2021 was the top performing year on record for investment wines with some seeing growth of over 60% in one year. Will we see the trend continue in 2022?

Wine investors refocused on blue-chip Burgundy and Bordeaux in 2021 as the removal of US tariffs saw big brand investment wines offer value, security and liquidity. Continued uncertainty and volatility in equity markets drove investors to alternative assets and fine wine’s stellar performance outperformed shares across the year.

Seasoned wine investors boosted their portfolios with regional diversification adding new labels to their collections. Some added new vintages, creating and adding to verticals of blue-chip Burgundy, Bordeaux and Champagne investments. New investors relished a buoyant market seeing returns in months, a reminder perhaps needed that the traditional appeal of wine investments is stable, long-term growth and robust resistance to recession and inflationary pressures.

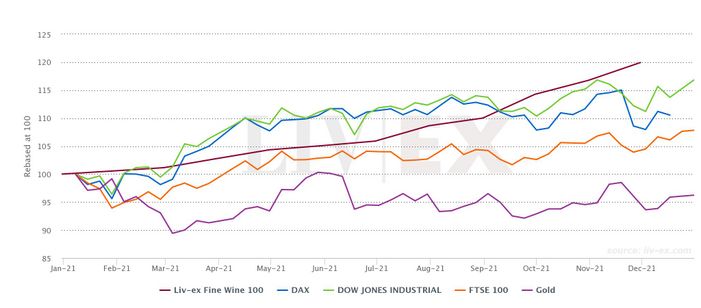

The trend growth recorded by the Liv-ex 100 index, which tracks the 100 most-traded wines on the exchange, recorded its highest ever level, overtaking the previous 2011 peaks, and at 30th November had risen 20.8% in 12 months. The key fine wine index recorded stronger growth than the FTSE 100, Dow Jones indices and gold at the same point in the year and was in touching reach of the S&P500.

Fine wine compared to equities & gold in 2021

Individual wine performances were even more impressive with Champagne and Burgundy delivering the largest movers. Salon, Le Mesnil 2012 rose a staggering 80% and Domaine Armand Rousseau Chambertin 2012 73.7% last year.

Top regional performances will shape portfolios in 2022

Champagne was the top performing region, the Liv-ex Champagne 50 recorded an impressive 33.7% average growth. Key wines Taittinger Comtes de Champagne 2006 and 2008, Cristal Rosé 2008, Krug 2000 and Salon, Le Mesnil 2002 all saw values rise by more than 50%. The US market for Champagne has grown significantly and is fast approaching UK levels of demand. Rosés, which have certainly been ‘in the pink’ in 2021 to the extent that Liv-ex introduced a Rosé Champagne index in the year.

Burgundy vied with Champagne for the top spot during 2021, and ran second on last count with 27.1% average growth. The region’s super-star brands were key drivers with several vintages of DRC hitting new all-time highs. Armand Rousseau saw its 2012 vintage rise 73% and Leflaive also made a top ten investment wine performance. Domaine Leroy ranked number 1 again in the Power 100 listing of most powerful fine wine brands.

Share of trade on Liv-ex is a key measure and Burgundy’s grew to an average 21.4% in 2021, with the largest increase in wines trading on the exchange. Trade share in the latter months of the year nearly matched Bordeaux by value. Investor demand for Burgundy has seen the rise of a number of new labels attracting secondary market action.

Bordeaux’s First Growths reclaimed top ten places in the Power 100 as the market re-engaged with the region. Lafite Rothschild wines were the most traded by value in the secondary market and second by volume to Italy’s Sassicaia.

Italy will continue to be a key focus for 2022 and rising demand for Piedmont wines influenced some of the top risers in the 2021 Power 100 ranking, these could offer opportunities for investors this year.

Top 10 emerging brands in 2021 Liv-ex Power 100:

| Wine | Region | 2020 ranking | 2021 ranking |

| Emmanuel Rouget | Burgundy | 249 | 44 |

| La Spinetta | Piedmont | 234 | 40 |

| Comm. G.B. Burlotto, Barolo | Piedmont | 187 | 26 |

| Sine Qua Non | California | 216 | 71 |

| Giuseppe Mascarello e Figlio | Piedmont | 207 | 82 |

| Giuseppe Ronaldi | Piedmont | 171 | 60 |

| Domaine des Lambrays | Burgundy | 162 | 69 |

| Coche-Dury | Burgundy | 147 | 55 |

| Clos de Tort | Burgundy | 178 | 89 |

| Sylvain Cathiard | Bugundy | 109 | 21 |

Source: Liv-ex.com, December 2021

Should you invest in wine in 2022?

Economic conditions and financial markets continue to be uncertain with Omicron still rampant and focus on taming inflation expected to stimulate further interest rate rises this year. Fine wine continues to offer investors an important, tax-efficient means to deliver growth and spread risk in investment portfolios in 2022. Based on the fundamentals driving the market, we expect exciting opportunities for wine investors in the year ahead. For more information see our Guide to Collecting and Investing in Fine Wine and contact our team on 0203 384 2262.