Investors in fine wine have clear evidence of market recovery with price growth across the sector.

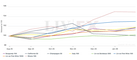

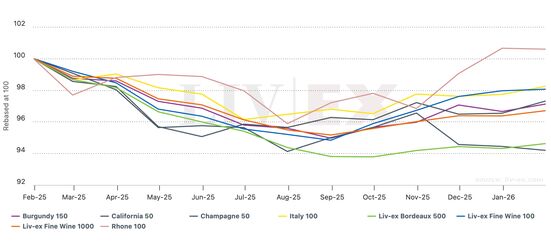

Liv-ex reported a fifth consecutive monthly rise for its key Liv-ex 100 benchmark at the end of January 2026. The index has grown 3% in the last six months and there is now a clear stretch of ‘blue water’ since the measure last recorded a negative trend in August 2025, when it slipped 0.4%.

Fine wine performance 12 months

Source: Liv-ex.com, 31.01.2026

The fine wine market turned to positive in September 2025 after a near three-year correction following the bull-run that peaked in October 2022.

In the last five months we have seen a gradual uplift across the key Liv-ex 100 and 1000 benchmarks and regional sub-indices are seeing varying degrees of recovery. Some individual wines are recording double-digit gains in a month.

Top 5 performing wines in January 2026

| Wine | Growth | Region |

| Pavillon Rouge du Chateau Margaux 2013 | 25% | Bordeaux / Margaux |

| Chateau L’Evangile 2022 | 24.7% | Bordeaux / Pomerol |

| Chateau L’Evangile 2021 | 23.4% | Bordeaux / Pomerol |

| Chateau Grand Puy Lacoste 2013 | 21.0% | Bordeaux / Pauillac |

| Chateau La Conseillante 2021 | 19.5% | Bordeaux / Pomerol |

Source: Liv-ex.com 31.01.2026

Is it the right time to invest in fine wine?

If you are looking to invest in a tax-efficient asset in the early stages of a market on the rise, fine wine fits the bill. The early months of 2026 are key to positioning whilst some wines are still priced to optimise future returns.

Market confidence is also on the up with activity boosted in the secondary market. January 2026 trade value on Liv-ex was 21.7% higher than December 2025 and volume 27.9% more.

The exchange reports that trade levels are approximately 20% higher than in Q2 – Q4 2025.

Wines attracting investors in Q1 2026

The primary focus for the wine trade every January is Burgundy with the latest vintage release. The region accounted for 31.8% of trade value on Liv-ex last month. This was reported as the highest monthly measure of Burgundy trade share since February 2025.

A key attraction in Q1 2026 is that prices for iconic wines are still relatively low making them much more accessible than usual. Older and rarer vintages of top Bordeaux and Champagne in particular are seeing increased demand and higher levels of trade.

Top 10 Traded Wines in January 2026

| Wine | January 2026 market price (12 x 75cl) | Region |

| Screaming Eagle Cabernet Sauvignon 2023 | £20,532 | Napa, USA |

| Chateau Haut Brion 1989 | £19,200 | Bordeaux |

| DRC, Romanée-Conti 2022 | £150,000 | Burgundy |

| Dom Perignon P2 2008 | £3,518 | Champagne |

| Domaine Roulot, Meursault 2023 | £1,720 | Burgundy |

| DRC La Tache 2022 | £44,000 | Burgundy |

| DRC, Romanée-Conti 2009 | £175,492 | Burgundy |

| Chateau Cos d’Estournel 2005 | £1,598 | Bordeaux |

| Domaine Jean Louis Chave Hermitage, Ermitage Cathelin 1995 | £69,534 | Rhone |

| Chateau Lafite Rothschild 2022 | £4,680 | Bordeaux |

Source: Liv-ex Report February 2026

Current demand for top Champagne drove the Liv-ex Champagne 50 to be the top performing regional index in January, up 0.8%. The stronger price performance of older vintages of exceptional Bordeaux First Growths and key Right Bank wines pushed the Liv-ex Investables benchmark to rise 1.1% in the month.

Our view

There is clear evidence now of a sustainable recovery in the fine wine market. Investors looking to position with prices still at a recognised low point should act now to enjoy the best possible returns. Different wines and regions are recovering at a varied a pace, so it is important to select carefully. Contact our expert team for more information on 0203 384 2262 and see our latest Market Report.