Whilst reports suggest Italy, Spain and the Rhone had the largest growth in wines traded on Liv-ex this year so far – up 154%, 153% and 127% respectively from their January 2020 levels, Bordeaux remains the market leader and commands 34% share of the total investment grade wine traded on the exchange.

Bordeaux is still the most prolific region for investment grade wines and enjoys the most established secondary market, which is why it is an important region to build your wine portfolio from. With the ever-expanding market it is now more important than ever to understand the best of Bordeaux.

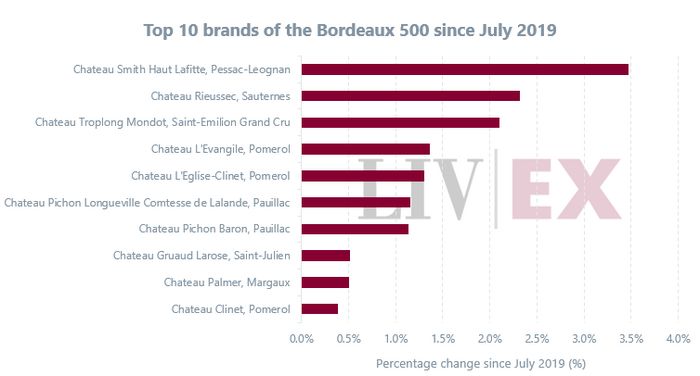

The Liv-ex Bordeaux 500 index is the most comprehensive measure of Bordeaux wines, representing the price movement of 500 leading wines from the region. The chart released by Liv-ex below illustrates the top 10 brands from the Bordeaux 500 over the past year since 31st July 2019:

The top performing Bordeaux brand over the last year is Chateau Smith Haut Lafitte (up 3.47%), followed closely by Sauternes’ Chateau Rieussec (2.32%) and Chateau Troplong Mondot, one of the leading lights of St Emilion and potentially tipped for a future classification upgrade. The other key brands of note for the year are L’Evangile, L’Eglise-Clinet, Pichon Longeville Comtesse de Lalande, Pichon Baron, Gruaud Larose, Palmer and Clinet.

The most unique opportunity for investors interested in Bordeaux over the last year, however, has been the release of the 2019 vintage in June – so these wines will not feature in this measure. Bordeaux En Primeur 2019 was released at prices not seen for a decade, some of the top Chateaux have sold at nearly 30% discount on 2018 and in a year of very good quality. It has been noted that the Chateaux have adopted a similar strategy to the one followed post the 2008 market crash and following recession – i.e. a price reduction on the 2008 En Primeurs in Spring 2009. The 2019 vintage has been all the more unusual due to its delayed and suppressed launch due to Covid-19. This vintage at the prices sold could be one of the most opportunistic purchases for fine wine investors.

We currently have limited allocation for CHATEAU PAVIE 2019:

- Château Pavie 2019 has been released at 15% less than the 2018 release price

- Château Pavie is one of the highest scored of the vintage, rating 98/99 – 100 points by James Suckling

- 2019 vintage release had a lower supply lower than normal

- First opportunity in a decade to buy Bordeaux En Primeur at such low price levels

- Due to our relationship with Château Pavie we will not charge a management fee on this special allocation.

July saw an increase of 0.54% on the Liv-ex 1000, its third consecutive month of gains, and with ongoing economic uncertainty we strongly believe that now is the time to be bolstering your investment portfolio with fine wine. To understand more about the best performing wines of Bordeaux, contact a member of our investment team today on +44 (0) 203 384 2262