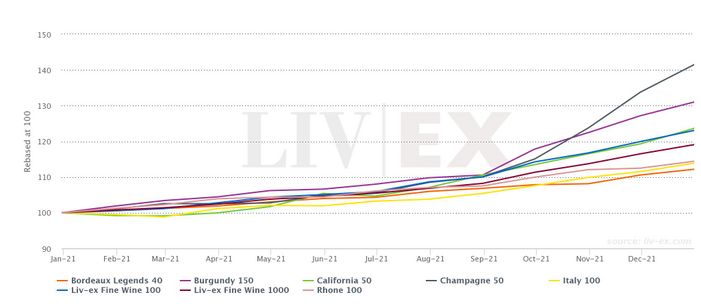

2021 was a rampaging bull of a year for wine investors with the secondary market experiencing record growth. The average price performance trend of the most traded investment wines was 23% and the high-flyers saw values increase by up to 80%. So where should wine investors look for the best returns in 2022?

What can we learn from 2021 investment wines trends?

- Liv-ex 100 average growth trend in 2021 up 23%

- Champagne was the regional top performer growing 41.5%

- Rosé Champagne demand soaring with US buyers up 219%

- Champagne Salon Le Mesnil 2002 delivered highest 12-month growth of 80%

- Burgundy secondary market share is near Bordeaux’s, at 30% in December

- Burgundy returns average 31%

- US wines drove growth of 22%

- Rhone wine investments grew an average 14.42%

- Italian wines delivered an average 13.87% return

Which regions should investors select wines from?

All of the key regions are seeing growth and to optimise returns you should diversify your wine investment portfolio by region and vintage. At the start of this year Champagne has got the market fizzing, Burgundy returns are booming, blue-chip Bordeaux are solid bankers, Italy’s va va voom is a crowd pleaser, the US flag is flying high, and Rhone is on the rise.

Champagne and Burgundy were powerful engines for the market in 2021 and investors should now look to these regions as essential to include in portfolio planning.

Champagne offers quality and growth normally at a lower entry point and key brands for investors are Dom Perignon, Louis Roederer Cristal, Krug, Bollinger, Taittinger, Pol Roger Sir Winston Churchill and top performer last year Salon Le Mesnil.

Burgundy is a major focus in Q1 every year as the latest en primeurs are released (currently the 2020 vintage). The region also accounted for the top performers in December 2021 with the highly affordable Domaine Leflaive Puligny Montrachet Premier Cru Clavallon 2015 rising 33% in the month. A more typical entry point for high-profile Burgundy investments, Domaine Leroy, Vosne Romanée Premier Cru Beaux Monts 2015 grew 21.3% to £67,200 (12 x 75cl) – an impressive return in one month! Most traded Burgundy vintages on Liv-ex in 2021 were 2015, 2017 and 2018.

Bordeaux wine investments are still the most liquid in the secondary market and this factor combined with quality and growth are why the First Growths are referred to as blue-chip and cornerstone assets in a wine portfolio along with the iconic Petrus, Le Pin and St Emilion top four. Strong opportunities for growth are the First Growth second wines and up and coming labels like Right Bank Figeac.

Italy’s Super Tuscans and top Piedmont wines took the market by storm in 2020 and are established as important diversification tools, with Sassicaia vintages some of the most traded on Liv-ex also offering liquidity. Piedmont investment wines are similar to Burgundy in that their very low supply drives higher prices as demand for these labels increases in a developing market.

The Rhone was a revelation in 2021 and whilst a highly productive wine-growing region, only a very small number of wines have achieved secondary market traction until recently The most notable of these being Guigal’s La Landonne, La Turque and La Mouline, and Chateau Beaucastel, Jean Luis Chave and Paul Jaboulet are also worth watching.

California’s Napa icons are enjoying increasing levels of trade in the secondary market and despite low supply being dominated by extremely strong US domestic buying, a growing number of releases via La Place de Bordeaux is opening the market up. Screaming Eagle, Opus One, Dominus, Harlan Estate, Scarecrow and Sine Qua Non wines are top performing US wine investments.

Australia and Spain have a small number of wines which warrant investor attention and the former’s Penfolds Grange vintages are some of the most valuable wines in the world. Spain’s brands of note are Vega Sicilia Unico and Pingus.

Wine investment market status

Fine wine investments maintained robust growth throughout 2021 despite the pandemic’s influence on global economies and financial markets. This year the fine wine stock exchange, Liv-ex.com, has opened with more than £100million of live bids and offers, providing the broadest and most liquid secondary market ever for wine investors to engage in. With growing efficiency and investment services available to you there has been no better time to invest in fine wine, whether as a new investor or if you are adding to an existing collection.

For information on which wines are currently offering the best opportunities for wine investors contact our team on 0203 384 2262.