Reuters reported that the top performing investment wine delivered 80% growth in 2021, outperforming Bitcoin’s 70% and major tech shares. Investors are including fine wine and other tangible assets in their financial plans for 2022 to enjoy growth and to protect capital, tax efficiently.

2021 Wine Investment Performance Headlines

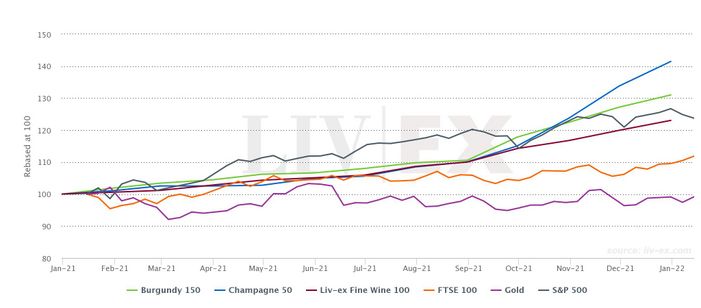

- Fine wine trend – Liv-ex 100 grew 23.1%

- FTSE 100 rose 14.3%

- Gold declined -4.3%

- Champagne Salon Le Mesnil 2002 rose 108%

- Top performing region – Liv-ex Champagne 100 index up 40.5%

Reuters’ article commented on the fact that leading wine investments delivered stronger returns than Bitcoin and top tech stocks in 2021. Champagne Salon Le Mesnil 2002’s 80% growth was highlighted in comparison to Bitcoin’s 70% in the year to early December at the article date. This performance exceeded the.NYFANG index which monitors Facebook, Amazon, Netflix, Google, Tesla and Microsoft last year. By the end of 2021 Salon Le Mesnil 2002 had grown 108%.

Fine wine compared to FTSE 100, S&P500 and gold in 2021

Key benefits of wine investment are stability, growth and tax efficiency. Wine as an alternative asset is becoming much more widely understood as platforms like Liv-ex bring transparency and efficiency to the market. This combined with strong growth performance and resilience during periods of economic downturn and rising inflation, is attracting more investors into the market.

Forbes has commented on the increased focus by wealth managers and institutional investors normalising investment in alternative assets like fine wine as returns impress and outperform traditional investments. The value of investment wine as an important diversification tool to gain growth and stability in a portfolio, and the tax-efficient returns that investors can enjoy, were highlighted in 2021 when all previous records were broken.

The fine wine market has started 2022 on a roll with the total value of bids and offers on Liv-ex at a record level, surpassing £100 million in early January. The secondary fine wine market is broader and deeper than ever and offers a wealth of buying and selling opportunities for wine investors at highly accessible levels.

We believe every investor should understand and have access to a fine wine investment service and be guided to create a rewarding wine collection as part of their overall portfolio strategy.

For more information about investing in fine wine in 2022, download our Guide and contact our expert team on 0203 384 2262.