Burgundy’s 2024 vintage is a third smaller than 2023 with wines launching into a market gearing for growth.

The legendary labels of Burgundy are renowned as some of the rarest and most valuable wines in the world.

The simple economics of finite supply and growing demand is the fundamental dynamic of wine investment. So, when productivity is lower than usual and demand is at least constant, price is generally boosted. Can this simple rule be applied to Burgundy’s newest wines with the prevailing market conditions in 2026?

The simple economics of finite supply and growing demand is the fundamental dynamic of wine investment. So, when productivity is lower than usual and demand is at least constant, price is generally boosted. Can this simple rule be applied to Burgundy’s newest wines with the prevailing market conditions in 2026?

Wine producers, critics and journalists have set out their initial commentary on the 2024 Burgundy vintage. It was an extraordinarily challenging year in the region’s vineyards with frost and mildew the architects of losses that have produced one of the smallest yields for Burgundy this century.

How are market conditions in Q1 2026 affecting Burgundy prices?

The Liv-ex Burgundy 150 index has risen consistently over recent months supported by the highest level of demand on the secondary market in more than two years. Burgundy is leading the early stages of a return to growth in 2026 as buyers take advantage of current discounts available.

Prices for some of the world’s most aspirational wines are at a level which offers a significant opportunity for investors to optimise future growth in the region’s wines. Values are also stabilising as demand grows. Burgundy’s share of transaction value on Liv-ex mid-January 2026 is being boosted by the launch of the 2024 vintage wines, accounting for 37.1% of trade compared to Bordeaux’s 30.1%.

Notably, UK buyers were responsible for 43% of trade value on Liv-ex in the week 9 to 15th January, over half of which were Burgundy purchases.

Recent vintages 2022 and 2023 are a primary focus with Burgundy 2022 wines the most traded by value, but there has been a marked increase in activity of more accessible, i.e.lower-priced Burgundies, on the exchange.

Which Burgundy wines should investors consider?

Top 10 Burgundy brands in Liv-ex Power 100 2025

| Order | Burgundy Producer | Power 100 2025 Rank | Average trade price of producer’s wine |

| 1 | Leflaive | 3 | £1,699 |

| 2 | Joseph Drouhin / Drouhin Vaudon | 4 | £2,360 |

| 3 | Bouchard Pere & Fils | 14 | £1,679 |

| 4 | Domaine Romanée Conti | 18 | £39,107 |

| 5 | Louis Latour | 23 | £2,003 |

| 6 | Faiveley | 26 | £1,043 |

| 7 | Pierre Yves Colin-Morey | 30 | £1,293 |

| 8 | Meo-Camuzet | 33 | £2,253 |

| 9 | Joseph Roty | 35 | £1,092 |

| 10 | Prieure Roch | 38 | £2,736 |

Source: Liv-ex Power 100 Report, 2025

Burgundy has generated the highest number of producers ranked in the annual Liv-ex Power 100 Report by region in recent years. This has been challenged during the market correction, but Burgundy remains the leader. In the 2025 Power 100 Report twenty-nine made the top ranking, still the highest regional count.

Burgundy’s top 5 ranked brands in recent years

|

| 2025 / (overall rank) | 2024 / (overall rank) | 2023 / (overall rank) | 2022 / (overall rank) |

| 1 | Leflaive (3) | Joseph Drouhin/ Drouhin Vaudon(4) | Leflaive (1) | Leroy (1) |

| 2 | Joseph Drouhin/ Drouhin Vaudon (4) | Henri Boillot (6) | Meo Canuzet (3) | Arnoux Lachaux (2) |

| 3 | Bouchard Pere & Fils (14) | Leroy (9) | Joseph Drouhin (5) | Leflaive (3) |

| 4 | Domaine Romanée Conti (18) | Domaine Leflaive (12) | Henri Boillot (8) | Armand Rousseau (4) |

| 5 | Louis Latour (23) | Bouchard Pere & Fils (17) | Leroy (10) | Prieure Roch (5) |

Source: Liv-ex Power 100 Reports 2025 / 2024 /2023 / 2022

Burgundy 2024 vintage key points for investors

- Supply is significantly smaller than average years with even some prestigious estates producing tiny quantities. Burgundy 2024 harvest yield was a third smaller than the plentiful 2023 vintage

- Wines will drink younger with alcohol levels lower than recent averages

- A complex vintage that favours white wine with some outstanding examples

- An inconsistent year for red Burgundy but scarcity will likely drive prices in the top labels

- Rising demand for Burgundy in the secondary market

The Burgundy 2024 En Primeur campaign launched in January 2026 with the backdrop of growing price stability and evidence of green shoots of recovery in the fine wine market. December 2025 data revealed the continuing trend of rising demand for Burgundy and price growth for individual wines.

Top 5 performing Burgundy wines in 2025

| Wine | Price growth 1 year |

| Joseph Drouhin Montrachet G.C Marquis de Laguiche 2021 | 22.2% |

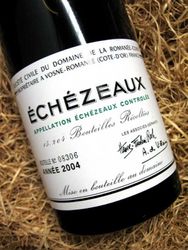

| Domaine de la Romanée Conti, La Tache 2018 | 21.0% |

| Domaine de la Romanée Conti, Echezaux 2020 | 16.5% |

| Domaine de la Romanée Conti, Richebourg 2015 | 16.2% |

| Domaine de la Romanée Conti, Grands Echezaux 2019 | 15.2% |

Source: Liv-ex.com, data at 31.12.2025

Wine producers, critics and journalists have set out their initial commentary on the 2024 Burgundy vintage. It was an extraordinarily challenging year in the region’s vineyards with frost and mildew the architects of losses that have produced one of the smallest yields for Burgundy this century.

