockdown arrangements will be set imminently. The Government economic forecast published today predicts the economy will shrink 35% by June 2020. Financial markets will continue to be unpredictable over the coming months as the economic impact of the pandemic becomes increasingly apparent. Fine wine meanwhile continues to offer a safe haven and the potential to protect capital in these extremely uncertain times.

For more information on investment grade wines and creating a fine wine portfolio contact us on 0203 383 2262.