European markets fell on Valentine’s Day 2022 as the distinct lack of love on the Russia / Ukraine border became increasingly evident. With the threat of war casting a dark shadow of uncertainty over financial markets, investors are seeking safe havens and wine is the current top performer.

France’s CAC plummeted 3.4%, Germany’s DAX slid more than 3.1% and the FTSE fell 1.6% on the 14th February with rising tension as the continued pleas of global political leaders made no evident progress with Putin. Evrax, the FTSE’s largest faller, saw its share value sink 30% in the day, as its significant interests in Russia were perceived to be at risk of any sanctions that maybe imposed on the country.

War isn’t good for stock markets and rising uncertainty is already sending shock waves into global markets. In response, investors are seeking safe havens and gold’s price is rising as investors seek security.

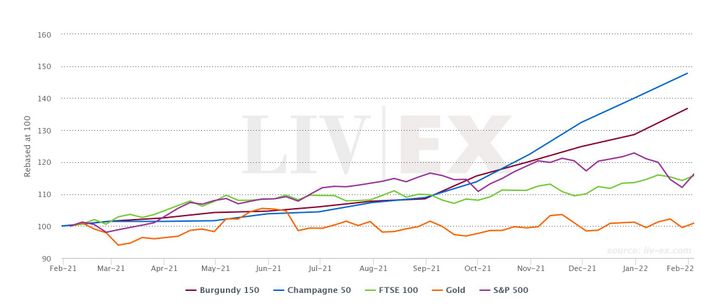

Fine wine’s safe haven performance compared to Gold and Equities

Again, we remind investors that fine wine also offers protection for capital especially in periods of rising inflation and economic uncertainty, exactly where we are today. The 12 months to 31st January 2022 (latest published Liv-ex data) has seen investment wines enjoy an average growth of 24% and top performers hit over 100%. Gold declined -4.3% in the same period and the FTSE rose 16%. Champagne investments achieved an average 47.7% and Burgundy 36.7% in 2021 and are continuing to drive market growth in 2022.

Inflation numbers for January 2022 due out imminently and wine has been an excellent hedge for investors so far as the CPI recorded the highest growth level in nearly 20 years in December 2021. Gold has not maintained the stable defence that wine has in this run to date.

Hopefully, Ukraine and Russia will resolve the current situation and we can expect a rebound in sensitive stocks if so, but whilst uncertainty prevails investors have options to protect their capital.

For more information see our Guide to Investing in Fine Wine and contact our team for the latest performance information on 0203 384 2262.