Investing in fine wine is a growing trend as investors seek growth and value in the low interest rate environment that continues to prevail as we nudge into the third decade of the 21st Century. Wine investment is also now much better understood as information is more readily available with regular features in mainstream press and organisations such as Liv-ex, the market equivalent of a stock exchange, and Vin-X, a fine wine investment specialist, provide important data, services and trade efficiencies.

Alternative investments, such as fine wine, provide the opportunity to diversify and strengthen a portfolio and the key benefits of investing in wine are set out below.

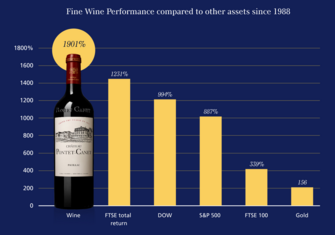

Performance – Fine wine typically delivers stable growth over the long term. The finite supply of investment-grade fine wine creates a dynamic which supports long term, stable growth. Investment-grade wines are produced under stringent rules which limits supply per vintage at the same time they are crafted to improve with age. Consequently, as wine continues to improve over time, demand increases, it starts to be consumed and become increasingly rare, which supports price growth over the long term.

Advantageous tax treatment – Fine wine is classed by HMRC as a ‘wasting asset’ and as such any gains from fine wine investment do not generally attract Capital Gains Tax, however individuals should always seek advice from a professional tax advisor.

Diversification – Fine wine investment performance is generally not correlated with financial markets, therefore investing in wine can offer the opportunity to balance out risk and the volatility experienced with equities.

Hedge against inflation and economic challenges – Fine wine is less susceptible to adverse economic conditions and generally can be used to preserve wealth by hedging against the negative effects of recession, inflation, currency devaluation and movements in financial markets.

Tangible assets – Wine has an inherent physical value unlike stocks and shares.

Looking at an alternative investment like fine wine could be particularly compelling in 2020. The uncertain global economic and political conditions experienced in 2019 continue to prevail this year. The impact of Brexit on the UK economy, and even the EU, will not be clear any time soon, will Trump achieve a second term, will Corona virus be stopped in its tracks in 2020 and how will the engine room economies of the Far East perform amidst this and other geo-political challenges. You can see how financial markets could easily be challenged and broadening a portfolio with tangible, stable assets like fine wine could protect capital and reduce risk.

What to do when investing in fine wine?

- Decide how much capital you wish to invest?

- Be clear about what period of time you will plan to hold your wine investment for – we recommend that you have a medium to long term plan to optimise performance

- Discuss your investment goals with a wine investment expert

- Research the market to understand key wines for performance, trends and opportunities

- Confirm your choice of fine wines

- Ensure the wine is insured and correctly stored to protect quality and value

- Keep informed about performance and market conditions

- Time your exit to optimise returns

Wines to look at in 2020

There is a real opportunity to acquire highly sought-after, investment-grade wines that have been victims to forces in 2019 (US Tariffs, Brexit and fashionable trends taking demand into other regions) that are available now at prices offering strong potential for growth in the longer term. Blue-chip First Growth and Right Bank Bordeaux could provide real value in 2020, such is the strength in the secondary market in these wines and their great capacity to age over the long term that they represent important building blocks to a fine wine portfolio.

Top Champagnes and Italian Super Tuscans are currently exempt from the US Tariffs imposed in Autumn 2019, and are enjoying growing demand and value. Champagne, traditionally has an excellent track record in terms of stable long term price growth and the top wines of Tuscany and Piedmont are enjoying a growing profile and a broadening market.

The iconic Burgundies are some of the most valuable investment wines in the world and continue to be a key focus for wine investors and collectors. 2019 saw a drift in some Burgundy price performances, partly due to general market conditions but also as a result of a broadening focus as investors sought value in other Burgundy brands following significant regional price growth during 2017 and 2018.

As an alternative asset generally, fine wine offers real benefits to investors and if you are considering investing in wine in 2020, as with all investments, make sure you have done your research and ideally take advice from a wine investment specialist to guide you to create a rewarding fine wine collection you can enjoy for years to come. Vin-X’s team of wine investment experts can help wine investors – from novice first timers to experienced collectors – providing market information, selecting fine wines that offer growth potential, arrange specialist fine wine bonded storage and ultimately assist with the sale of wines when investors are ready to exit.

Contact us now for more information on the fine wine market, which wines you should be including in your collection and our service on 0203 384 2262, or alternatively, visit our contact page.