The April 2020 economic data published this morning by the ONS, stating an unprecedented 20% contraction in the UK economy, slams home the impact of Covid-19 on our nation’s financial health. The full impact in terms of jobs and investments is yet to be realised and investors are looking at opportunities to bolster value and protect capital during these troubled times.

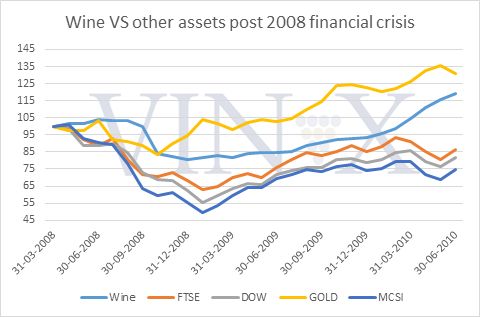

A key lesson to be learnt from the 2008 crash was that investors in tangible assets such as fine wine enjoyed the most significant growth curve in the following period as equities and the economy nose-dived. Increased demand for the Bordeaux First Growths in 2009-10 in particular saw prices rise to record levels that have yet to be matched – could we see a similar dynamic in the coming period?

As the reality of the financial cost of Covid starts to become apparent, Bordeaux is releasing its 2019 Bordeaux vintage at a level that could be the most significant opportunity of this decade!

Bordeaux 2019 is being released at an average approaching 30% discount on the 2018 vintage and at prices not seen for the best of Bordeaux for a number of years.

This has been a unique vintage release both in terms of the back-drop of a global pandemic and the timing of a pricing correction the market has been demanding for some time. The usual en primeur launch with tastings in Bordeaux could not happen this year and, with the uncertainty cast by Covid-19, Bordeaux has taken a bold step to reduce the release prices as they did post the 2008 crash – breathing energy into the market, with the potential to deliver strong returns for investors. Will we see a similar trend to post 2008 unfold now?

Investing in fine wine offers the following benefits:

- Tangible asset with inherent value unlike shares

- Historic performance of strong, long-term growth

- Tax efficient treatment – should be Capital Gains Tax exempt (subject to personal circumstances)

- Stability and low risk – no direct correlation to financial markets

- Diversification – with a safe, stable, tangible asset

The Bordeaux 2019 En Primeurs is an opportunity not to be missed. REGISTER HERE for information on our LIMITED 2019 ALLOCATIONS and to receive the latest news and information on the campaign.

Our expert team of fine wine investment specialists are available to explain the benefits of investing in en primeur wines now on 0203 384 2262.