One of the wettest years on record, the region‘s vignerons battled the elements to produce an extremely small vintage but with some ‘truly wonderful’ quality. The more fragile Pinot Noir was hardest hit by extremely wet conditions and a mildew epidemic. Chardonnay, more resilient fared better, but frosts in April and June also decimated crops with some growers losing up to 90%. Burgundy 2024 whites will be highly lauded but also much scarcer than the average vintage.

One of the wettest years on record, the region‘s vignerons battled the elements to produce an extremely small vintage but with some ‘truly wonderful’ quality. The more fragile Pinot Noir was hardest hit by extremely wet conditions and a mildew epidemic. Chardonnay, more resilient fared better, but frosts in April and June also decimated crops with some growers losing up to 90%. Burgundy 2024 whites will be highly lauded but also much scarcer than the average vintage.

Productivity in some estates in top appellations Vosne-Romanee, Nuits St Georges and Gevrey-Chambertin is down 80% to 90% on recent norms. As in Bordeaux, some Burgundian estates are withdrawing from the En Primeur process or reducing their allocations. This could be scaled up with the 2024 wines due to the starting lower supply and is an additional factor. The vintage could be the smallest Burgundy En Primeur release in years.

Where should Burgundy buyers look for value in 2026?

Investors should consider which Burgundy brands remain the most actively traded and where there has been more sustained price performance in the longer term and combine this with current pricing and where the opportunity for growth is most evident.

Top performing Burgundy wines over 5 years

| Wine | Price growth 5 years |

| Domaine Bonneau du Martray Corton Charlemagne 2012 | 143% |

| Domaine Bonneau du Martray Corton Charlemagne 2013 | 136.2% |

| Domaine Leflaive Chevalier Montachet G.C. 2016 | 108% |

| Domaine Leflaive Chevalier Montachet G.C. 2017 | 107.3% |

| Domaine Leflaive Chevalier Montachet G.C. 2015 | 92.2% |

Source: Liv-ex.com, data at 31.12.2025

Top traded wines by value on Liv-ex in December 2025 were led by Burgundy’s DRC, Romanée Conti 2010 which last traded at £191,976 (12 x 75cl) in that month. Mid-January 2026 Burgundy top-five wines by value traded included DRC, La Tache 2022 at £44,000 and DRC Romanée Conti 2009 at £175,492 (12 x 75cl).

Domaine de la Romanée Conti is the most iconic Burgundy label. With just around 1,000 cases made in an average year and single bottle (75cl) sales of legendary vintages such as the 1946 DRC Romanée-Conti selling at auction for over $500,000 (in 2018), the label for most investors is out of reach. However, 2026 may provide the opportunity for some as prices are more accessible for these highly aspirational wines.

Domaine de la Romanée Conti is the most iconic Burgundy label. With just around 1,000 cases made in an average year and single bottle (75cl) sales of legendary vintages such as the 1946 DRC Romanée-Conti selling at auction for over $500,000 (in 2018), the label for most investors is out of reach. However, 2026 may provide the opportunity for some as prices are more accessible for these highly aspirational wines.

More accessible Burgundy for investors

An important trend during the bull run 2020 to 2022 was the broadening of the secondary market in Burgundy as investors and collectors sought out more affordable wine. Price growth across the broader spectrum of top estate wines stretched to neighbouring vineyards of some of the legendary labels as demand rose.

This market characteristic resulted in the movement of Burgundy wines in the Power 100 rankings where we have seen lesser-known labels rise up the listing and iconic wines drop as buyers became wary of higher-priced wines during the market correction. Also, those domaines which produce a larger number of wines at differing price points achieve higher rankings based on their level of market share.

Our opinion on investing in Burgundy 2024 En Primeurs

The key challenge for the vignerons and their agents is pricing. As a scarcer vintage, the wines are not expected to be launched at a discount to the 2023 release prices. 2024 is also a more complex vintage, individual vineyard plots varied massively with the challenges that the climate conditions created and the resultant quality and supply. The reds are generally ‘younger drinkers’, fresher and perhaps more traditional than the riper wines of recent years. Burgundy 2024 is noted to be a ‘white wine’ vintage and some good enough to be laid down. The trade in white Burgundy has risen by value and volume on Liv-ex recently.

So, there are many factors to consider alongside the broader market conditions in an increasingly volatile geo-political period creating uncertainty for investors in all markets. If the Burgundians price to engage the market, the 2024 campaign could provide a welcome boost to the start of 2026. It has already spiked trade in the region’s wines in January with Burgundy’s market share soaring to 37.1% in the week 9th to 15th.

So, there are many factors to consider alongside the broader market conditions in an increasingly volatile geo-political period creating uncertainty for investors in all markets. If the Burgundians price to engage the market, the 2024 campaign could provide a welcome boost to the start of 2026. It has already spiked trade in the region’s wines in January with Burgundy’s market share soaring to 37.1% in the week 9th to 15th.

Ultimately, adding Burgundy to a fine wine portfolio is important in terms of diversification, growth potential and adding value. Q1 2026 offers a great opportunity to take advantage of prices near market lows, but starting to lift, and to position for strong future returns.

For more information on the current market conditions and investing in Burgundy, see our latest reports and contact our expert team on 0203 384 2262.